Taking Stock of FCC (BME:FCC)’s Valuation After Its New 10-Year Tías Services Contract

Fomento de Construcciones y Contratas (BME:FCC) just secured a 10 year street cleaning and beach services contract in Tías, backed by an 8 million euro fleet upgrade. This provides a steady new revenue stream that deserves a closer look.

See our latest analysis for Fomento de Construcciones y Contratas.

That backdrop helps explain why, despite a fairly quiet recent share price patch, investors in Fomento de Construcciones y Contratas have enjoyed a robust 1 year total shareholder return of 27.16 percent and a 5 year total shareholder return of 116.59 percent. This suggests momentum is still broadly constructive as new contracts like Tías reinforce the growth story.

If this kind of steady contract driven growth appeals to you, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

Yet even with that track record and a fresh 10 year contract in hand, FCC still trades below analyst targets and our intrinsic value estimate. This raises the question: is this a mispriced opportunity, or is future growth already baked in?

Most Popular Narrative Narrative: 17.5% Undervalued

With the most followed narrative placing fair value meaningfully above the last close of €11.14, the gap between price and projections is hard to ignore.

Ongoing significant investment in energy recovery plants and advanced materials recycling reflects a shift toward circular economy solutions and decarbonization, aligning FCC with tightening environmental regulations and the growing demand for green infrastructure. This is likely to boost both topline growth and long-term profitability in high-margin environmental services.

Want to see what is powering this valuation gap? The narrative leans on rising margins, accelerating earnings and a bold profit multiple years from now. Curious which assumptions really move the needle?

Result: Fair Value of $13.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained legal uncertainties in the UK Environment division and heavy debt funded investment could pressure margins, derail forecasts and narrow that apparent valuation discount.

Find out about the key risks to this Fomento de Construcciones y Contratas narrative.

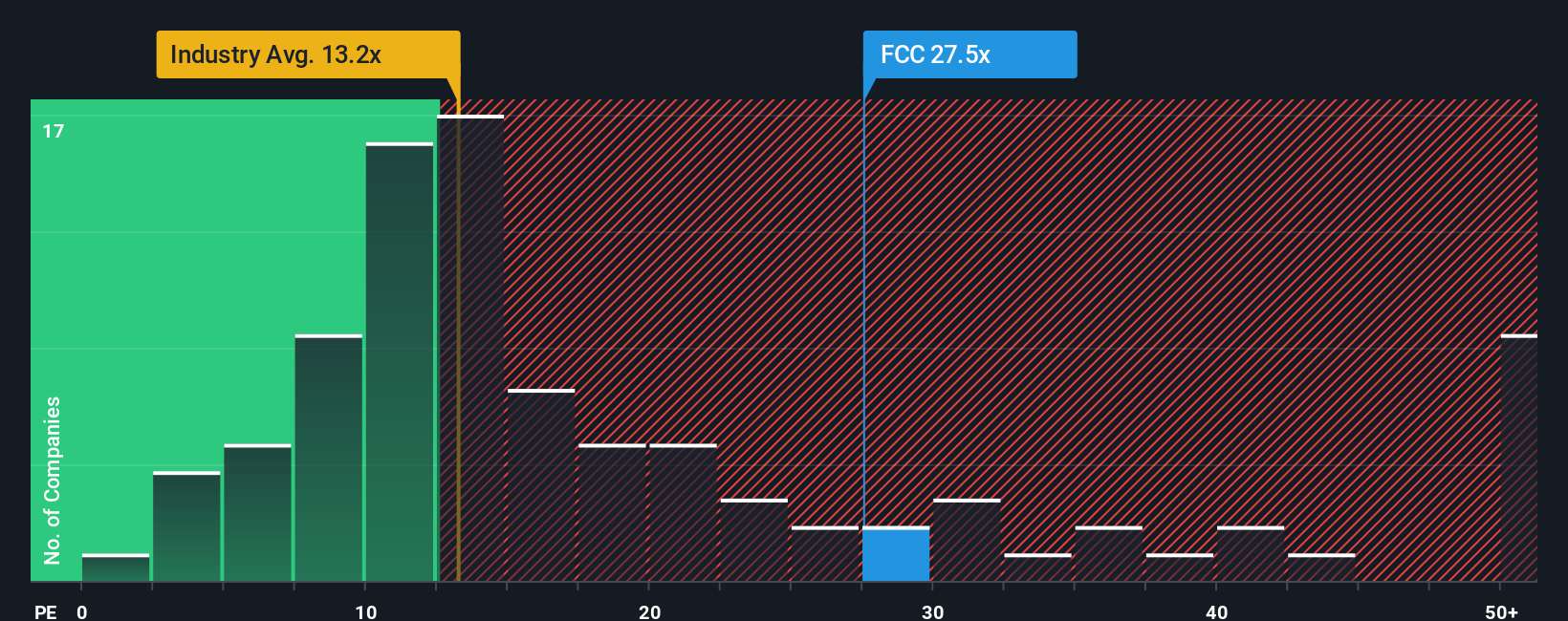

Another View, Multiples Tell a Different Story

On simple valuation ratios, FCC looks far less of a bargain. Its price to earnings sits at 27.9 times, almost double the European Commercial Services average of 14.3 times and well above its own fair ratio of 18.4 times, hinting at real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fomento de Construcciones y Contratas Narrative

If you see things differently or want to test your own assumptions against the numbers, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Fomento de Construcciones y Contratas research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more actionable investment ideas?

Before the market moves without you, put the Simply Wall St Screener to work and line up your next opportunities with focused, data driven stock shortlists.

- Capture hidden value by targeting companies trading below their cash flow potential through these 875 undervalued stocks based on cash flows that may be mispriced by the market.

- Explore innovation by focusing on these 25 AI penny stocks that are associated with demand for artificial intelligence solutions.

- Seek income opportunities by scanning these 14 dividend stocks with yields > 3% that can help strengthen your portfolio with cash yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal