Core Scientific (CORZ): Assessing Valuation After a Recent Short-Term Share Price Rebound

Core Scientific (CORZ) has been quietly on the move, with the stock jumping about 10% in the past day and edging higher over the past week, even as month and past 3 months returns remain negative.

See our latest analysis for Core Scientific.

Zooming out, that sharp 1 day and 7 day share price return upswing comes after a choppy few months of negative share price returns. This leaves the share price at $15.99 and total shareholder return only modestly positive over the past year, which suggests sentiment is improving but conviction is still forming around Core Scientific’s growth story and risk profile.

If this kind of rebound has your attention, it could be a good moment to see what else is setting up for potential upside by exploring fast growing stocks with high insider ownership.

With shares still well below analyst targets despite rapid revenue and earnings growth off a low base, investors now face a key question: Is Core Scientific an overlooked value play, or is the market already baking in its rebound potential?

Most Popular Narrative: 40.4% Undervalued

With Core Scientific last closing at $15.99 against a narrative fair value near $26.82, the valuation story leans heavily toward future upside and sets the scene for a key growth driver.

The analysts have a consensus price target of $19.045 for Core Scientific based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0 and the most bearish reporting a price target of just $15.0.

Curious what kind of revenue surge, margin turnaround, and future earnings multiple are embedded in that upside case? The narrative spells out those assumptions in more detail. Click in to see them.

Result: Fair Value of $26.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering execution risks around the AI or HPC pivot and heavy reliance on CoreWeave could still derail those upbeat growth assumptions.

Find out about the key risks to this Core Scientific narrative.

Another View: Market Ratio Flags a Rich Price

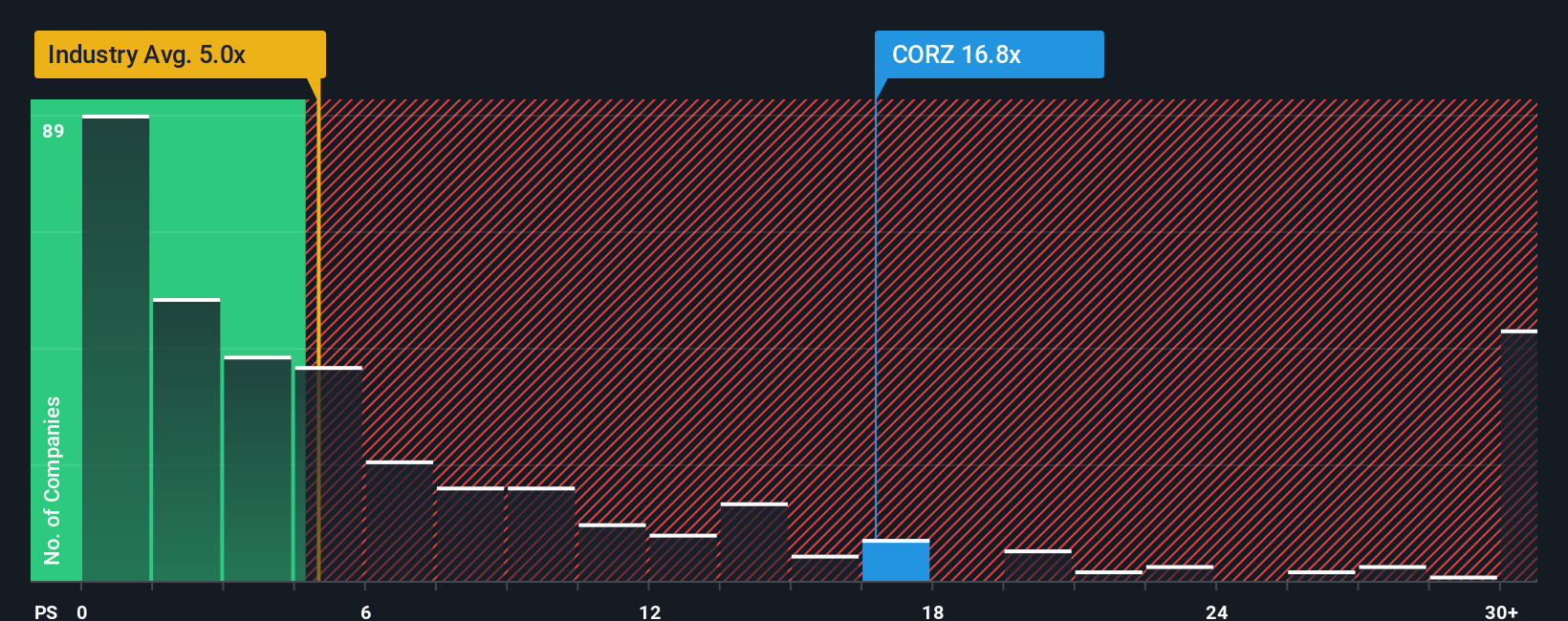

That 40.4% upside narrative contrasts sharply with how the market is pricing Core Scientific on sales. The stock trades at about 14.8 times revenue versus a fair ratio near 3.8 times and roughly 4 to 5 times for industry and peers, which points to elevated valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core Scientific Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build a personalized view in just a few minutes: Do it your way.

A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If you stop here, you could miss some of the most compelling opportunities on the platform, so let the Simply Wall St Screener guide your next move.

- Capture early stage growth by scanning these 3571 penny stocks with strong financials that combine attractive prices with balance sheets strong enough to support the next leg of expansion.

- Position yourself for structural tailwinds by targeting these 29 healthcare AI stocks where intelligent tools transform diagnostics, treatment decisions and long term revenue potential.

- Lock in potential income streams by focusing on these 14 dividend stocks with yields > 3% that offer attractive yields alongside business models built to sustain regular payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal