Did New CFO and Ex‑Murphy CEO on Board Just Shift Oceaneering International's (OII) Investment Narrative?

- Oceaneering International has completed a leadership transition, appointing Michael W. Sumruld as Chief Financial Officer and Senior Vice President and adding former Murphy Oil CEO Roger Jenkins to its Board, both effective January 1, 2026, with outgoing CFO Alan R. Curtis remaining as an advisor to support continuity.

- This combination of a new finance chief with extensive capital allocation experience and a board member with deep offshore energy and governance expertise could meaningfully influence Oceaneering’s capital priorities and long-term business mix.

- With Michael Sumruld stepping in as CFO, we’ll now examine how this leadership shift could reshape Oceaneering International’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Oceaneering International Investment Narrative Recap

To own Oceaneering International, you need to be comfortable with a company that still leans on cyclical offshore oil and gas activity while working to grow more stable, technology and service-based revenue streams. The incoming CFO, Michael Sumruld, and new director, Roger Jenkins, do not materially change the near term reliance on offshore spending, which remains the key catalyst and the main risk if customer capex or utilization weakens.

The most relevant recent announcement here is Oceaneering’s ongoing share repurchase program, with US$150.77 million spent to buy back about 4.22% of shares since 2014. Taken together with this leadership transition, investors may watch how capital allocation choices balance returning cash to shareholders with reinvesting in areas like robotics and ADTech that could reduce exposure to offshore volatility.

Yet while management is working to broaden the business mix, investors should still be aware of the company’s high dependency on cyclical offshore spending and...

Read the full narrative on Oceaneering International (it's free!)

Oceaneering International's narrative projects $3.1 billion revenue and $185.9 million earnings by 2028. This requires 4.2% yearly revenue growth and an earnings decrease of $16.3 million from $202.2 million today.

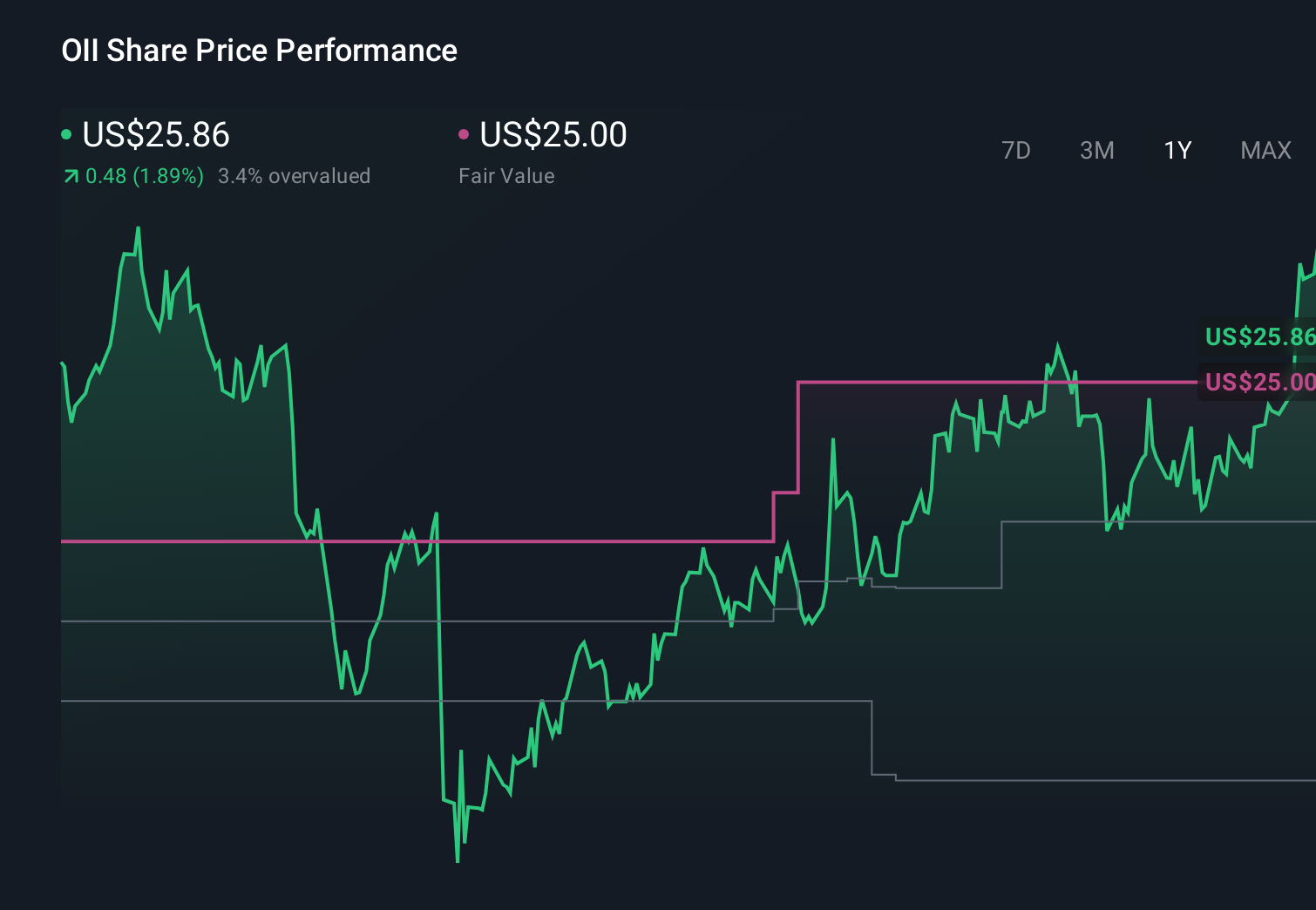

Uncover how Oceaneering International's forecasts yield a $22.38 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see fair value for Oceaneering between US$21.43 and about US$35.45 per share, underlining how far opinions can stretch. You should weigh those varied views against the ongoing risk that a pullback in offshore oil and gas capital spending could pressure Oceaneering’s utilization, earnings and cash returns over time.

Explore 4 other fair value estimates on Oceaneering International - why the stock might be worth 14% less than the current price!

Build Your Own Oceaneering International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oceaneering International research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Oceaneering International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oceaneering International's overall financial health at a glance.

No Opportunity In Oceaneering International?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal