European Value Stocks Estimated Below Intrinsic Worth January 2026

As the pan-European STOXX Europe 600 Index reaches new heights, buoyed by an improving economic environment and closing 2025 with its strongest annual performance since 2021, investors are increasingly turning their attention to stocks that may be trading below their intrinsic value. In this context of rising indices and a favorable economic climate, identifying undervalued stocks can present opportunities for those seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK18.50 | SEK36.62 | 49.5% |

| Streamwide (ENXTPA:ALSTW) | €73.00 | €142.93 | 48.9% |

| Recupero Etico Sostenibile (BIT:RES) | €6.56 | €12.99 | 49.5% |

| NEUCA (WSE:NEU) | PLN835.00 | PLN1647.82 | 49.3% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.30 | NOK66.22 | 49.7% |

| Jæren Sparebank (OB:JAREN) | NOK384.00 | NOK751.23 | 48.9% |

| Gesco (XTRA:GSC1) | €14.30 | €27.86 | 48.7% |

| Fodelia Oyj (HLSE:FODELIA) | €5.44 | €10.72 | 49.3% |

| Benefit Systems (WSE:BFT) | PLN3590.00 | PLN7095.77 | 49.4% |

| Allcore (BIT:CORE) | €1.36 | €2.66 | 48.9% |

Underneath we present a selection of stocks filtered out by our screen.

Exail Technologies (ENXTPA:EXA)

Overview: Exail Technologies offers robotics, maritime, navigation, aerospace, and photonics technology solutions both in France and internationally, with a market cap of €1.44 billion.

Operations: Exail Technologies generates revenue primarily from Navigation & Maritime Robotics (€335.41 million), Advanced Technologies (€108.99 million), and Structure Exail Technologies (€1.14 million).

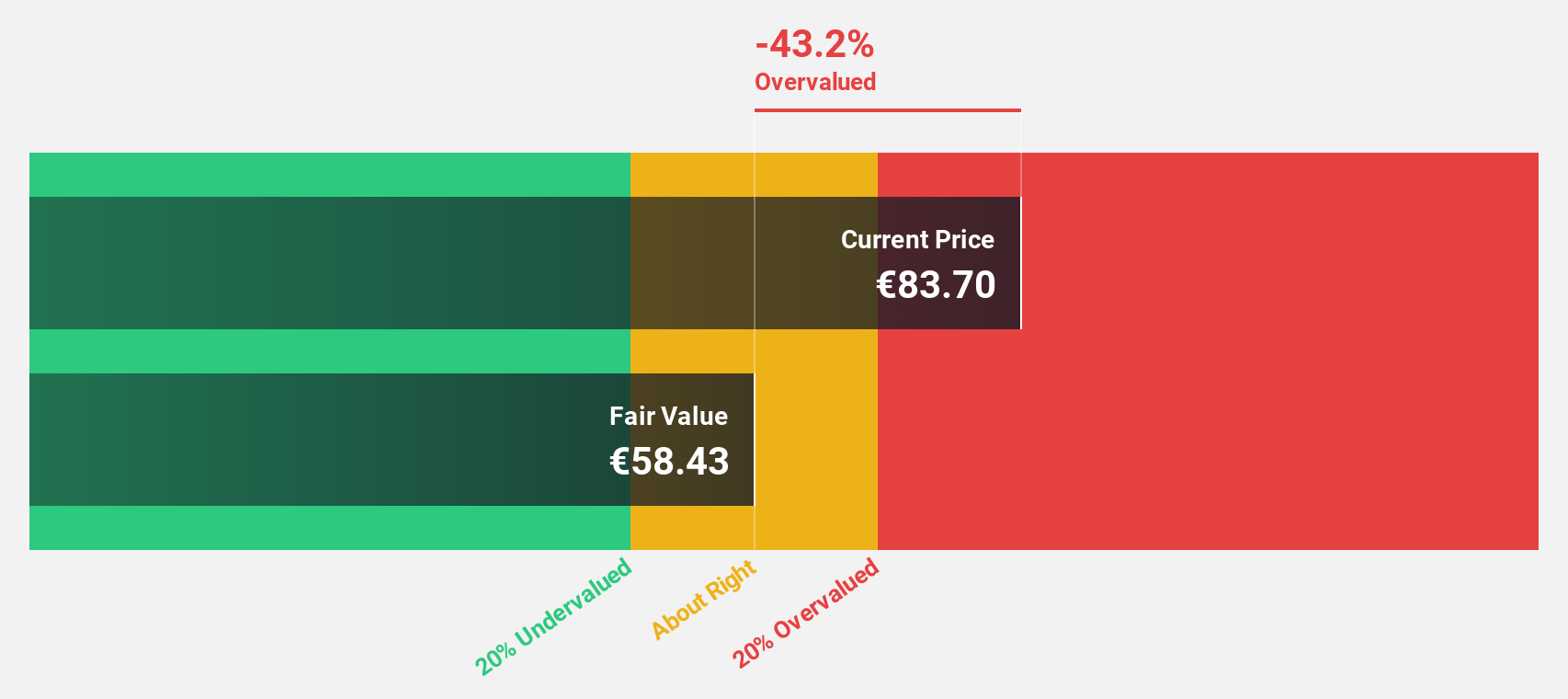

Estimated Discount To Fair Value: 46.5%

Exail Technologies is currently trading at €85.1, significantly below its estimated fair value of €159.11, highlighting its potential as an undervalued stock based on cash flows. Despite a highly volatile share price recently, it has been added to the Euronext 150 Index, enhancing its market visibility. The company turned profitable this year and boasts strong earnings growth forecasts of 87.14% annually, though interest payments remain insufficiently covered by earnings.

- Our expertly prepared growth report on Exail Technologies implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Exail Technologies stock in this financial health report.

GomSpace Group (OM:GOMX)

Overview: GomSpace Group AB (publ) manufactures and sells nanosatellites, components, and turnkey satellite solutions across various regions including Europe, the United States, and Asia, with a market cap of SEK3.12 billion.

Operations: GomSpace Group generates revenue by producing and distributing nanosatellites, satellite components, and comprehensive satellite solutions across Europe, the United States, Asia, and other international markets.

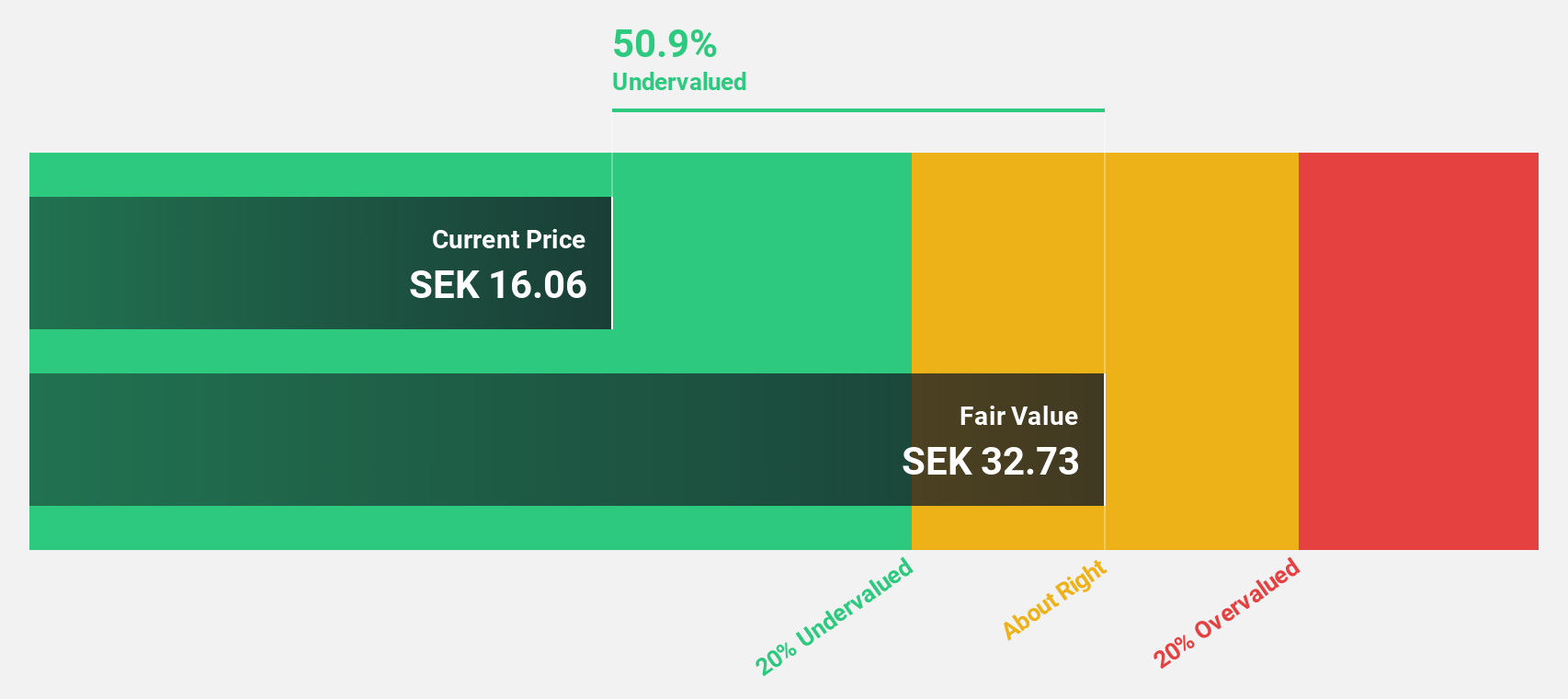

Estimated Discount To Fair Value: 47.3%

GomSpace Group's stock is trading at SEK 18.5, significantly below its estimated fair value of SEK 35.09, suggesting it may be undervalued based on cash flows. The company has secured several high-value contracts with the European Space Agency and a leading European defense firm, boosting revenue expectations to SEK 420-450 million for 2025. Despite recent shareholder dilution and negative equity, GomSpace anticipates becoming profitable within three years with strong revenue growth forecasts of 28.6% annually.

- Upon reviewing our latest growth report, GomSpace Group's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of GomSpace Group.

Benefit Systems (WSE:BFT)

Overview: Benefit Systems S.A. offers non-pay employee benefits solutions across several countries including Poland, Czech Republic, Slovakia, Bulgaria, Croatia, and Turkey with a market cap of PLN11.76 billion.

Operations: The company's revenue segments include PLN2.77 billion from Poland (including Cafeteria) and a segment adjustment of PLN1.38 billion.

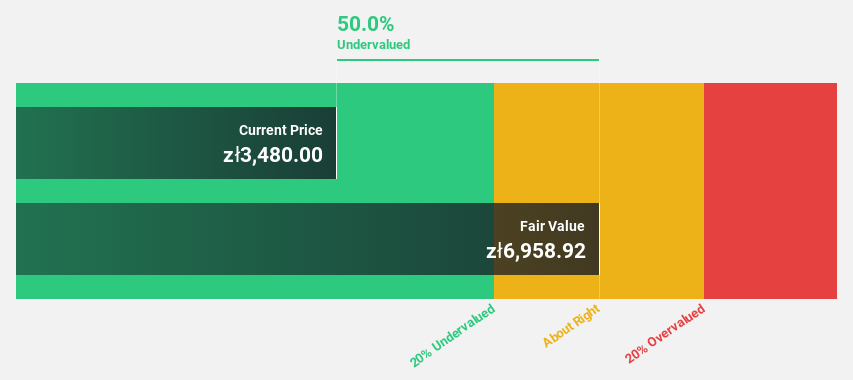

Estimated Discount To Fair Value: 49.4%

Benefit Systems is trading at PLN 3,590, well below its estimated fair value of PLN 7,095.77. The company's revenue growth forecast of 14.8% annually surpasses the Polish market's average and recent earnings reports show significant increases in both revenue and net income compared to last year. However, the dividend yield of 3.76% isn't fully covered by free cash flows, which could be a concern for investors focused on sustainability.

- Our growth report here indicates Benefit Systems may be poised for an improving outlook.

- Navigate through the intricacies of Benefit Systems with our comprehensive financial health report here.

Turning Ideas Into Actions

- Explore the 197 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal