Reassessing ONEOK (OKE): A Fresh Look at Valuation After Recent Share Price Rebound

ONEOK (OKE) has been drifting after a mixed stretch for the stock, with modest gains this week but a weaker past month and year. Investors are weighing stable operations against a softer share price trend.

See our latest analysis for ONEOK.

At around $74.34, ONEOK’s recent 7 day share price return of 2.05 percent contrasts with its 1 year total shareholder return of negative 23.95 percent. This suggests momentum is only cautiously rebuilding after a tougher stretch.

If you are reassessing energy exposure and want more ideas, this could be a good moment to explore fast growing stocks with high insider ownership for other resilient growth stories.

With earnings still growing, a sizable discount to analyst targets, and a sharp pullback in the share price, is ONEOK quietly undervalued today, or is the market already pricing in most of its future growth?

Most Popular Narrative Narrative: 16.1% Undervalued

ONEOK’s fair value in the most followed narrative sits meaningfully above the recent $74.34 close, framing a story of steady growth meeting discounted expectations.

Ongoing expansions and capital investments in key areas like the Permian and Delaware Basins (for example, new processing plants and pipeline connections) position ONEOK to capture incremental fee based volumes and benefit from robust U.S. shale production, leading to higher top line growth and enhanced earnings stability.

Curious how modest volume gains turn into a double digit uplift in future profits and a richer earnings multiple than the industry standard? The full narrative reveals the precise revenue, margin, and earnings targets behind this valuation jump and the timeline analysts think it all has to happen on.

Result: Fair Value of $88.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tighter commodity spreads and slower than expected synergy realization could quickly challenge the upbeat earnings and valuation trajectory that is embedded in this narrative.

Find out about the key risks to this ONEOK narrative.

Another Angle on Valuation

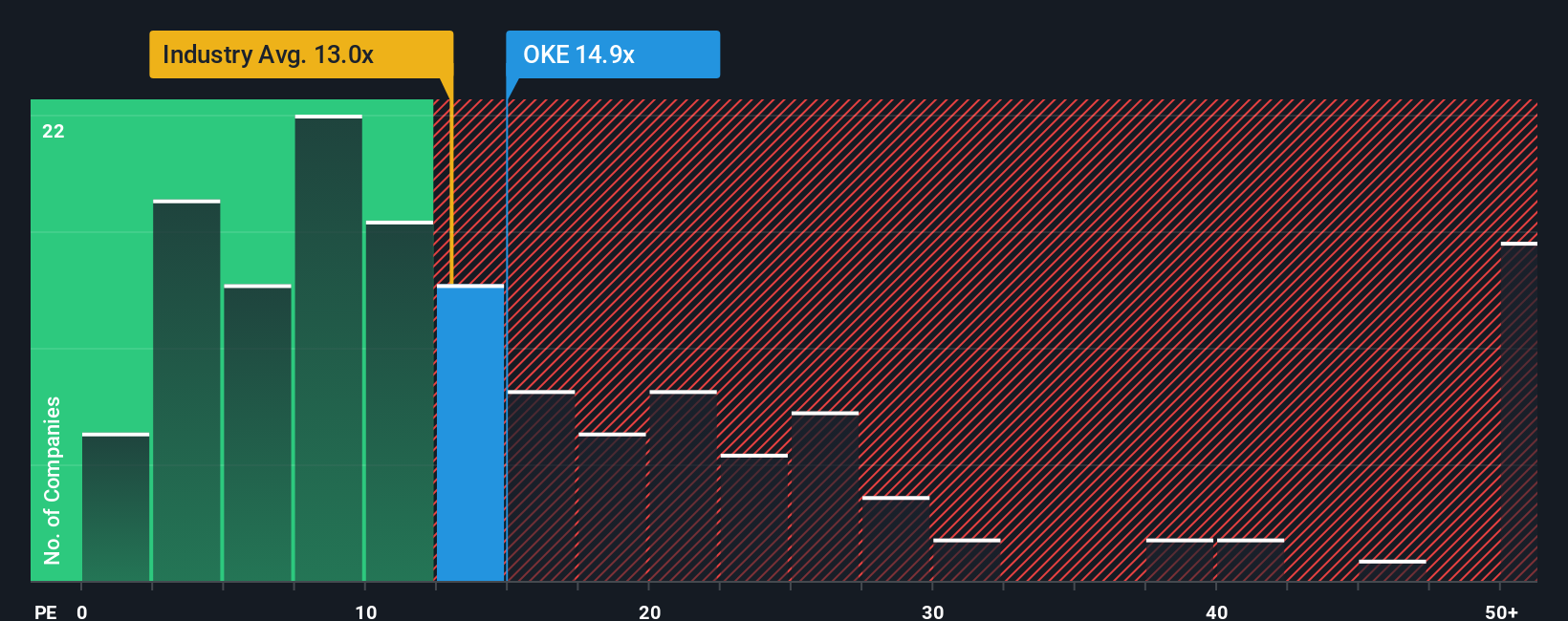

While the popular narrative sees upside to around $88.63, ONEOK already trades on a 14 times earnings multiple, slightly richer than the US Oil and Gas industry at 13.2 times but below peers at 15.4 times and its fair ratio of 20 times. Is the market cautiously underrating its earnings power, or sensibly capping the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ONEOK Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a personalized view in minutes: Do it your way.

A great starting point for your ONEOK research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, set yourself up for the next opportunity by using our screeners to target specific strengths that could complement your view on ONEOK.

- Secure potential bargains by scanning these 875 undervalued stocks based on cash flows that pair solid cash flow potential with prices the market may be misjudging.

- Capitalize on innovation by filtering for these 25 AI penny stocks that are harnessing artificial intelligence to reshape entire industries.

- Strengthen your income strategy by reviewing these 14 dividend stocks with yields > 3% that aim to deliver reliable yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal