Remitly (RELY): Revisiting Valuation After Investor Day Growth Targets and Renewed Analyst Optimism

Remitly Global (RELY) is back on investors radar after its recent Investor Day, where management doubled down on the company’s digital remittance leadership and laid out ambitious multi year growth and profitability targets.

See our latest analysis for Remitly Global.

Those upbeat Investor Day targets landed after a bruising stretch, with the 1 year total shareholder return down around 43% and the 90 day share price return sliding about 16%. This suggests momentum has been fading even as growth ambitions rise.

If Remitly’s volatility has you thinking more broadly about growth ideas, this could be a good moment to explore fast growing stocks with high insider ownership.

With shares down sharply over the past year but still trading nearly 40% below the average analyst target, is Remitly an underappreciated compounder in digital remittances, or is the market already discounting all that future growth?

Most Popular Narrative: 38% Undervalued

With Remitly Global last closing at $13.22 versus a narrative fair value around $21.17, the story hinges on rapid growth and widening margins.

The strategic launch of stablecoin functionality and multicurrency wallets positions Remitly to capitalize on the accelerating adoption of digital financial services and rising global smartphone penetration, which should drive higher customer acquisition, improve retention, and diversify revenue streams.

Want to see what justifies such an aggressive jump in earnings power? The narrative leans on faster top line expansion and a sharply richer profit profile. Curious how those moving parts combine into that ambitious fair value? Read on to unpack the full playbook.

Result: Fair Value of $21.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stiff competition and potential regulatory pushback on stablecoins could squeeze fees, increase compliance costs, and derail those margin and growth assumptions.

Find out about the key risks to this Remitly Global narrative.

Another Angle on Valuation

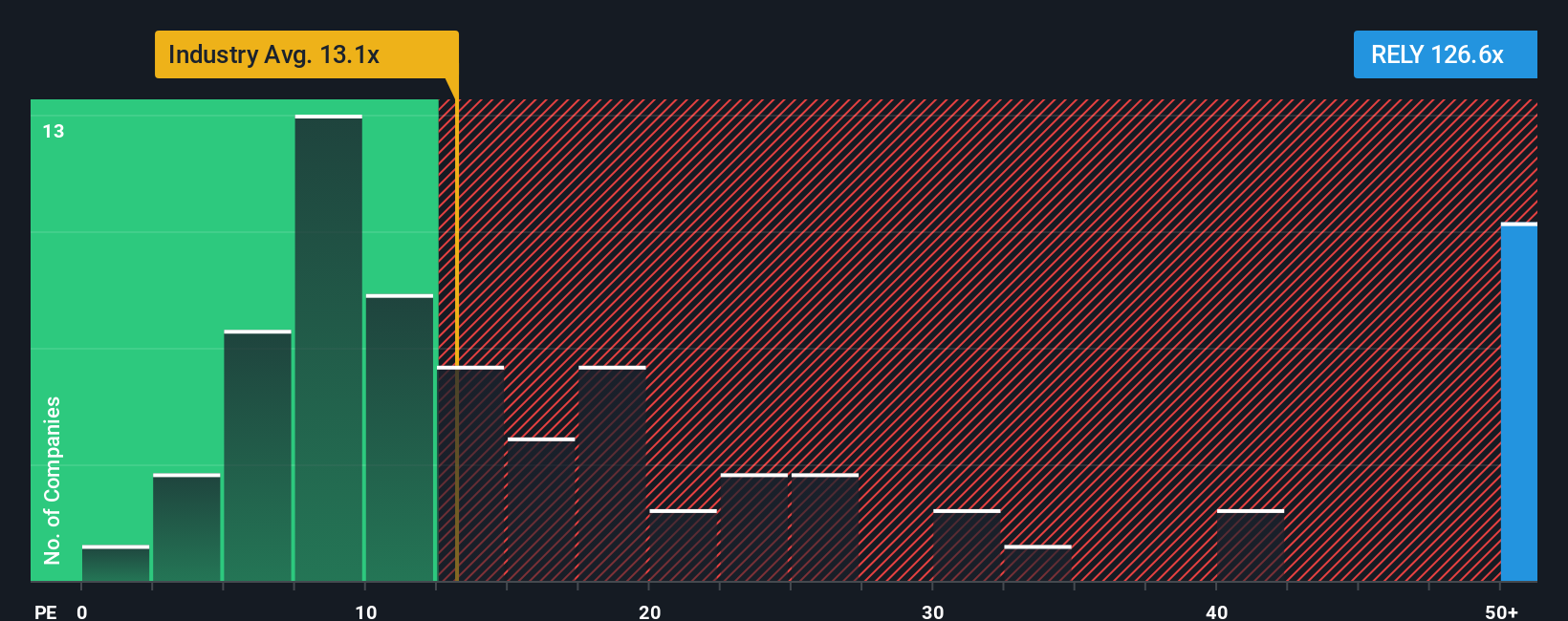

Analysts see Remitly as 38% undervalued on a growth driven fair value, but today’s price tells a tougher story. At roughly 131.6 times earnings versus 27.6 times for peers and a fair ratio of 30.1, the stock appears richly priced, which raises the question of how much upside is really left.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Remitly Global Narrative

If you want to stress test these assumptions or follow your own data driven instincts, you can build a personalized Remitly thesis in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Remitly Global.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning focused stock ideas on Simply Wall St, tailored to different strategies and risk levels.

- Capture high-upside potential in overlooked names by reviewing these 3571 penny stocks with strong financials with stronger balance sheets than their tiny market caps suggest.

- Capitalize on the AI transformation by targeting these 25 AI penny stocks that combine rapid revenue growth with real, scalable products, not just hype.

- Anchor your portfolio in value by assessing these 875 undervalued stocks based on cash flows that trade below estimated cash flow potential, before the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal