Rigetti Computing (RGTI): Valuation Check as Big Investors Turn Cautious on Pure-Play Quantum Stocks

Rigetti Computing (RGTI) is back in focus after fresh commentary from top hedge funds underscored growing skepticism toward pure play quantum stocks, even as the company pushes ahead with ambitious hardware and cloud roadmaps.

See our latest analysis for Rigetti Computing.

That skepticism is now being reflected in the tape, with Rigetti’s 90 day share price return of minus 43.42 percent and 30 day share price return of minus 16.04 percent signalling fading momentum, even as its 3 year total shareholder return above 3,000 percent reminds investors how quickly sentiment can flip around emerging technologies at a 23.6 dollar share price.

If this quantum volatility has your attention, it might be worth seeing what else is gaining traction among innovative chip and AI names via high growth tech and AI stocks.

With analysts still seeing nearly 50 percent intrinsic upside and the stock sharply off recent highs, is Rigetti now trading below its true potential, or is the market already factoring in years of anticipated quantum growth?

Price-to-Book of 20.9x: Is it justified?

Rigetti’s latest close at 23.60 dollars comes with a steep price-to-book ratio of 20.9 times, signalling a market valuation far above balance sheet equity and sector peers.

Price to book compares a company’s market value to its net assets. It is a common yardstick for hardware intensive, capital heavy semiconductor and quantum computing players where tangible investment is substantial.

At 20.9 times book value versus roughly 3.9 times for the broader US semiconductor group and 7 times for close peers, investors are clearly paying up for Rigetti’s forecast rapid top line expansion and long dated quantum opportunity, even as the company remains deeply loss making and is not expected to turn profitable within the next three years.

That premium, over five times the wider industry norm and roughly triple peer averages, highlights just how far expectations have already stretched relative to current fundamentals, leaving little margin for execution missteps as the story develops.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 20.9x (OVERVALUED)

However, sustained losses and slower than expected quantum adoption, particularly from cautious government and enterprise customers, could quickly unwind today’s premium valuation.

Find out about the key risks to this Rigetti Computing narrative.

Another View on Rigetti's Valuation

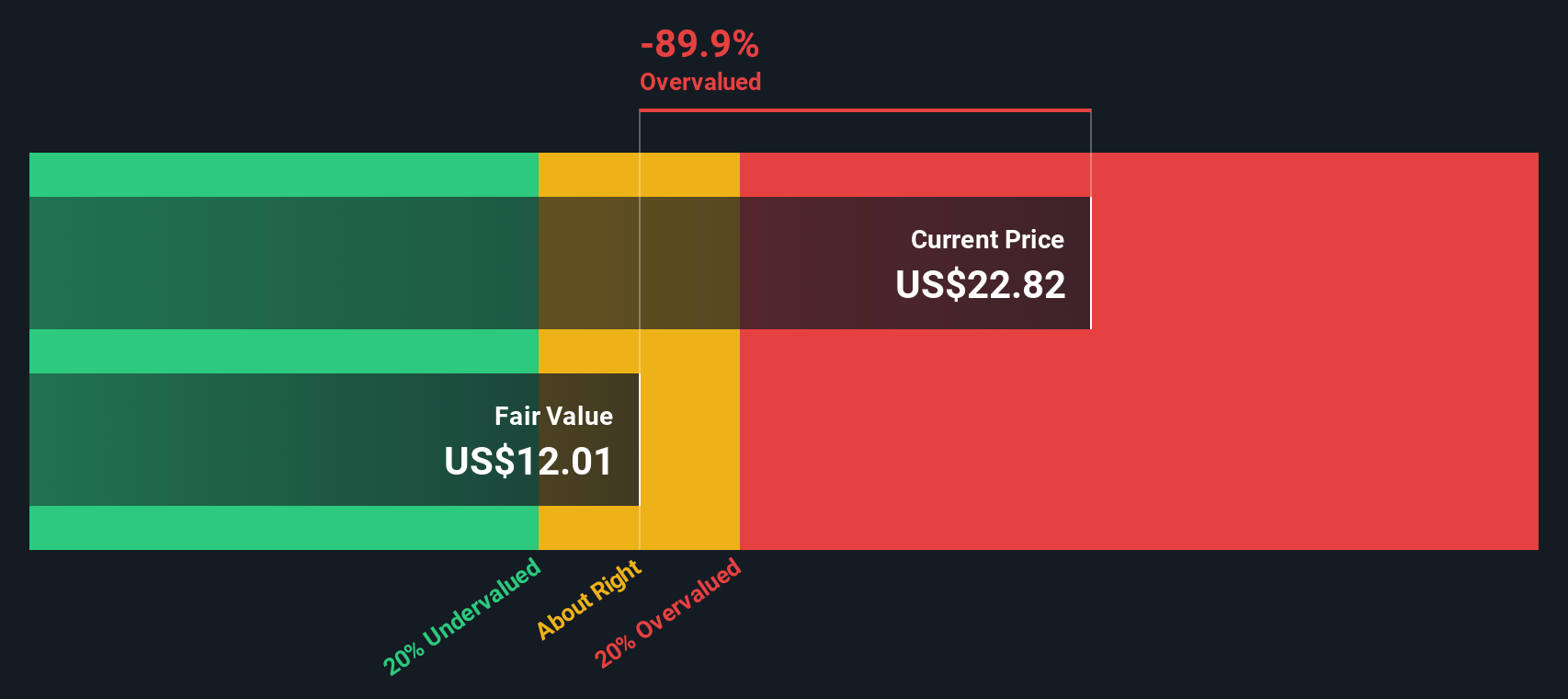

While that 20.9 times price to book looks stretched, our DCF model paints a very different picture. It suggests RGTI may be trading roughly 48 percent below its estimated fair value of 45.43 dollars per share. Is the market underpricing long term quantum cash flows, or overrating today’s balance sheet risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rigetti Computing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rigetti Computing Narrative

If you see Rigetti’s story differently, or would rather dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Rigetti Computing research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to uncover stocks that match your strategy, not the crowd’s.

- Capture potential multi-baggers early by scanning through these 3571 penny stocks with strong financials where improving financial strength can turn small names into serious contenders.

- Position your portfolio at the front of technological change by targeting these 25 AI penny stocks that blend cutting edge innovation with credible growth trajectories.

- Secure a margin of safety with these 875 undervalued stocks based on cash flows that may offer strong cash flow potential at prices the broader market has not fully woken up to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal