3 Middle Eastern Dividend Stocks Yielding Up To 5.9%

As the Middle Eastern markets navigate the challenges posed by fluctuating oil prices and geopolitical tensions, investors are increasingly looking towards dividend stocks as a potential source of steady income. In this environment, selecting stocks with consistent dividend yields can provide a buffer against market volatility, making them an attractive option for those seeking stability amidst uncertainty.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.30% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.26% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.43% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.14% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.04% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.34% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.46% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 6.61% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.11% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.98% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Middle Eastern Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

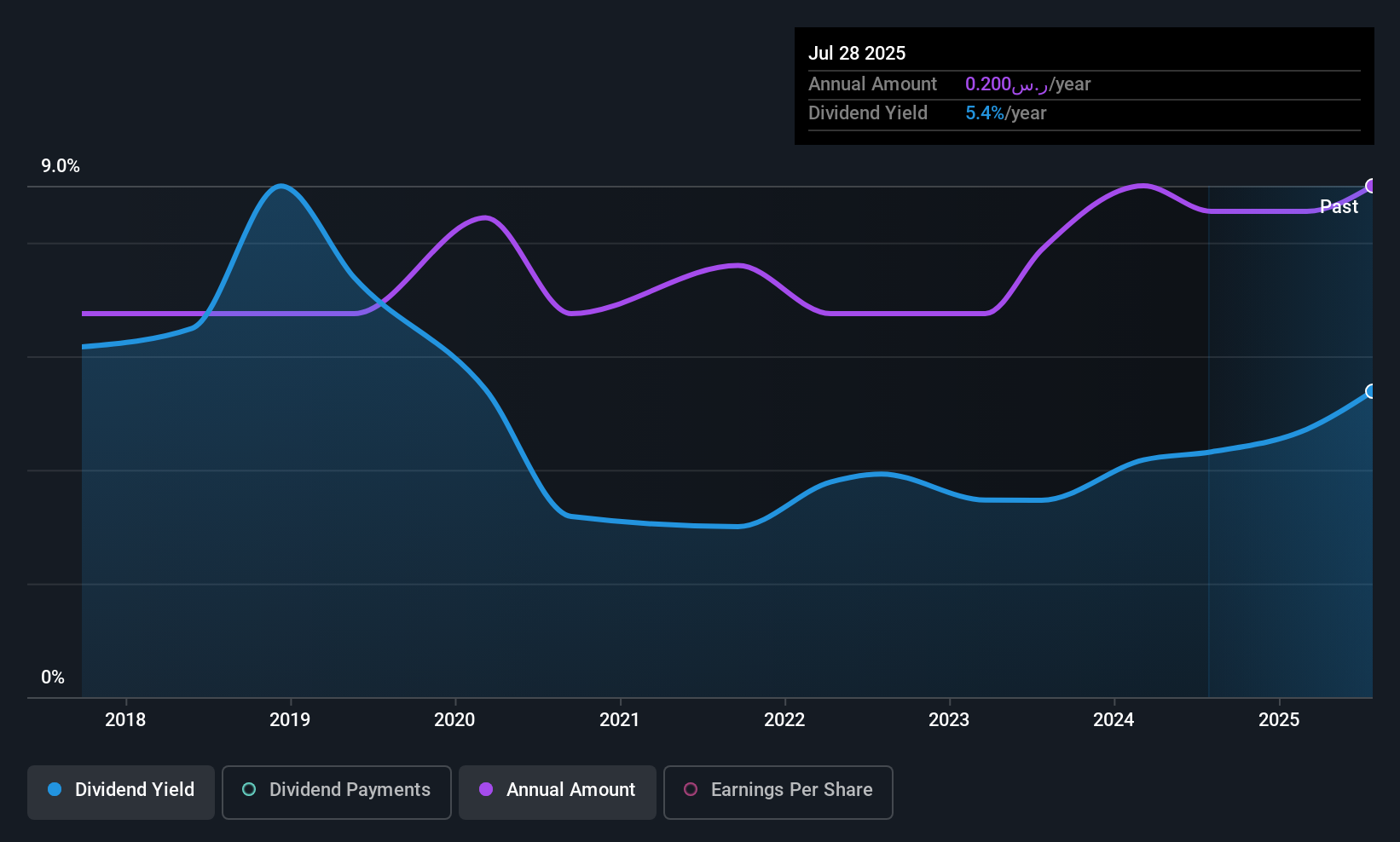

Al Rajhi Banking and Investment (SASE:1120)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Rajhi Banking and Investment Corporation, along with its subsidiaries, offers banking and investment services both within Saudi Arabia and internationally, with a market cap of SAR384 billion.

Operations: Al Rajhi Banking and Investment Corporation's revenue is derived from its Retail Segment (SAR17.42 billion), Treasury Segment (SAR7.54 billion), Corporate Segment (SAR8.39 billion), and Investment Services, Brokerage and Other Segments (SAR1.84 billion).

Dividend Yield: 3%

Al Rajhi Banking and Investment's dividend payments have been volatile over the past decade, with significant annual drops. Despite this, dividends are currently covered by earnings with a 39.2% payout ratio and forecasted to remain sustainable at 50.9% in three years. Recent earnings growth of 28.7% supports potential dividend stability, although its yield of 3.04% is below top-tier payers in the Saudi Arabian market. The bank's recent agreement as a paying agent for Al Kuzama Trading Company underscores its role in facilitating timely dividend distributions.

- Dive into the specifics of Al Rajhi Banking and Investment here with our thorough dividend report.

- According our valuation report, there's an indication that Al Rajhi Banking and Investment's share price might be on the expensive side.

Thob Al Aseel (SASE:4012)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market cap of SAR1.34 billion.

Operations: Thob Al Aseel's revenue segments include SAR369.43 million from Thobs and SAR129.35 million from Fabrics.

Dividend Yield: 6%

Thob Al Aseel's dividends, while in the top 25% of Saudi payers with a yield of 5.97%, have been volatile over its eight-year history. Recent earnings growth supports dividend coverage, with an 89.1% payout ratio and a low cash payout ratio of 33.6%. However, sales for the nine months ended September decreased to SAR 393.84 million from SAR 406.16 million last year, indicating potential revenue challenges impacting future payouts' stability.

- Unlock comprehensive insights into our analysis of Thob Al Aseel stock in this dividend report.

- Our valuation report here indicates Thob Al Aseel may be undervalued.

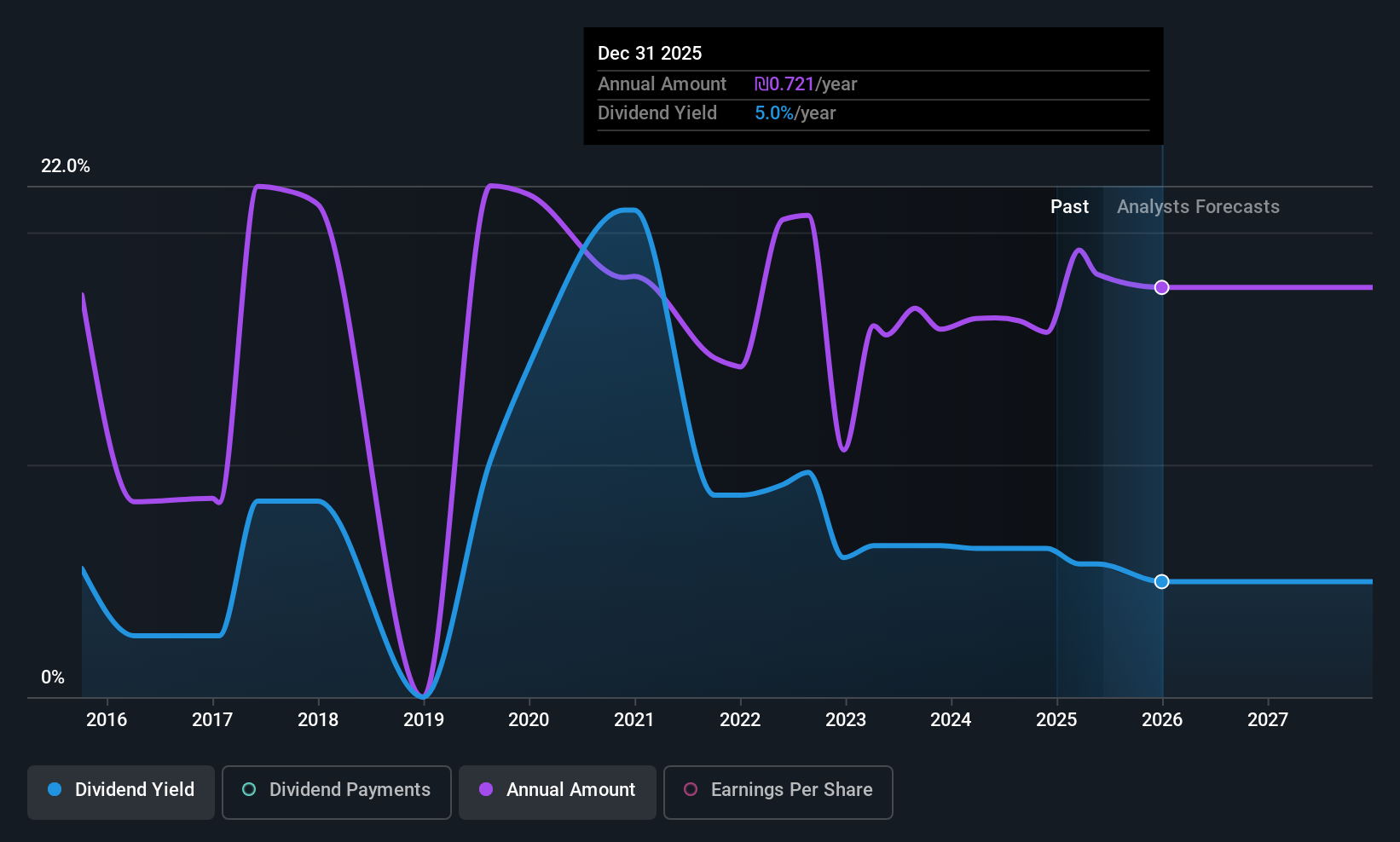

NewMed Energy - Limited Partnership (TASE:NWMD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NewMed Energy - Limited Partnership focuses on the exploration, development, production, and sale of petroleum, natural gas, and condensate in Israel, Jordan, and Egypt with a market cap of ₪21.62 billion.

Operations: NewMed Energy - Limited Partnership generates its revenue primarily from the exploration and production of oil and gas, amounting to $875.20 million.

Dividend Yield: 3.7%

NewMed Energy's dividends are reasonably covered by earnings with a payout ratio of 53.8%, and cash flows cover its payouts at a 75.6% cash payout ratio, though they have been volatile over the past decade. Despite a lower yield of 3.69% compared to top Israeli dividend payers, recent earnings results showed decreased revenue and net income for Q3 2025, which may influence future dividend stability amidst high debt levels.

- Delve into the full analysis dividend report here for a deeper understanding of NewMed Energy - Limited Partnership.

- Our comprehensive valuation report raises the possibility that NewMed Energy - Limited Partnership is priced higher than what may be justified by its financials.

Summing It All Up

- Delve into our full catalog of 60 Top Middle Eastern Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal