Does Lawsuit Dismissal And 7,000-Store Goal Change The Bull Case For Chipotle Mexican Grill (CMG)?

- A federal judge has now dismissed a securities class action lawsuit accusing Chipotle Mexican Grill of misleading investors about portion sizes and customer dissatisfaction, removing a legal overhang for the company and its executives.

- At the same time, Chipotle is pressing ahead with an ambitious plan to reach 7,000 locations in the U.S. and Canada, underlining how management is prioritizing long-term expansion even as consumer headwinds weigh on recent comparable sales trends.

- Next, we’ll examine how the lawsuit’s dismissal and Chipotle’s aggressive unit expansion pipeline may influence its broader investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Chipotle Mexican Grill Investment Narrative Recap

To own Chipotle, you have to believe its brand, unit growth, and margin structure can outweigh near term pressure from softer comparable sales and a premium valuation. The lawsuit dismissal removes a legal overhang, but does not significantly change the near term catalyst, which still centers on whether traffic and same store sales can stabilize as the company spends heavily on expansion. The biggest risk remains that a weaker consumer backdrop continues to weigh on transaction trends.

The expansion plan to reach 7,000 locations in the U.S. and Canada is the announcement that most clearly ties into this news. With the legal risk reduced, attention shifts back to Chipotle’s ability to execute on hundreds of new openings per year while managing costs, especially if tariffs or higher build out expenses emerge. How well these new restaurants perform will be critical for justifying the current earnings multiple and supporting the growth narrative.

Yet investors should also be aware that if consumer headwinds deepen and weigh further on comparable sales, the payback on all this new capital going into store openings and equipment could...

Read the full narrative on Chipotle Mexican Grill (it's free!)

Chipotle Mexican Grill's narrative projects $16.4 billion revenue and $2.3 billion earnings by 2028. This requires 12.3% yearly revenue growth and a $0.8 billion earnings increase from $1.5 billion today.

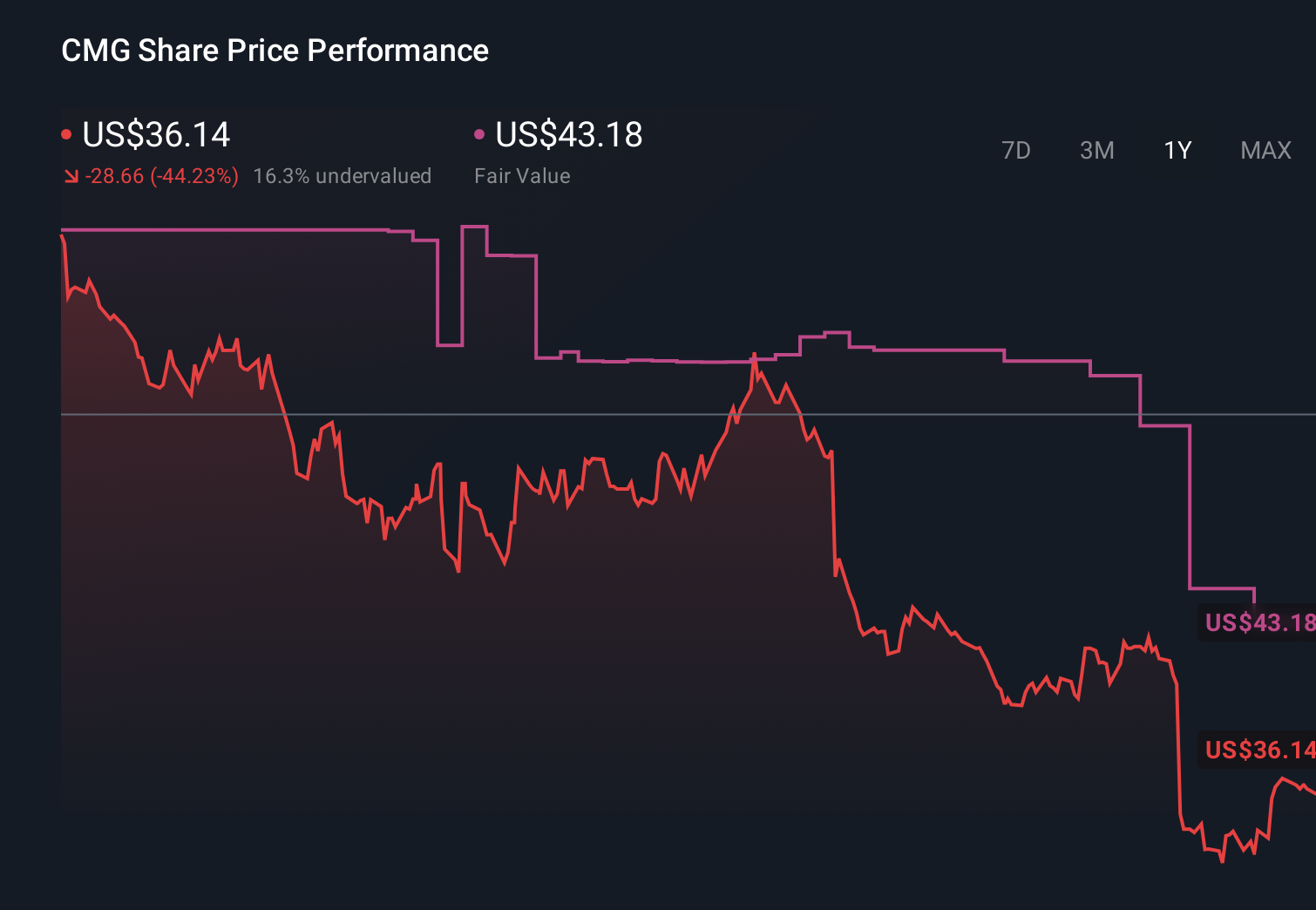

Uncover how Chipotle Mexican Grill's forecasts yield a $43.18 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Twenty three Simply Wall St Community estimates place Chipotle’s fair value between US$30.17 and US$67.56, reflecting a wide spread of individual views. Against this backdrop, the key near term question for many is whether Chipotle’s push toward thousands of additional stores can offset consumer spending risks and recent comparable sales softness, which will likely influence how those different valuations play out over time.

Explore 23 other fair value estimates on Chipotle Mexican Grill - why the stock might be worth 20% less than the current price!

Build Your Own Chipotle Mexican Grill Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chipotle Mexican Grill research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Chipotle Mexican Grill research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chipotle Mexican Grill's overall financial health at a glance.

No Opportunity In Chipotle Mexican Grill?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal