Assessing Cipher Mining (CIFR) Valuation After The Ulysses High Power Ohio Expansion

Why Cipher Mining's Ulysses acquisition matters for investors

Cipher Mining (CIFR) recently agreed to acquire the 200 megawatt Ulysses site in Ohio, including 195 acres of land, secured capacity from AEP Ohio, and direct access to the PJM wholesale electricity market.

The site is planned to energize in the fourth quarter of 2027 and is described as well suited for high performance computing, with multiple fiber paths and proximity to a major metropolitan area.

Ulysses is Cipher's first development outside Texas, bringing its US data center pipeline to 3.4 GW across 8 sites. This gives investors a fresh data point on how the company is scaling and diversifying its footprint.

See our latest analysis for Cipher Mining.

The Ulysses announcement comes after a volatile stretch for Cipher Mining, with a 1-day share price return of 9.76% and a 7-day share price return of 7.43%, following a 30-day share price return decline of 15.98%. Over a longer horizon, the picture is very different, with a 1-year total shareholder return of 176.92% and a 3-year total shareholder return above 16x. This indicates that momentum has been strong even as shorter-term swings continue.

If this kind of expansion-focused story has your attention, it may be a useful moment to broaden your view and check out high growth tech and AI stocks for potential next ideas.

With Cipher shares up very strongly over 1 year but facing a 16% 30 day pullback, and trading at a steep discount to the average analyst price target, is this Ulysses-driven growth a genuine opening or already reflected in the market?

Most Popular Narrative Narrative: 40.6% Undervalued

Against the last close of US$16.20, the most followed narrative anchors on a fair value of US$27.25, framing Cipher as materially mispriced and tightly linked to its power and AI infrastructure build out.

The analysts have a consensus price target of $7.727 for Cipher Mining based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $6.0.

Want to see what sits behind that higher fair value and very large revenue ramp assumptions? The narrative leans on aggressive top line expansion, a sharp shift in margins and a premium future earnings multiple usually reserved for high growth software names. Curious which specific earnings path and valuation multiple need to line up for Cipher to reach that price?

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative can break if Bitcoin-driven revenue weakens for an extended period or if heavy data center spending forces dilutive capital raises.

Find out about the key risks to this Cipher Mining narrative.

Another angle on valuation

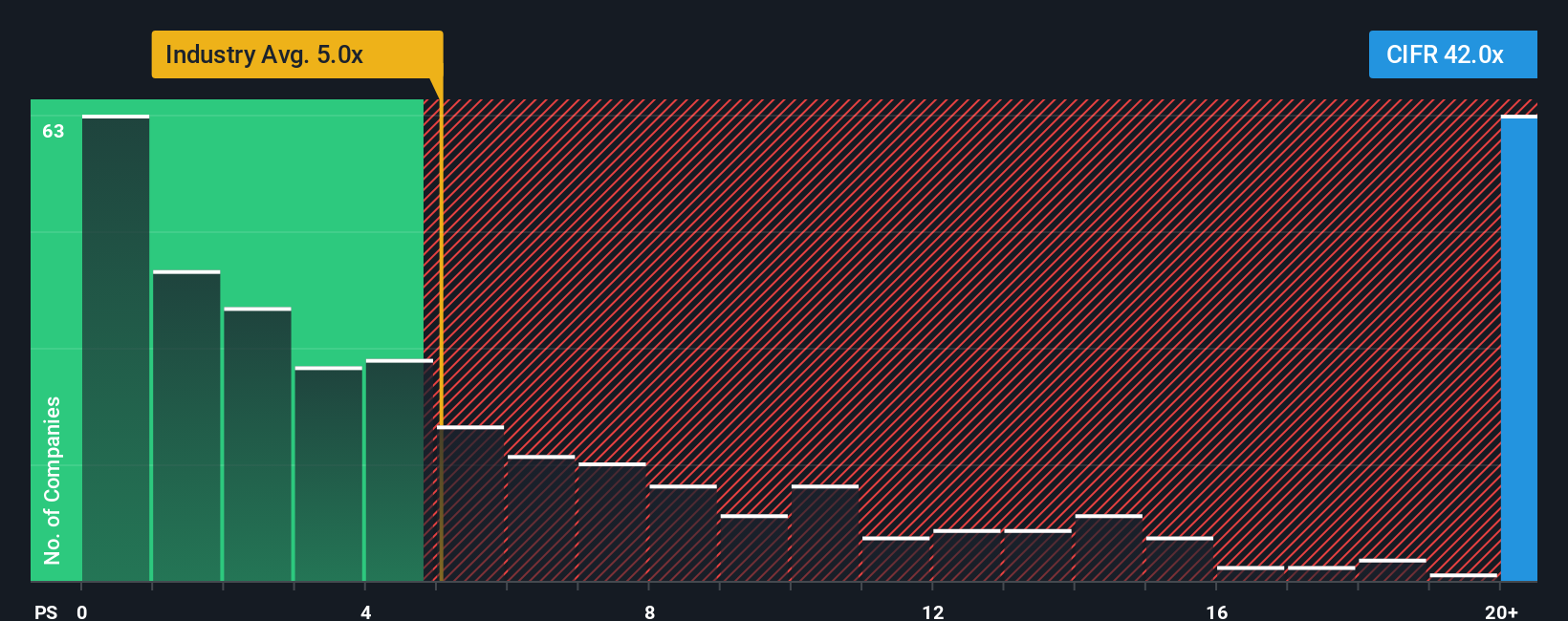

That 40.6% discount to a US$27.25 fair value leans heavily on long term growth and margin shifts. On current numbers, though, Cipher trades on a P/S of 31x, compared with 4.7x for the US Software industry, 17.4x for peers, and a fair ratio of 7.7x. That is a wide gap for you to weigh: is the market overpaying for growth, or is the narrative missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cipher Mining Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom Cipher story in just a few minutes with Do it your way.

A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Cipher has sparked your interest, do not stop there. Casting a wider net across different themes can help you spot opportunities you might otherwise miss.

- Target companies that aim to turn small share prices into big stories by scanning these 100+ penny stocks with strong financials with stronger financial footing.

- Zero in on potential AI beneficiaries by checking out these 25 AI penny stocks that are tied to artificial intelligence trends.

- Hunt for possible mispriced names by reviewing these 867 undervalued stocks based on cash flows grounded in discounted cash flow estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal