ROKIT Healthcare Inc. (KOSDAQ:376900) Stocks Pounded By 25% But Not Lagging Industry On Growth Or Pricing

The ROKIT Healthcare Inc. (KOSDAQ:376900) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

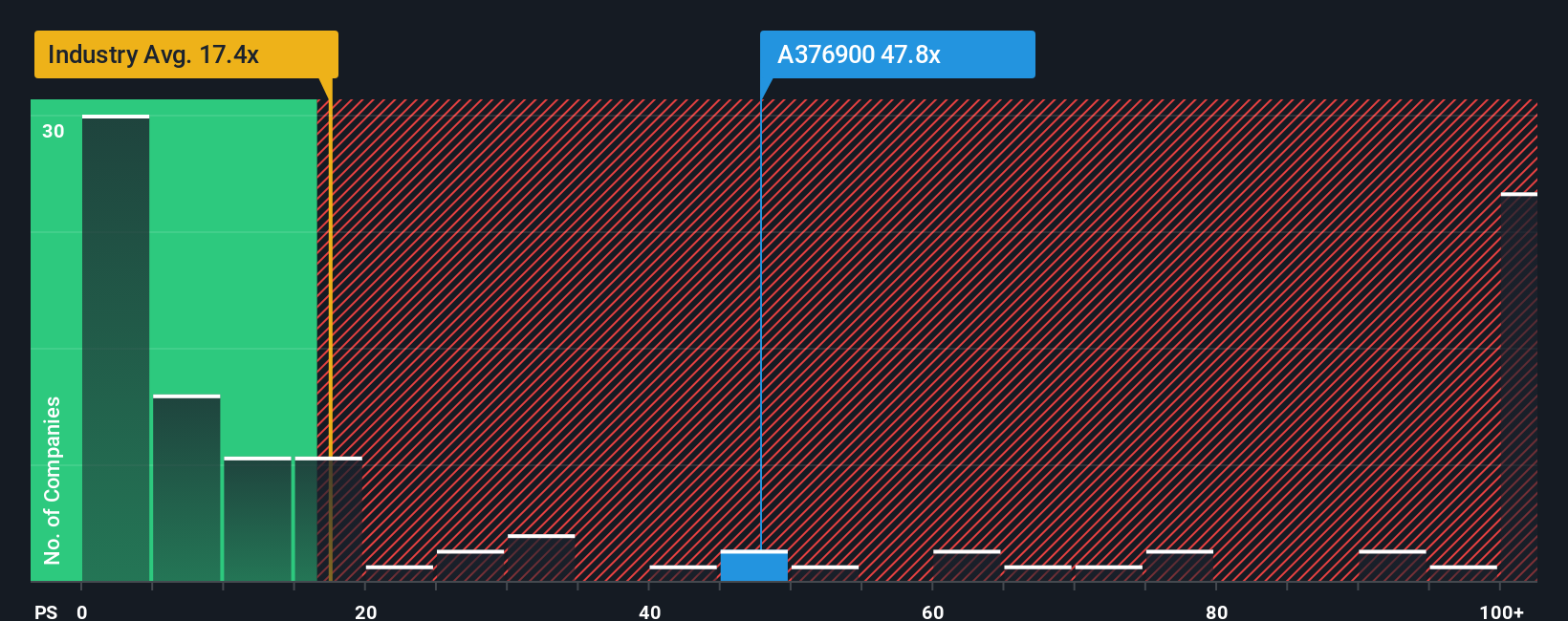

Although its price has dipped substantially, ROKIT Healthcare may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 47.8x, when you consider almost half of the companies in the Biotechs industry in Korea have P/S ratios under 17.4x and even P/S lower than 4x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for ROKIT Healthcare

How ROKIT Healthcare Has Been Performing

Recent times haven't been great for ROKIT Healthcare as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on ROKIT Healthcare will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For ROKIT Healthcare?

ROKIT Healthcare's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 55% gain to the company's top line. Pleasingly, revenue has also lifted 180% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 76% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 51%, which is noticeably less attractive.

With this information, we can see why ROKIT Healthcare is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From ROKIT Healthcare's P/S?

Even after such a strong price drop, ROKIT Healthcare's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of ROKIT Healthcare's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for ROKIT Healthcare you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal