Earnings Tell The Story For Mitsubishi Corporation (TSE:8058)

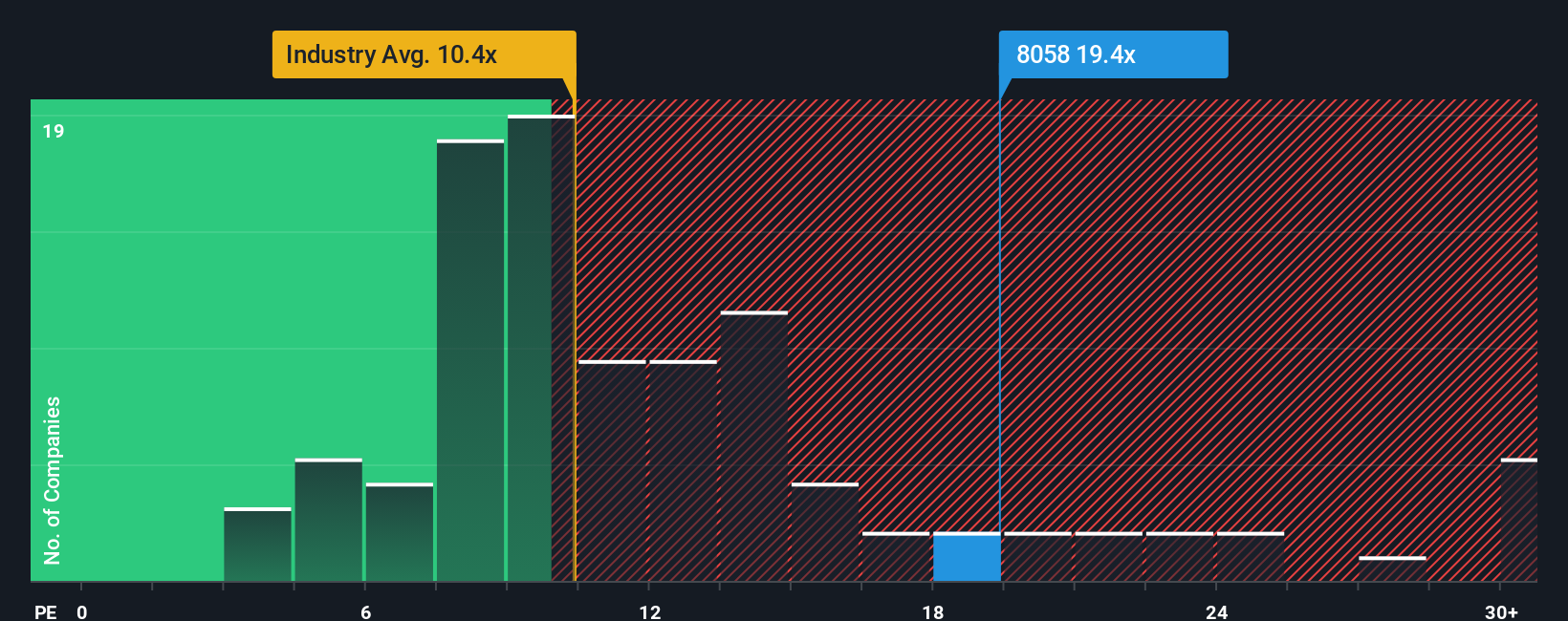

With a price-to-earnings (or "P/E") ratio of 19.4x Mitsubishi Corporation (TSE:8058) may be sending bearish signals at the moment, given that almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 10x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Mitsubishi's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Mitsubishi

How Is Mitsubishi's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Mitsubishi's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 36%. The last three years don't look nice either as the company has shrunk EPS by 37% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 16% each year over the next three years. That's shaping up to be materially higher than the 9.0% per year growth forecast for the broader market.

With this information, we can see why Mitsubishi is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Mitsubishi maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Mitsubishi that we have uncovered.

You might be able to find a better investment than Mitsubishi. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal