nLIGHT (LASR): A Fresh Look at Valuation After a Strong 1-Year Share Price Run

nLIGHT (LASR) has quietly turned into one of those stocks that reward patient investors, with shares up roughly 3% this month and about 25% over the past 3 months despite ongoing losses.

See our latest analysis for nLIGHT.

Zooming out, that 24.66% 3 month share price return sits on top of a substantial 256.93% 1 year total shareholder return. This suggests momentum is building as investors reassess nLIGHT’s growth and risk profile.

If nLIGHT’s run has you thinking about what else could surprise on the upside, it might be worth scanning other high growth tech and AI names via high growth tech and AI stocks.

With the stock now trading close to analyst targets after a massive 12 month run, the real question is whether nLIGHT is still mispriced on its long term laser and defense potential, or if markets are already baking in years of growth.

Most Popular Narrative Narrative: 8.3% Undervalued

With shares last closing at 38.37 dollars against a narrative fair value of about 41.86 dollars, the story leans toward upside anchored in lasers and defense.

The rapid growth and expanding pipeline in aerospace and defense, particularly around high power laser solutions (e.g, HELSI 2 program, DE M SHORAD, Golden Dome initiative, and increased directed energy orders internationally), positions nLIGHT to benefit from rising global defense spending and modernization, supporting strong multi year revenue growth.

Want to see what kind of revenue climb, margin reset, and rich future earnings multiple are baked into that price target? The full narrative spells it out.

Result: Fair Value of $41.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on defense programs, along with ongoing weakness in commercial lasers, means any budget cuts or execution missteps could quickly challenge this upbeat thesis.

Find out about the key risks to this nLIGHT narrative.

Another Angle on Valuation

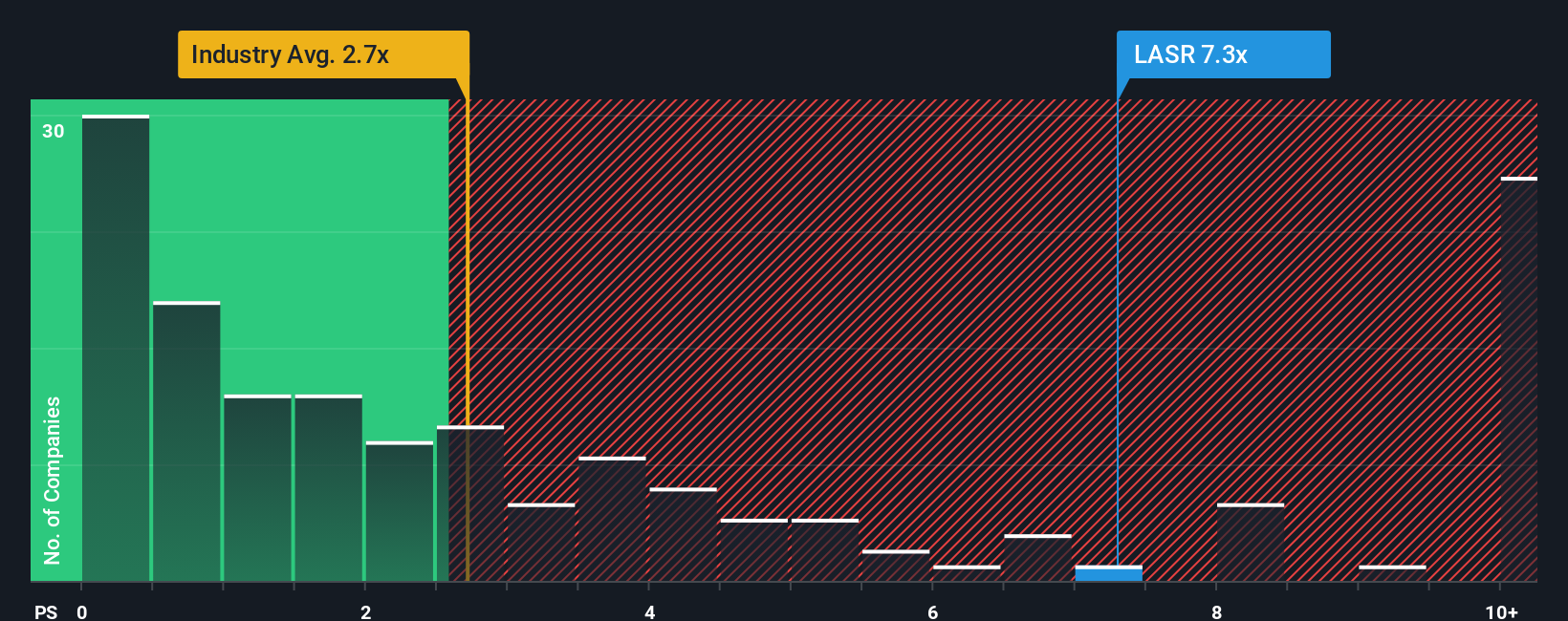

While the narrative fair value suggests nLIGHT is about 8% undervalued, the market is paying a steep 8.6 times sales versus 2.5 times for the US Electronic industry and 3.4 times for peers, well above a 1.3 times fair ratio. That rich gap raises the question: how much good news is already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nLIGHT Narrative

If you see the setup differently or prefer to dig into the numbers yourself, you can easily build a custom view in just a few minutes: Do it your way.

A great starting point for your nLIGHT research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with nLIGHT when the next wave of opportunities could be forming elsewhere. Use the Simply Wall Street Screener to stay one step ahead.

- Capture early-stage upside by scanning these 3571 penny stocks with strong financials that already show solid financial foundations instead of hoping the crowd eventually notices them.

- Position yourself at the heart of the AI boom by reviewing these 25 AI penny stocks that pair powerful technology with real revenue momentum.

- Lock in quality at a sensible price by focusing on these 875 undervalued stocks based on cash flows that the market has not fully appreciated yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal