Wingstop (WING): Assessing Valuation After Stephens Names It a 2026 ‘Best Ideas’ Pick

Wingstop (WING) just jumped 7.7% after Stephens added the company to its 2026 Best Ideas list, a move that pushed the stock back into focus for growth oriented restaurant investors.

See our latest analysis for Wingstop.

That call from Stephens lands after a choppy stretch, with the latest 1 day share price return of 7.7% standing in contrast to a 1 year total shareholder return of negative 13.4%. However, an almost 90% total shareholder return over three years suggests long term momentum is still very much intact.

If Wingstop's move has you thinking about what else could surprise to the upside, it is a good moment to scan the market for fast growing stocks with high insider ownership.

With shares still trading at a noticeable discount to Wall Street targets despite rich growth expectations, the real question now is whether Wingstop is quietly undervalued or if the market has already priced in its next leg of expansion.

Most Popular Narrative Narrative: 19.3% Undervalued

Compared to Wingstop's last close at $256.84, the most followed narrative pegs fair value closer to $318, implying meaningful upside if its assumptions hold.

The expansion and planned system-wide launch of MyWingstop's proprietary digital infrastructure including hyper personalized marketing and a new loyalty program leveraging a rapidly growing 60 million member digital guest database sets the stage for higher customer engagement, increased transaction frequency, and a sustained lift in digital sales mix, supporting long term earnings growth.

Want to see what kind of growth engine justifies that gap? The narrative leans on ambitious revenue expansion, resilient margins, and a premium future earnings multiple. Curious how those moving parts interact to back this fair value.

Result: Fair Value of $318.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer softness and rising labor costs could pressure traffic and margins, which may limit Wingstop's ability to deliver the growth baked into current expectations.

Find out about the key risks to this Wingstop narrative.

Another View On Valuation

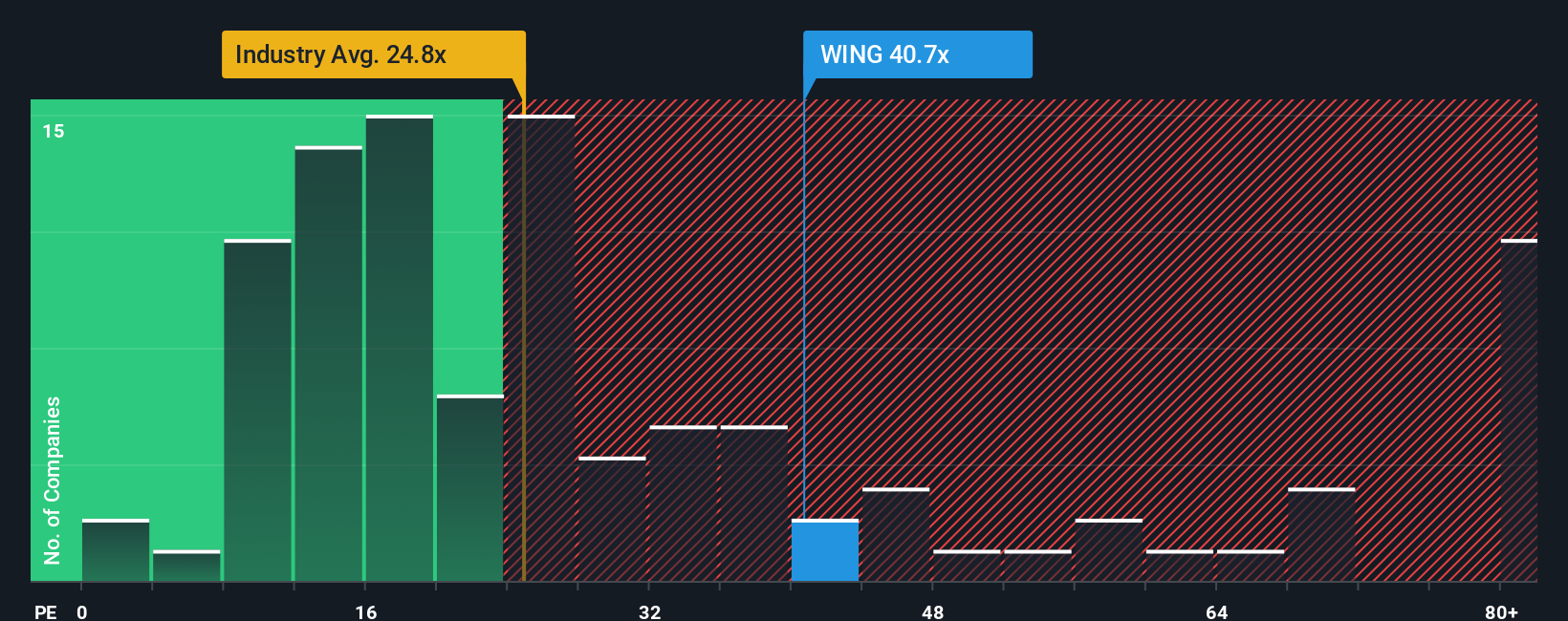

Snap back to today and the picture looks harsher. At around 41 times earnings versus a US Hospitality average of 21.7 times and a fair ratio of 18 times, Wingstop screens clearly expensive. This raises the question: is momentum masking real valuation risk here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wingstop Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Wingstop research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover focused stock ideas that match your strategy before the market wakes up.

- Capitalize on mispriced quality by targeting companies trading below intrinsic value with these 875 undervalued stocks based on cash flows tailored to forward cash flows.

- Explore developments in automation and machine learning by zeroing in on these 25 AI penny stocks positioned within the AI economy.

- Strengthen your income stream with these 14 dividend stocks with yields > 3% that may help you manage inflation risk while adding a potential defensive element to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal