Not Many Are Piling Into ChargePoint Holdings, Inc. (NYSE:CHPT) Stock Yet As It Plummets 33%

To the annoyance of some shareholders, ChargePoint Holdings, Inc. (NYSE:CHPT) shares are down a considerable 33% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

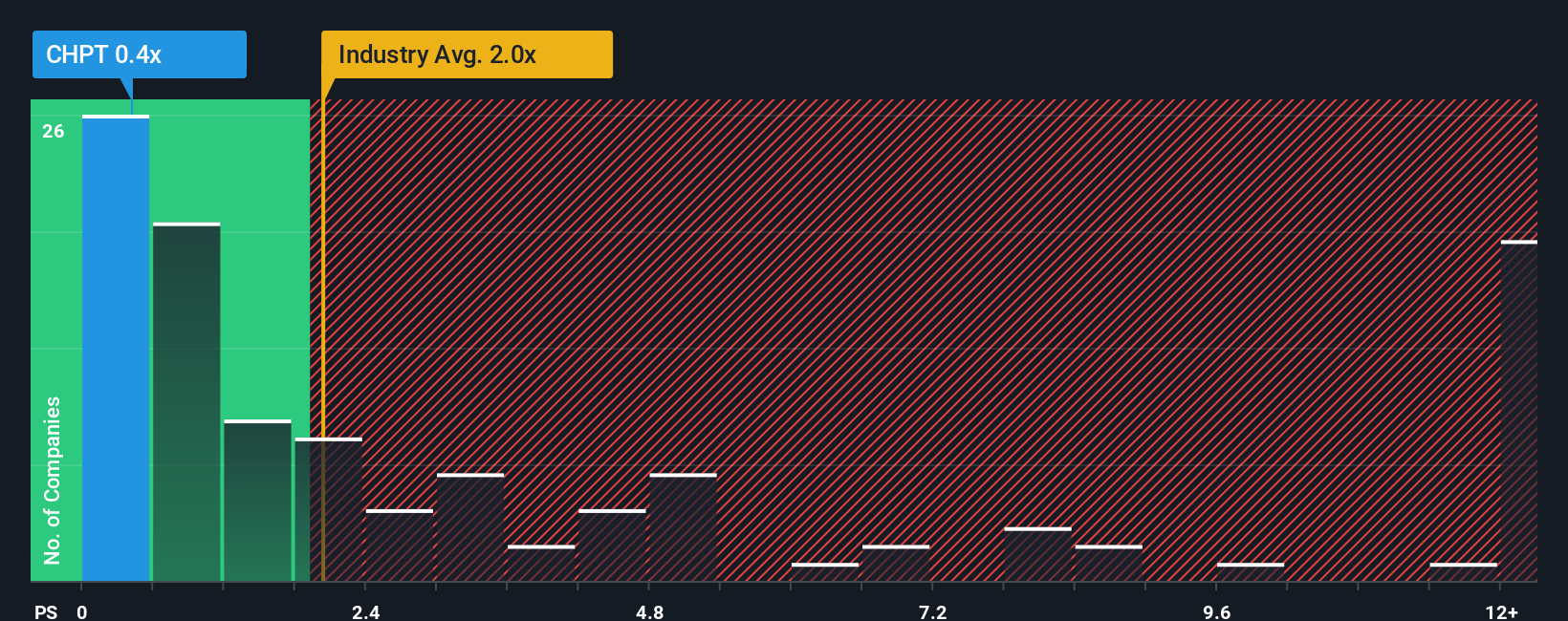

After such a large drop in price, ChargePoint Holdings' price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Electrical industry in the United States, where around half of the companies have P/S ratios above 2x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for ChargePoint Holdings

What Does ChargePoint Holdings' Recent Performance Look Like?

ChargePoint Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think ChargePoint Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For ChargePoint Holdings?

In order to justify its P/S ratio, ChargePoint Holdings would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.3%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 14% each year as estimated by the ten analysts watching the company. With the industry predicted to deliver 16% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it odd that ChargePoint Holdings is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

The southerly movements of ChargePoint Holdings' shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for ChargePoint Holdings remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware ChargePoint Holdings is showing 3 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal