Equinix (EQIX): Assessing Valuation After Recent Stabilization in Share Price Performance

Equinix (EQIX) has quietly outperformed the broader real estate space over the past month, rising about 3% even as the stock remains down roughly 19% over the past year.

See our latest analysis for Equinix.

That mixed backdrop shows momentum is stabilizing rather than surging, with a 30 day share price return of just over 3% but a 1 year total shareholder return still nearly 19% lower. This reminds investors that sentiment is only cautiously warming up again.

If Equinix has you rethinking digital infrastructure, it is a good time to see what else is gaining traction across tech and data plays via high growth tech and AI stocks.

With revenue and earnings still growing and the share price trading at a sizable discount to analyst targets, investors now face a key question: Is Equinix undervalued, or already reflecting its next leg of growth?

Most Popular Narrative Narrative: 20.9% Undervalued

With Equinix last closing at $764.11 versus a narrative fair value near $965.56, the gap points to upside if growth and margins land as projected.

The rapid expansion and customer adoption of Equinix Fabric and interconnection services (with 8% Y/Y growth, over 4,000 customers, and record interconnection revenue) create new high-margin, asset-light revenue lines, supporting expansion of overall net margins.

Curious how steady double digit top line growth, rising margins and a premium future earnings multiple could still argue for upside, not excess, in this valuation story.

Result: Fair Value of $965.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained heavy capex needs, along with reliance on a concentrated hyperscale customer base, could quickly pressure margins and challenge the current undervaluation narrative.

Find out about the key risks to this Equinix narrative.

Another Angle on Valuation

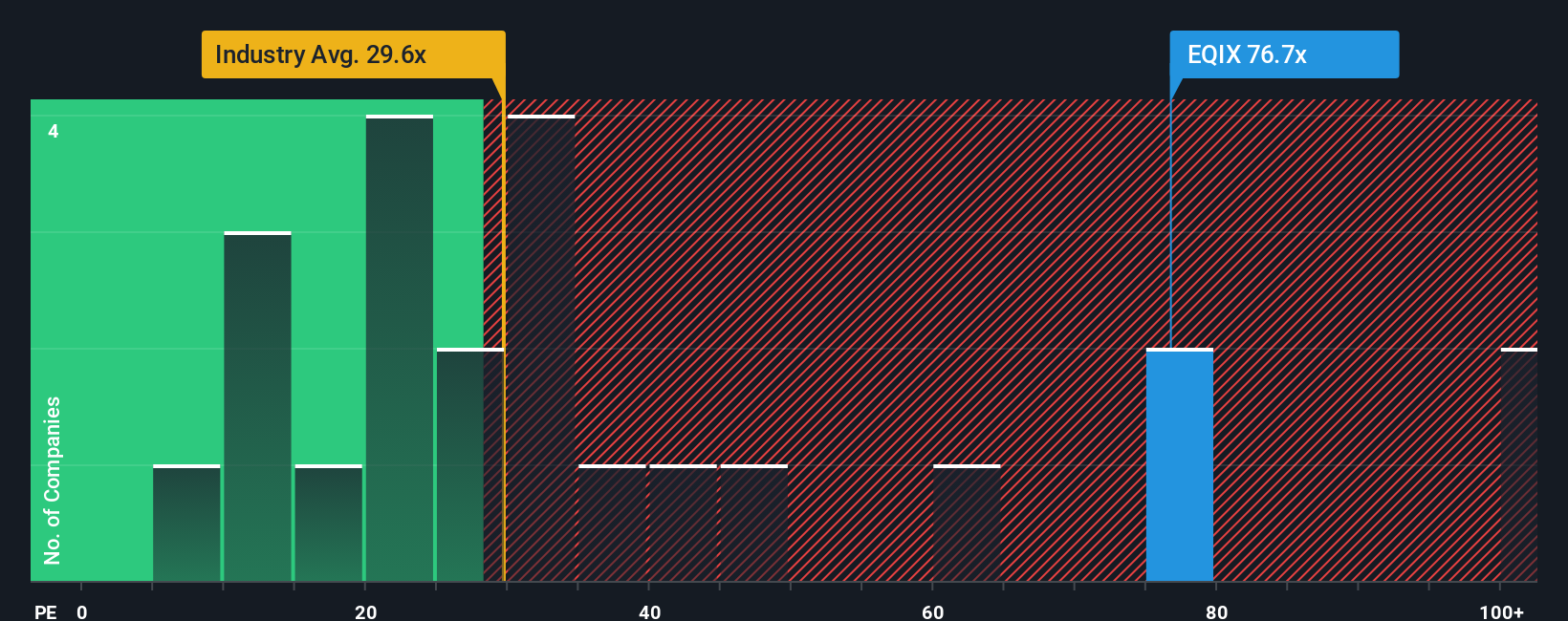

While the narrative fair value suggests upside, Equinix trades at about 70 times earnings versus 27 times for the US Specialized REITs industry and a 36 times fair ratio. That rich gap leans toward valuation risk, not safety, if growth or margins disappoint from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equinix Narrative

If you see the story differently or just want to dig into the numbers yourself, you can build a fresh narrative in minutes, Do it your way.

A great starting point for your Equinix research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may consider using the Simply Wall Street Screener to uncover fresh, data driven opportunities other investors are overlooking.

- Look for potential mispricings by searching for companies trading below intrinsic value through these 875 undervalued stocks based on cash flows and position yourself ahead of a possible re rating.

- Explore the next wave of innovation by targeting cutting edge businesses involved in artificial intelligence with these 25 AI penny stocks before their growth fully shows up in the headlines.

- Strengthen your income stream by focusing on companies offering reliable, attractive payouts using these 14 dividend stocks with yields > 3% so your capital can potentially work harder over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal