Tempus AI (TEM): Reassessing Valuation After Regulatory Pivot and Strengthening Diagnostics Position

Tempus AI (TEM) is back in the spotlight as Wall Street zeroes in on its push toward FDA approved and Advanced Diagnostic Laboratory Test pathways, a shift that could reshape how its testing business gets paid.

See our latest analysis for Tempus AI.

Despite a tough stretch that has seen a 30 day share price return of minus 18.65 percent and a 90 day share price return of minus 33 percent, the stock still boasts a 12 month total shareholder return of 63.03 percent. This suggests momentum has cooled recently even as the longer term story remains intact around its data driven diagnostics push and upcoming FDA milestones.

If Tempus AI's regulatory pivot has your attention, this is also a good moment to scan other innovative healthcare names using our healthcare stocks for fresh ideas beyond TEM.

With shares now trading at a steep discount to Wall Street targets yet still reflecting big expectations for FDA and ADLT driven growth, is Tempus AI a mispriced opportunity, or is the market already discounting its next leg higher?

Most Popular Narrative Narrative: 29.9% Undervalued

With the narrative fair value set at 88.92 dollars versus a last close of 62.36 dollars, the story hinges on rapid scaling and richer margins ahead.

The ongoing expansion of clinical genomic integrations such as Tempus' broad MRD and liquid biopsy portfolios means that, upon future reimbursement, there is further upside to both volume and revenue, with potential positive impact on net margins due to greater operating leverage on fixed R&D costs.

Curious how this narrative turns rising test volumes, richer data deals, and a future style profit margin into that punchy valuation gap? The full breakdown spells it out.

Result: Fair Value of $88.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and lingering reimbursement uncertainty could still stall Tempus AI's margin expansion and delay the upside implied in this narrative.

Find out about the key risks to this Tempus AI narrative.

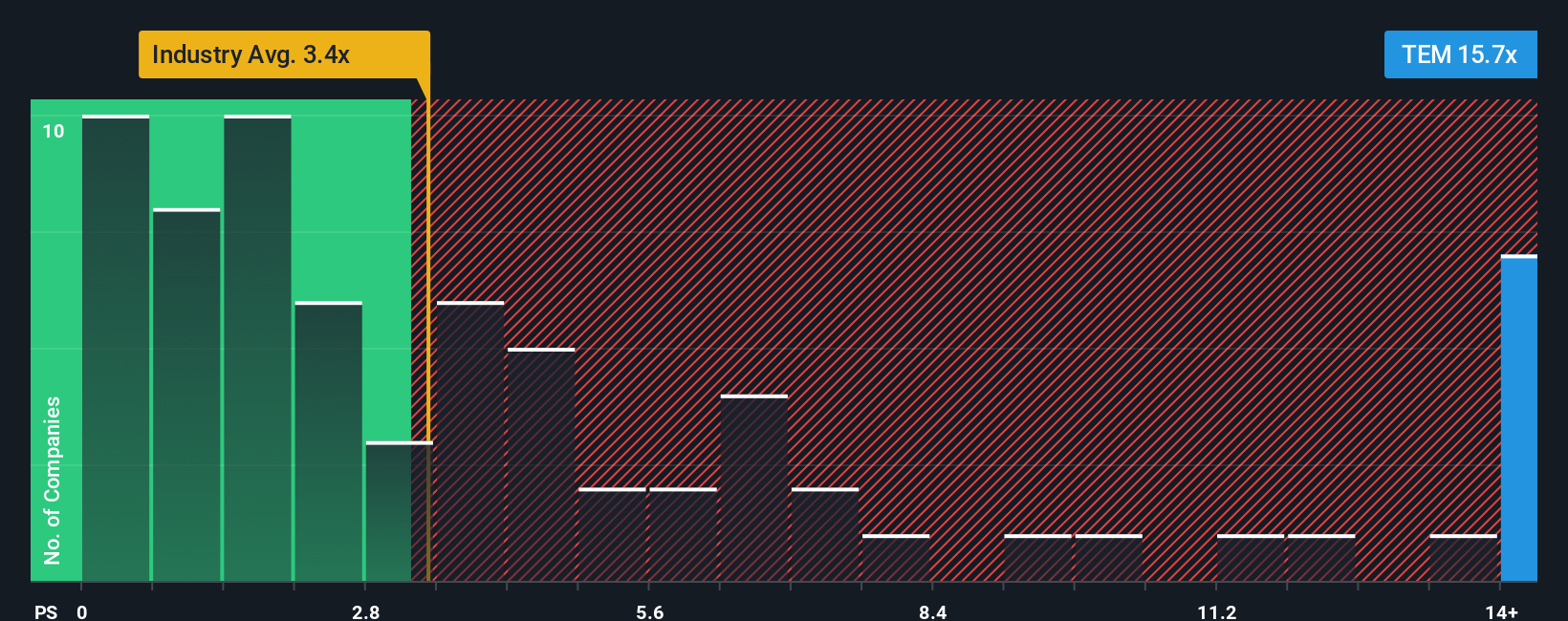

Another View, Market Ratios Look Stretched

While the narrative suggests nearly 30 percent upside, today’s price to sales ratio of around 10 times looks rich versus US Life Sciences peers at 3.2 times and a fair ratio of 7.9 times. That premium raises the risk that any stumble could hit the share price hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tempus AI Narrative

If this angle does not fully resonate, or if you would rather analyze the numbers yourself, you can shape a personalized view in minutes, Do it your way.

A great starting point for your Tempus AI research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next edge by running targeted searches on Simply Wall Street's powerful screeners so promising opportunities do not pass you by.

- Capitalize on mispriced potential by scanning these 875 undervalued stocks based on cash flows that pair solid fundamentals with attractive entry points.

- Ride the next wave of innovation by targeting these 25 AI penny stocks positioned at the forefront of machine learning and automation.

- Strengthen your income game by reviewing these 14 dividend stocks with yields > 3% that can boost portfolio yield without abandoning quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal