What to Expect From Equity Residential’s (EQR) Q4 2025 Earnings Report

Headquartered in Chicago, Illinois, Equity Residential (EQR) is a real estate investment trust focused squarely on residential living. The company acquires, develops, and manages apartment communities in and around major urban centers.

With a market capitalization of approximately $23.6 billion, Equity Residential firmly sits in “large-cap” territory, a category reserved for companies valued above $10 billion. This scale enables the company to own and manage 318 rental properties totaling 86,320 apartment units across some of the most economically vibrant U.S. metropolitan markets.

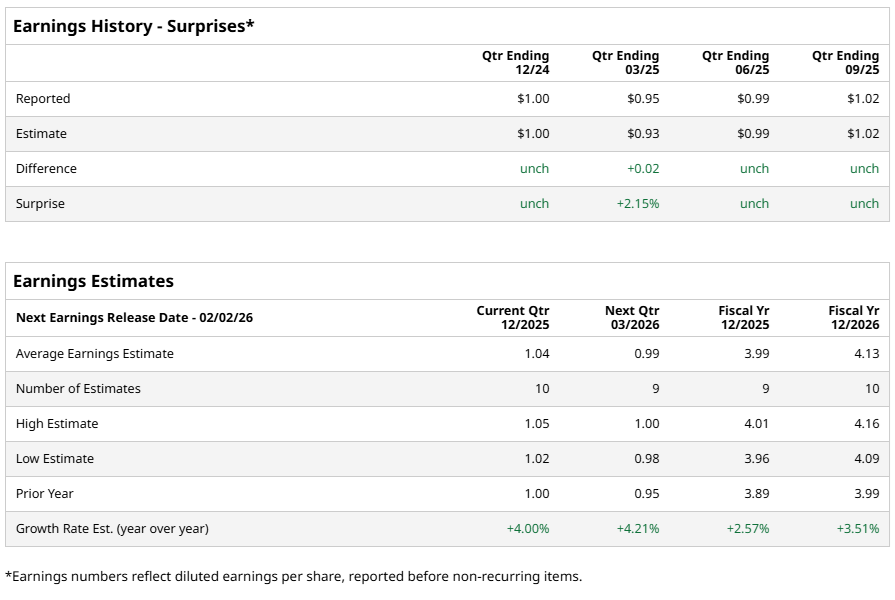

Attention now centers on Equity Residential’s Q4 fiscal 2025 earnings, scheduled for Monday, Feb. 2. Wall Street forecasts diluted EPS of $1.04, a 4% increase from last year’s $1. Moreover, the company has exceeded EPS estimates in one of the last four quarters while matching expectations in the remaining three.

Looking back, the company reported third-quarter fiscal 2025 results on Oct. 28, 2025. Revenue rose 4.6% year over year to $782.4 million, surpassing consensus estimates of $781.4 million. Strong operating fundamentals across most markets, particularly standout performances in San Francisco and New York, powered the growth.

Normalized funds from operations (FFO) per share rose 4.1% from the prior year’s quarter to $1.02, aligning with analyst expectations. However, management lowered full-year fiscal 2025 guidance for revenue, net operating income, EPS, and FFO. The cautious outlook unsettled investors, triggering a 4.2% share price decline in the following trading session.

Despite near-term volatility, analysts project diluted EPS for fiscal 2025 to climb 2.6% year over year to $3.99, followed by an additional 3.5% increase to $4.13 in fiscal 2026.

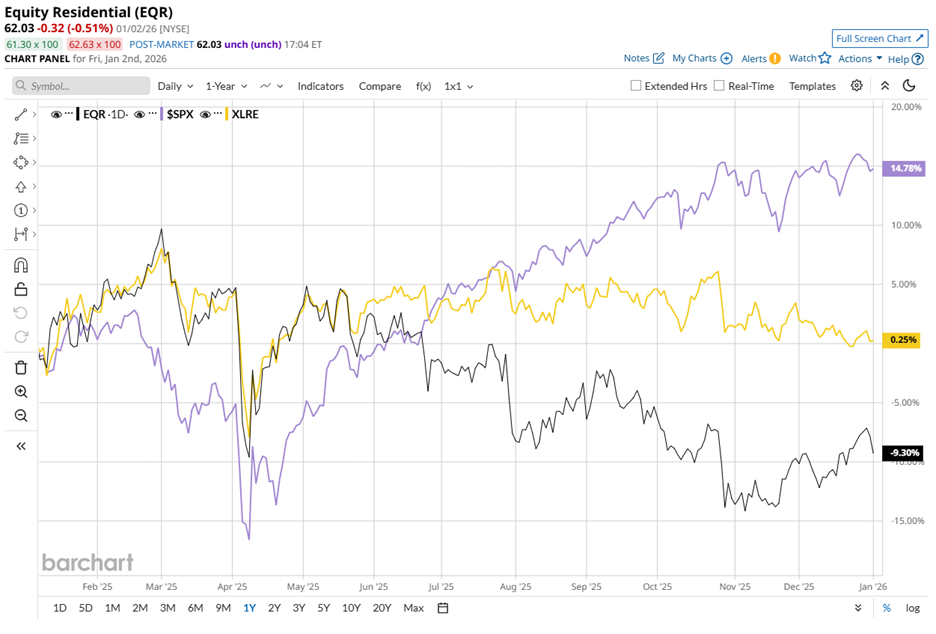

From a stock performance perspective, Equity Residential’s shares have faced relative pressure. Over the past 52 weeks, shares declined 11.5%, although they remain up 1.6% year-to-date (YTD). In contrast, the S&P 500 Index ($SPX) gained 16.9% over the same annual period while remaining only marginally positive YTD.

Compared with the State Street Real Estate Select Sector SPDR ETF (XLRE), EQR stock has lagged slightly, as the sector ETF posted marginal gains across both timeframes.

Wall Street continues to assign an overall “Moderate Buy” rating, and this view has remained unchanged for the past three months. Among the 25 analysts covering the stock, eight recommend a “Strong Buy,” one suggests a “Moderate Buy,” while 16 advise to “Hold.”

Upside potential also remains meaningful. The average target of $69.77 implies potential upside of 12.5%. Meanwhile, the Street-high target of $80 points to a 29% upside.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal