Teva Pharmaceutical Industries (NYSE:TEVA): Assessing Valuation After a 46% Share Price Rebound

Teva Pharmaceutical Industries (NYSE:TEVA) has quietly outperformed many large pharma names over the past year, with the stock climbing about 46% as investors warm to its turnaround and specialty-drug pipeline.

See our latest analysis for Teva Pharmaceutical Industries.

Despite a soft patch in the past week, Teva’s recent 1 month share price return of 8.75 percent and 3 year total shareholder return of 194.20 percent suggest momentum is still very much on its side.

If Teva’s rebound has you rethinking the pharma space, this could be a good moment to scan other potential opportunities among healthcare stocks.

Yet after such a sharp rally and improving fundamentals, the key question now is whether Teva still trades at a meaningful discount to its intrinsic value, or if the market has already priced in the next leg of growth.

Most Popular Narrative: 5.6% Undervalued

With Teva closing at $30.95 versus a most popular narrative fair value of about $32.77, the story tilts toward modest upside driven by operating leverage.

The fair value estimate has risen moderately to approximately $32.77 from about $28.61, reflecting increased confidence in Teva’s medium term outlook.

The future P/E multiple has increased meaningfully to roughly 21.4 times from about 18.7 times, which implies a higher valuation assigned to Teva’s forward earnings.

Want to see why this narrative leans on accelerating earnings, fatter margins, and a richer future multiple than today’s market is implying? The full breakdown reveals the specific growth runway, profitability shift, and valuation bridge that underpin this fair value call, but you will need to dig into the narrative to see exactly how those moving parts line up.

Result: Fair Value of $32.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering dependence on a few branded drugs and Teva’s still hefty debt burden could quickly derail the upside if execution or pricing disappoints.

Find out about the key risks to this Teva Pharmaceutical Industries narrative.

Another View: Earnings Multiple Flags Richer Pricing

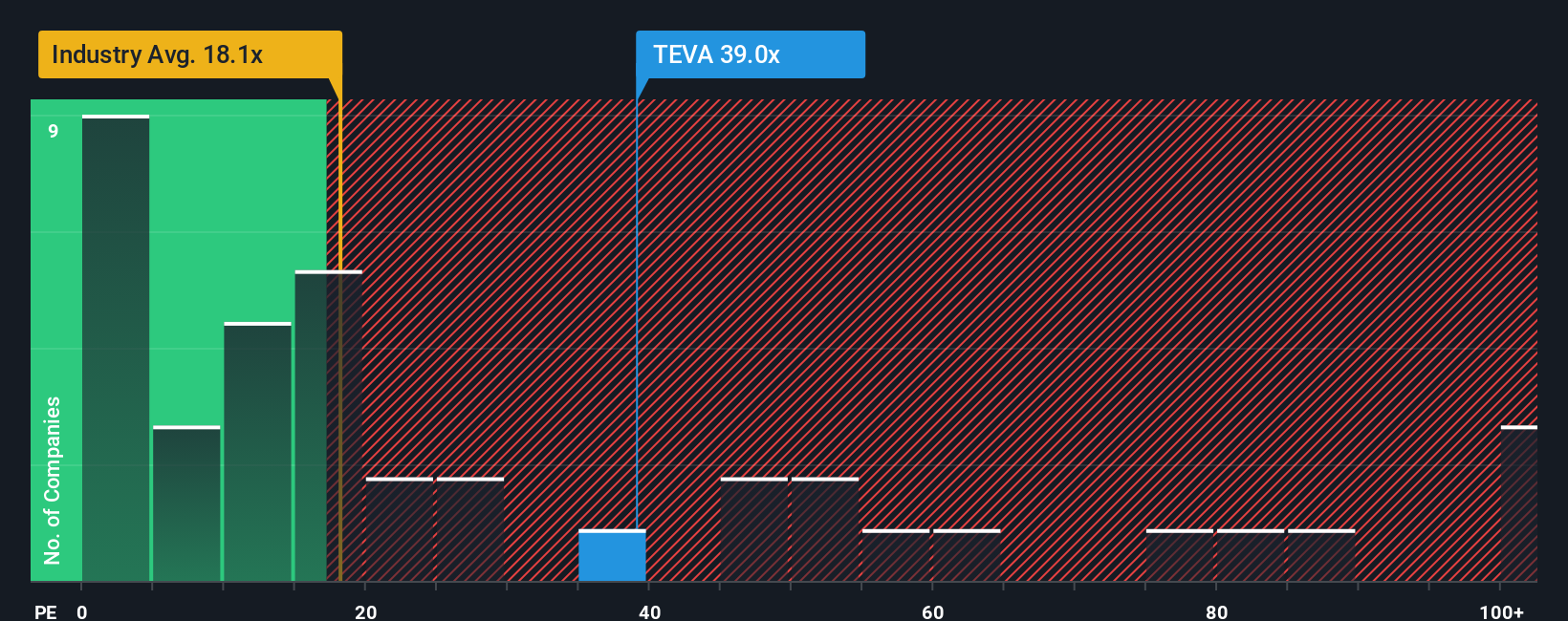

While the narrative fair value points to modest upside, Teva’s current P/E near 49.8 times screens expensive beside the US pharmaceuticals average of 19.9 times and a 25.3 times fair ratio that the market could drift toward. This would mean less room for error if growth underdelivers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teva Pharmaceutical Industries Narrative

If you want to stress test these assumptions or rely on your own homework, you can quickly build a personalized view in just minutes. Do it your way

A great starting point for your Teva Pharmaceutical Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investment edge?

Use the Simply Wall St Screener now to uncover fresh stock ideas that match your strategy so you are not left watching stronger opportunities pass by.

- Capture mispriced quality by targeting these 875 undervalued stocks based on cash flows that combine solid fundamentals with attractive upside potential before the crowd catches on.

- Ride the next wave of innovation by focusing on these 25 AI penny stocks positioned at the heart of the artificial intelligence transformation.

- Explore potential income streams by scanning these 14 dividend stocks with yields > 3% offering yields that can contribute to your long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal