XPeng (NYSE:XPEV): Reassessing Valuation After 126% Delivery Surge and Rapid Global Expansion

XPeng (NYSE:XPEV) just capped 2025 with eye catching delivery numbers, reporting 429,445 vehicles for the year, up 126% from 2024, a scale up that immediately reframes how investors think about its growth path.

See our latest analysis for XPeng.

The latest delivery surge, along with XPeng’s Middle East and Africa push and new extended range models, helps explain why the stock sits at a $20.43 share price with a strong one year total shareholder return of 74.47%. This suggests momentum is building even after a tougher recent three month share price return.

If XPeng’s run has you watching the whole EV space more closely, this could be a smart moment to scan other auto manufacturers for your watchlist.

With deliveries and global reach scaling this quickly, plus the shares still trading below average analyst targets, is XPeng quietly undervalued at this point, or is the price already reflecting all of that potential future growth?

Most Popular Narrative: 27.7% Undervalued

With XPeng last closing at $20.43 against a most popular narrative fair value near the high twenties, this storyline sees sizable upside if its projections land.

The analysts have a consensus price target of $26.291 for XPeng based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.26, and the most bearish reporting a price target of just $18.27.

Curious what kind of revenue trajectory, margin lift and earnings power need to materialise to justify that gap, all under an 11.5% discount rate assumption?

Result: Fair Value of $28.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and intense EV price competition could derail that upside narrative if margin gains and overseas expansion fail to materialise as expected.

Find out about the key risks to this XPeng narrative.

Another Angle on Valuation

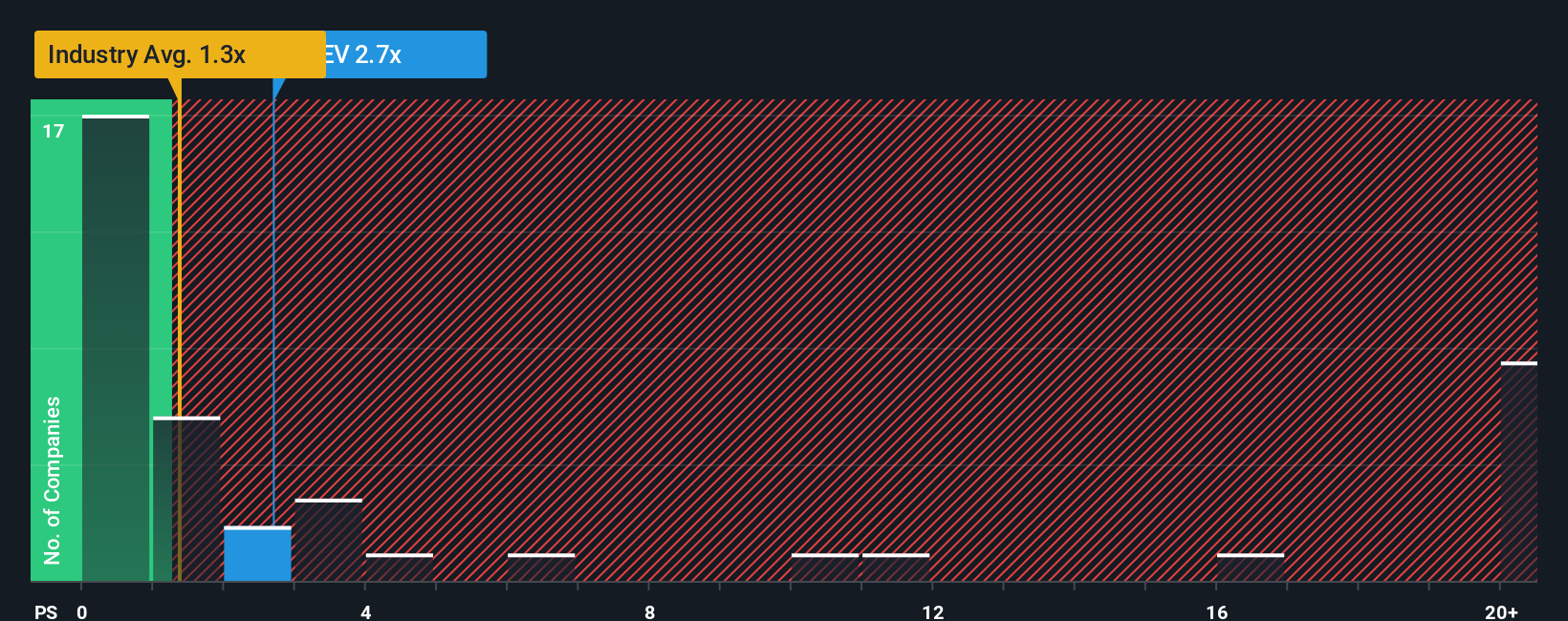

Multiples paint a more cautious picture. XPeng trades at a price to sales of 1.9 times, richer than the US auto industry at 0.7 times and above its 1.6 times fair ratio. This suggests the market may already be pricing in much of the high growth narrative, while leaving open the question of whether it is still underestimating the long term.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPeng Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding XPeng.

Ready for your next investing move?

Before the market prices in the next wave of opportunities, consider putting your capital to work by scanning focused stock ideas tailored to different strategies and risk levels.

- Explore potential multi baggers early by targeting quality growth names in these 3571 penny stocks with strong financials that still fly under most investors' radar.

- Review these 14 dividend stocks with yields > 3% that may help strengthen your portfolio with consistent cash returns.

- Track these 80 cryptocurrency and blockchain stocks that could benefit from increasing adoption of blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal