Boeing (BA) Is Up 5.2% After EVA Orders Four 787-9 Jets – Has The Bull Case Changed?

- In December 2025, EVA Airways Corporation announced it would purchase four Boeing 787-9 aircraft for up to US$485,000,000 each, with a total consideration capped at US$1.94 billion, following board approval and price negotiations based on market levels.

- Coming alongside fresh analyst attention on Boeing’s production stability and quality improvements, the EVA Airways order underscores growing confidence in the company’s widebody franchise and operational direction.

- We’ll now examine how this combination of new 787-9 orders and improving production stability could reshape Boeing’s existing investment narrative.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Boeing Investment Narrative Recap

To own Boeing today, you need to believe the company can convert its large backlog into profitable, reliably delivered aircraft while gradually repairing its balance sheet and reputation. The EVA Airways 787-9 order supports the demand side of that story, but it does not materially change the key short term catalyst, which is achieving stable 737 and 787 production rates, nor does it resolve the biggest risk, which remains persistent losses and cash pressure in the commercial business.

The most relevant recent announcement here is Bank of America’s inclusion of Boeing in its high conviction list, explicitly tying investor confidence to stable commercial production rates. When you set that alongside EVA’s widebody commitment, it highlights how closely near term sentiment is tied to Boeing’s ability to keep assembly lines running smoothly and convert strong order activity into improving margins and cash flow.

Yet behind the renewed interest and fresh widebody orders, investors should still be aware of Boeing’s high debt load and ongoing cash burn...

Read the full narrative on Boeing (it's free!)

Boeing's narrative projects $114.4 billion revenue and $7.1 billion earnings by 2028. This requires 14.9% yearly revenue growth and an $18.0 billion earnings increase from $-10.9 billion today.

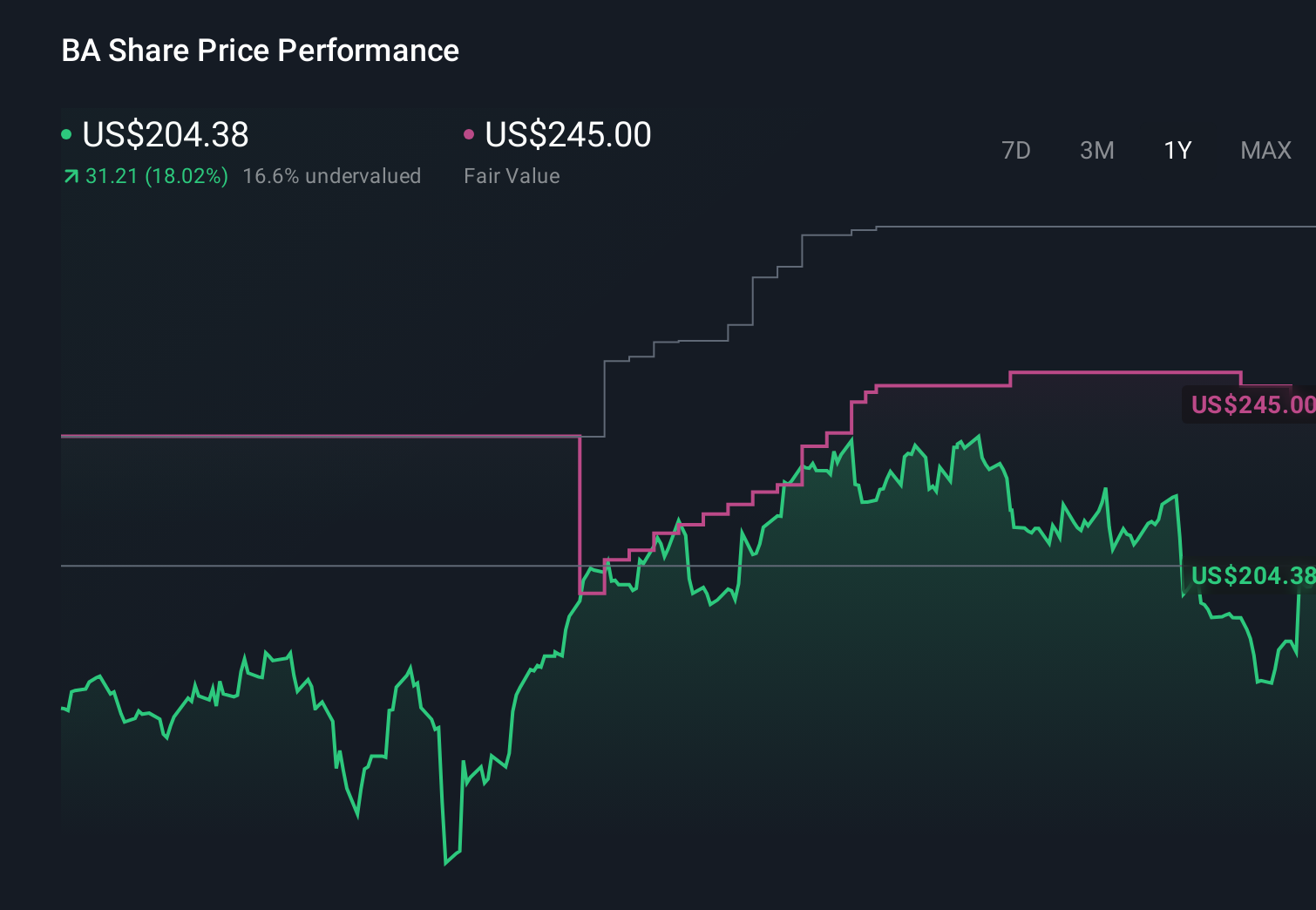

Uncover how Boeing's forecasts yield a $244.33 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Twenty Simply Wall St Community valuations for Boeing span roughly US$206.8 to US$386.0, underlining how far apart individual views can be. You might weigh those opinions against Boeing’s reliance on production stabilization to improve margins and cash flow, then explore several alternative viewpoints before deciding how this aligns with your own expectations.

Explore 20 other fair value estimates on Boeing - why the stock might be worth 9% less than the current price!

Build Your Own Boeing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boeing research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Boeing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boeing's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal