Global Penny Stocks To Watch In January 2026

As we enter January 2026, global markets are witnessing a mix of developments, with U.S. stocks experiencing a slight decline despite strong annual gains and European indices reaching new highs. Amid these broader market movements, the concept of penny stocks remains relevant for investors seeking potential growth opportunities in smaller or newer companies. While the term 'penny stock' may seem dated, these investments can still offer substantial value when backed by solid financials and growth prospects. In this article, we'll explore three penny stocks that stand out for their financial strength and potential to deliver significant returns over time.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.46 | HK$903.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.265 | £489.8M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$3.03 | A$453.39M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.45 | SGD13.58B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.71 | $412.74M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.215 | MYR331.28M | ✅ 4 ⚠️ 3 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.89 | NZ$244.72M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £186.68M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,568 stocks from our Global Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

AIM Vaccine (SEHK:6660)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AIM Vaccine Co., Ltd. focuses on the research, development, manufacture, and sale of human-use vaccines in China with a market cap of HK$4.22 billion.

Operations: The company generates revenue primarily from the sale of vaccines and research and development services, amounting to CN¥1.26 billion.

Market Cap: HK$4.22B

AIM Vaccine Co., Ltd. operates in the vaccine sector with a market cap of HK$4.22 billion and generates CN¥1.26 billion in revenue, primarily from sales and R&D services. Despite being unprofitable with losses increasing by 18.5% annually over five years, it is forecasted to grow revenue significantly at 60.71% per year. The management team has an average tenure of 4.9 years, providing stability amidst recent executive changes, including Ms. Liu Ling becoming the sole company secretary after Ms. Wong Pui Kiu Ingrid's resignation on December 31, 2025.

- Dive into the specifics of AIM Vaccine here with our thorough balance sheet health report.

- Gain insights into AIM Vaccine's future direction by reviewing our growth report.

Sichuan Shengda Forestry Industry (SZSE:002259)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sichuan Shengda Forestry Industry Co., Ltd is engaged in the production and sale of liquefied natural gas (LNG) in China, with a market capitalization of CN¥2.84 billion.

Operations: The company generates revenue from its gas business, amounting to CN¥939.64 million.

Market Cap: CN¥2.84B

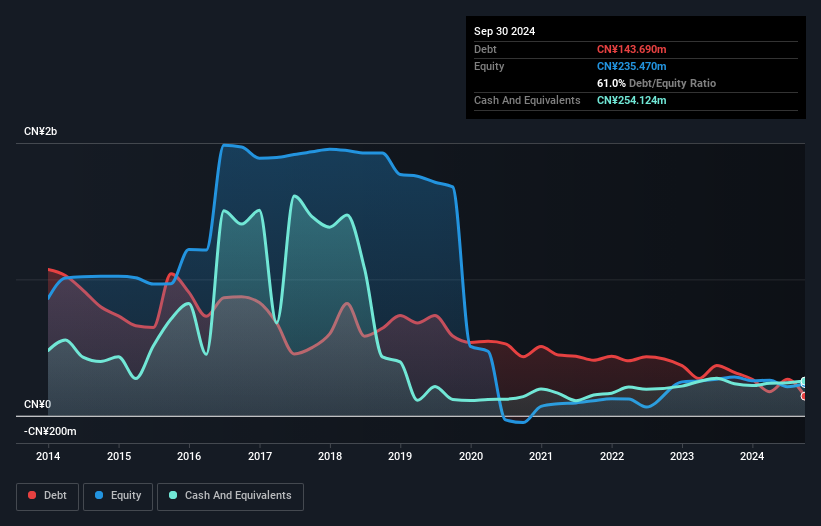

Sichuan Shengda Forestry Industry Co., Ltd has transitioned to profitability, reporting a net income of CN¥19.59 million for the nine months ending September 2025, compared to a net loss previously. The company's short-term assets exceed both its short and long-term liabilities, indicating solid liquidity management. Despite having a low return on equity at 17.8%, its debt is well-covered by operating cash flow and interest payments are comfortably managed by EBIT. However, financial results were affected by a large one-off loss of CN¥72.1 million in the last year. The stock trades slightly below its estimated fair value.

- Click to explore a detailed breakdown of our findings in Sichuan Shengda Forestry Industry's financial health report.

- Explore historical data to track Sichuan Shengda Forestry Industry's performance over time in our past results report.

Wutong Holding Group (SZSE:300292)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wutong Holding Group Co., Ltd. manufactures and sells intelligent telecommunication devices in China, with a market cap of CN¥6.05 billion.

Operations: Wutong Holding Group Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥6.05B

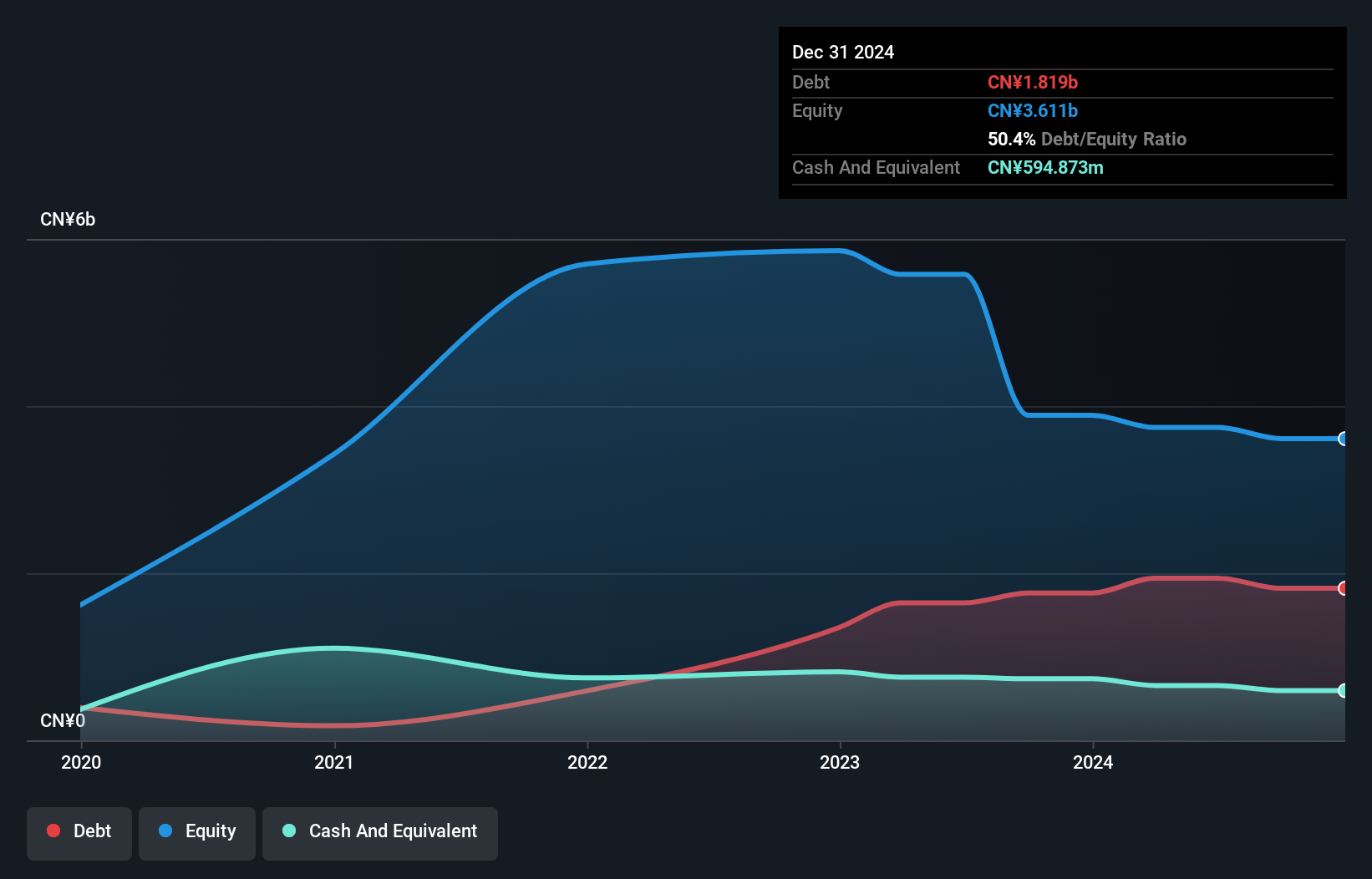

Wutong Holding Group Co., Ltd. has demonstrated robust earnings growth, with a 121.8% increase over the past year, significantly outpacing the industry average. The company maintains strong liquidity, as its short-term assets surpass both short and long-term liabilities. Debt management is prudent, with more cash than total debt and interest payments well-covered by EBIT. Despite a low return on equity of 8.1%, profit margins have improved to 2.4%. Recent governance changes propose expanding business scope and amending bylaws, reflecting strategic adjustments that could impact future operations positively or negatively depending on execution effectiveness.

- Click here and access our complete financial health analysis report to understand the dynamics of Wutong Holding Group.

- Gain insights into Wutong Holding Group's historical outcomes by reviewing our past performance report.

Make It Happen

- Jump into our full catalog of 3,568 Global Penny Stocks here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal