ASX Growth Leaders With Strong Insider Confidence

As the Australian market approaches the holiday season with a slight dip, largely due to profit-taking and external influences from Wall Street's highs, investors are keenly observing sectors like precious metals that have recently shown strength. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong internal confidence and potential resilience in fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.2% | 96.3% |

| Titomic (ASX:TTT) | 15% | 74.9% |

| Sea Forest (ASX:SEA) | 15.1% | 92.6% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 11% | 31.4% |

| Emerald Resources (ASX:EMR) | 18.4% | 43% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 32.1% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$4.20 billion.

Operations: The company's revenue is primarily derived from its mine operations, totaling A$430.41 million.

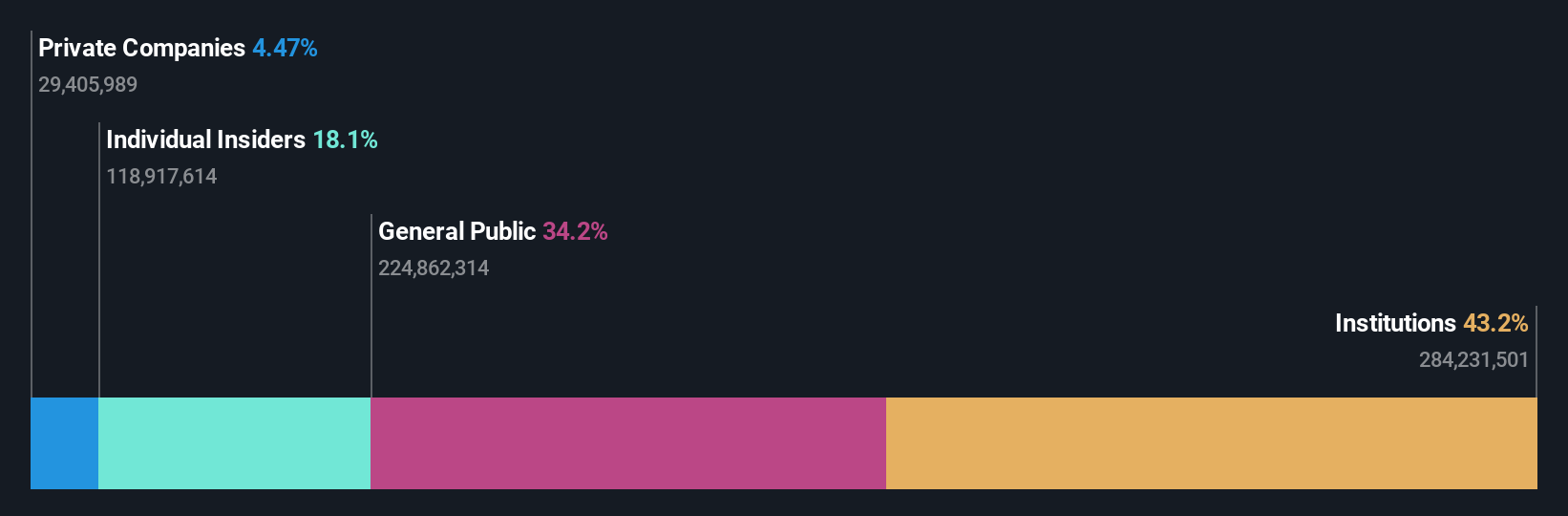

Insider Ownership: 18.4%

Emerald Resources is forecasted to experience substantial growth, with revenue expected to increase by 36.7% per year, outpacing the Australian market's growth. Earnings are also projected to grow significantly at 43% annually over the next three years. Despite recent production challenges due to weather conditions affecting its Okvau Gold Mine, Emerald maintains robust guidance for 2026. The stock trades significantly below its estimated fair value, suggesting potential upside for investors focused on growth opportunities in Australia.

- Navigate through the intricacies of Emerald Resources with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Emerald Resources shares in the market.

Mesoblast (ASX:MSB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Mesoblast Limited, with a market cap of A$3.55 billion, is involved in developing regenerative medicine products across Australia, the United States, Singapore, and Switzerland.

Operations: The company's revenue segment primarily focuses on the development of a cell technology platform for commercialization, generating $17.20 million.

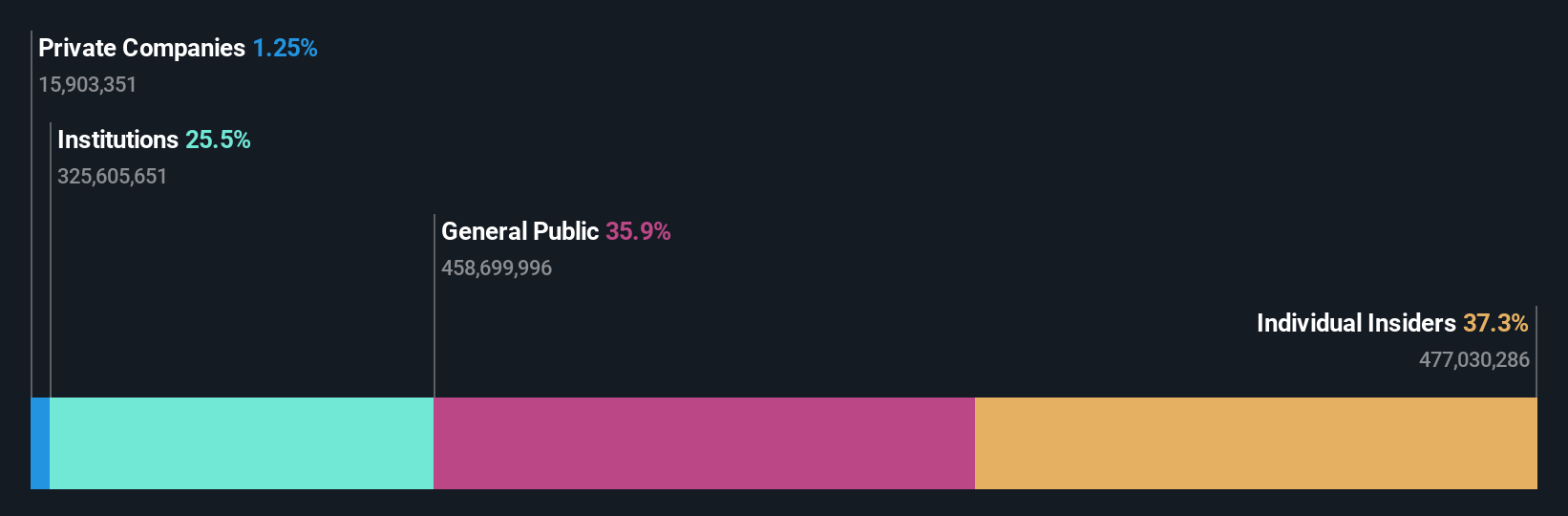

Insider Ownership: 32.8%

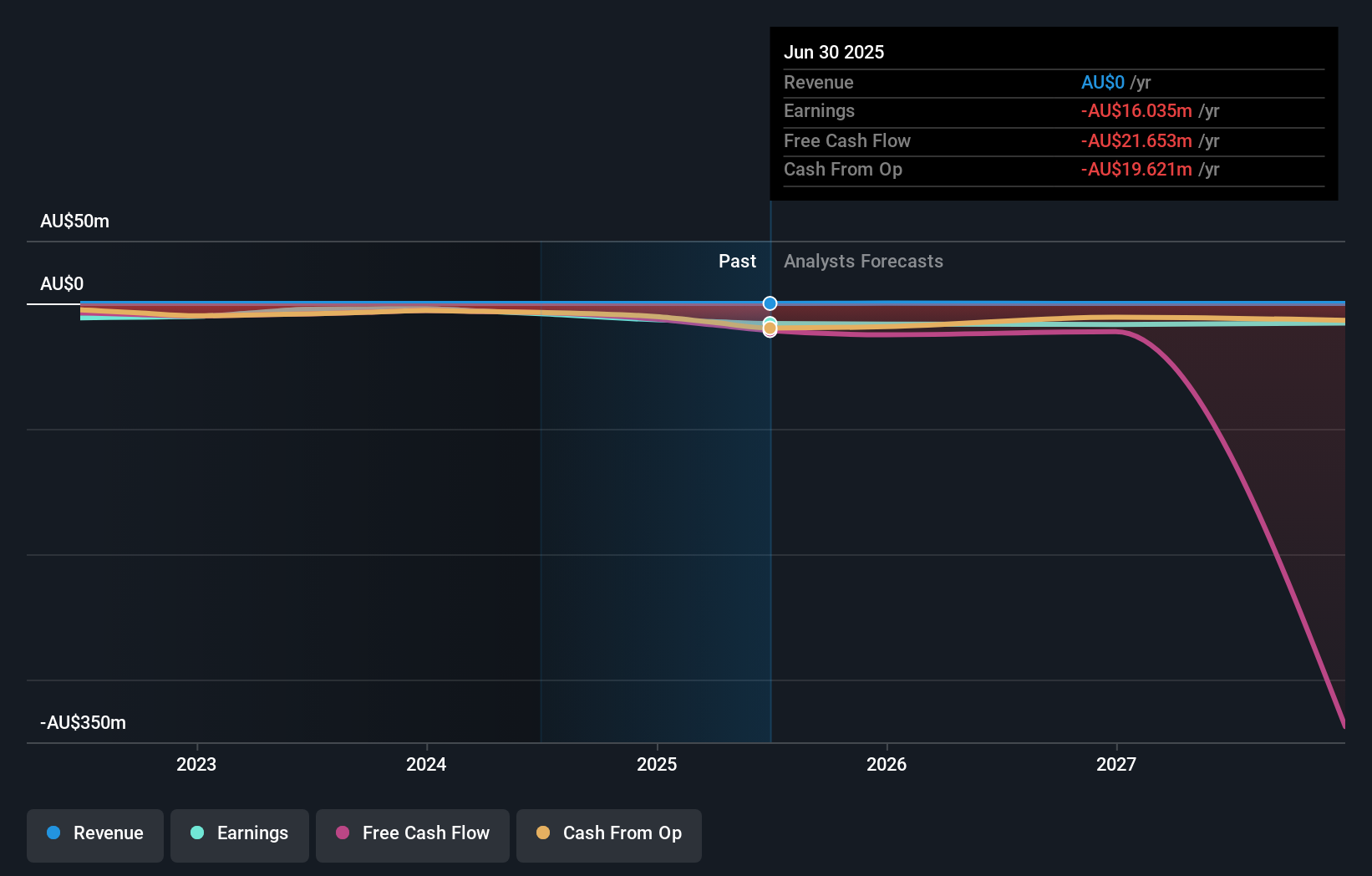

Mesoblast's high insider ownership aligns with its growth trajectory, as revenue is forecast to grow 43.5% annually, outpacing the Australian market. The company is expected to become profitable within three years, supported by recent FDA approval of Ryoncil® and strategic board changes enhancing governance. Mesoblast has secured a US$75 million credit line at reduced costs and filed for shelf registrations totaling over A$259 million, indicating strong financial positioning for future expansion.

- Dive into the specifics of Mesoblast here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Mesoblast is trading behind its estimated value.

Turaco Gold (ASX:TCG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Turaco Gold Limited is involved in the exploration of gold deposits in Cote d’Ivoire and has a market capitalization of A$873.80 million.

Operations: Turaco Gold Limited's revenue segments for mineral exploration activities in Cote d’Ivoire are not specified in the provided information.

Insider Ownership: 17.6%

Turaco Gold's growth potential is underscored by its substantial insider ownership and expected revenue growth of 62% annually, significantly outpacing the Australian market. Although current revenues are under A$1 million, the company is forecast to become profitable within three years. Despite trading at a significant discount to estimated fair value, Turaco Gold's return on equity remains low at 8.8% in future projections. Recent presentations highlight ongoing investor engagement and strategic focus.

- Get an in-depth perspective on Turaco Gold's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Turaco Gold's share price might be too pessimistic.

Make It Happen

- Click this link to deep-dive into the 110 companies within our Fast Growing ASX Companies With High Insider Ownership screener.

- Seeking Other Investments? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal