MercadoLibre (MELI): Taking Stock of Valuation After Recent Share Price Weakness and Strong 2026 Growth Expectations

Recent coverage around MercadoLibre (MELI) is zeroing in on a familiar theme: the company keeps executing in Latin American e-commerce and fintech even as the stock trades meaningfully below its peak.

See our latest analysis for MercadoLibre.

At around $1,973.70 per share, MercadoLibre’s recent pullback, including a 1 month share price return of approximately negative 4.5 percent and a 3 month share price return of roughly negative 8.4 percent, contrasts with its roughly 7.6 percent 1 year total shareholder return and powerful 3 year total shareholder return of about 126 percent. This suggests long term momentum remains intact even as near term sentiment cools a bit.

If MercadoLibre’s blend of e commerce and fintech growth has your attention, this could be a good time to scout other high growth tech names through high growth tech and AI stocks.

With analysts still modeling brisk growth and the shares trading at a sizeable discount to consensus targets, the key debate now is simple: Is MercadoLibre quietly undervalued, or is the market already pricing in its next leg of expansion?

Most Popular Narrative: 30.7% Undervalued

With MercadoLibre last closing at $1,973.70 against a narrative fair value of about $2,847, the spread points to a sizable upside gap worth unpacking.

Cross platform integration of commerce, fintech, and advertising demonstrated by accelerated ad revenue growth and enhanced tools for sellers deepens ecosystem stickiness, reinforcing customer lifetime value and delivering operating leverage that can support above consensus net income and earnings growth.

Want to see the engine behind this bold valuation call? The growth, margin, and earnings expansion blueprint is hiding in plain sight. Curious which assumptions really move the dial? Dive in to see the numbers this narrative is betting on.

Result: Fair Value of $2847.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competitive intensity in Brazilian e commerce and potential credit losses from rapid portfolio expansion could quickly challenge the current undervaluation narrative.

Find out about the key risks to this MercadoLibre narrative.

Another Lens on Valuation

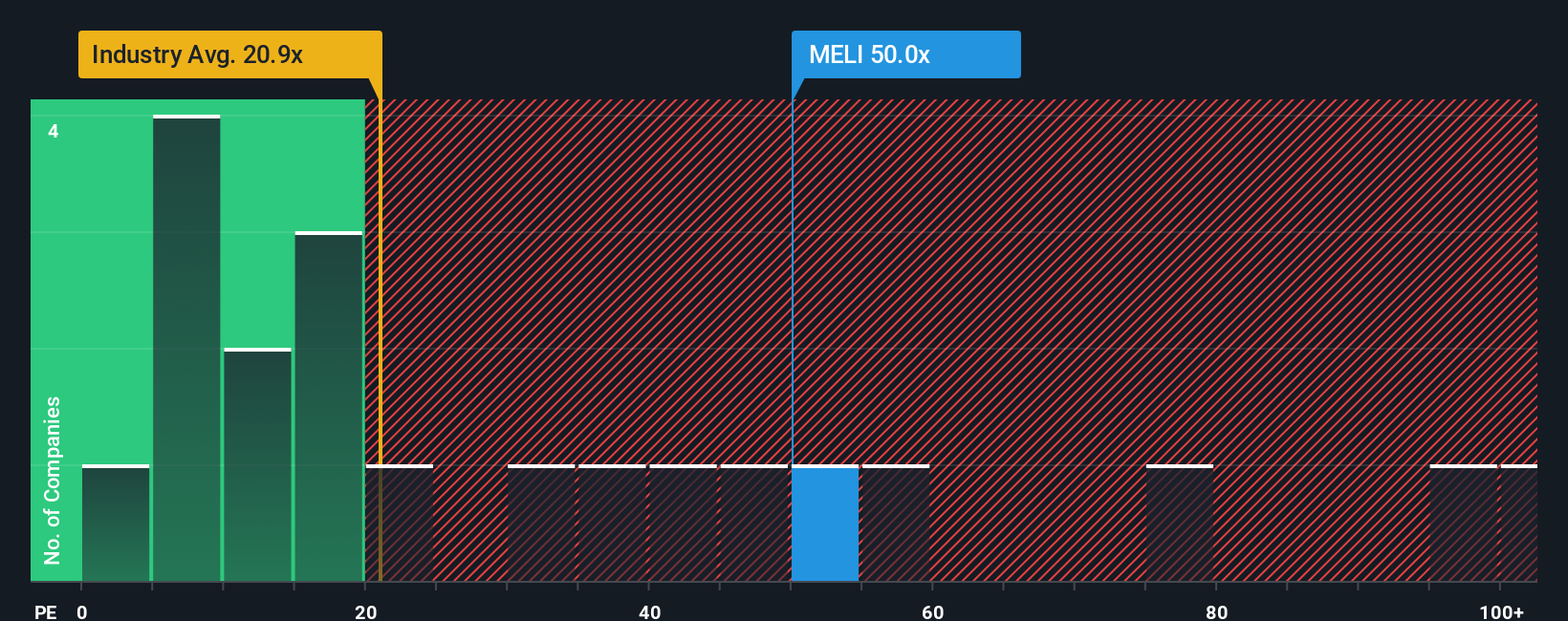

Step away from narrative fair value and MercadoLibre suddenly looks expensive. At 48.2 times earnings versus an industry average of 19.4 times and a peer average of 46.2 times, plus a fair ratio of 32.6 times, the market is paying up. This raises the question: is this still a bargain, or now a high expectations story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MercadoLibre Narrative

If you see the story differently or want to stress test the numbers yourself, you can craft a custom narrative in minutes, Do it your way.

A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunity using the Simply Wall Street Screener, where focused stock shortlists turn scattered research into targeted, actionable ideas.

- Capture potential mispricings by scanning these 875 undervalued stocks based on cash flows that pair strong fundamentals with attractive valuations before attention catches up.

- Ride powerful innovation trends by zeroing in on these 25 AI penny stocks shaping everything from automation to intelligent platforms across the market.

- Strengthen your income stream by targeting these 14 dividend stocks with yields > 3% that balance reliable payouts with the potential for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal