3 Stocks That May Be Trading Below Their Estimated Value In January 2026

As the United States stock market kicks off 2026 with mixed signals, following a year-end downturn despite significant annual gains in major indices, investors are keenly observing potential opportunities for undervalued stocks. In this environment, identifying stocks that may be trading below their estimated value could offer strategic entry points for those looking to capitalize on market inefficiencies and long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Valley National Bancorp (VLY) | $11.68 | $23.05 | 49.3% |

| SmartStop Self Storage REIT (SMA) | $30.94 | $60.67 | 49% |

| Investar Holding (ISTR) | $26.72 | $52.64 | 49.2% |

| Horizon Bancorp (HBNC) | $16.96 | $33.83 | 49.9% |

| Hims & Hers Health (HIMS) | $32.47 | $63.39 | 48.8% |

| Heritage Financial (HFWA) | $23.65 | $46.41 | 49% |

| Gaotu Techedu (GOTU) | $2.32 | $4.56 | 49.1% |

| Dime Community Bancshares (DCOM) | $30.09 | $60.07 | 49.9% |

| CNB Financial (CCNE) | $26.17 | $50.87 | 48.6% |

| BillionToOne (BLLN) | $81.84 | $160.13 | 48.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Bowhead Specialty Holdings (BOW)

Overview: Bowhead Specialty Holdings Inc. offers commercial specialty property and casualty insurance products in the United States with a market cap of $935.63 million.

Operations: The company generates revenue of $519.24 million from its commercial specialty property and casualty insurance products in the United States.

Estimated Discount To Fair Value: 45.5%

Bowhead Specialty Holdings is trading at US$28.54, significantly below its estimated fair value of US$52.34, indicating potential undervaluation based on cash flows. Recent financing activities include a US$150 million senior notes offering and a US$35 million revolving credit facility to support growth and operations. Despite slower revenue growth forecasts of 18.6% annually, earnings are expected to grow significantly at 21.85% per year, outpacing the broader U.S. market's projected growth rates.

- Our growth report here indicates Bowhead Specialty Holdings may be poised for an improving outlook.

- Take a closer look at Bowhead Specialty Holdings' balance sheet health here in our report.

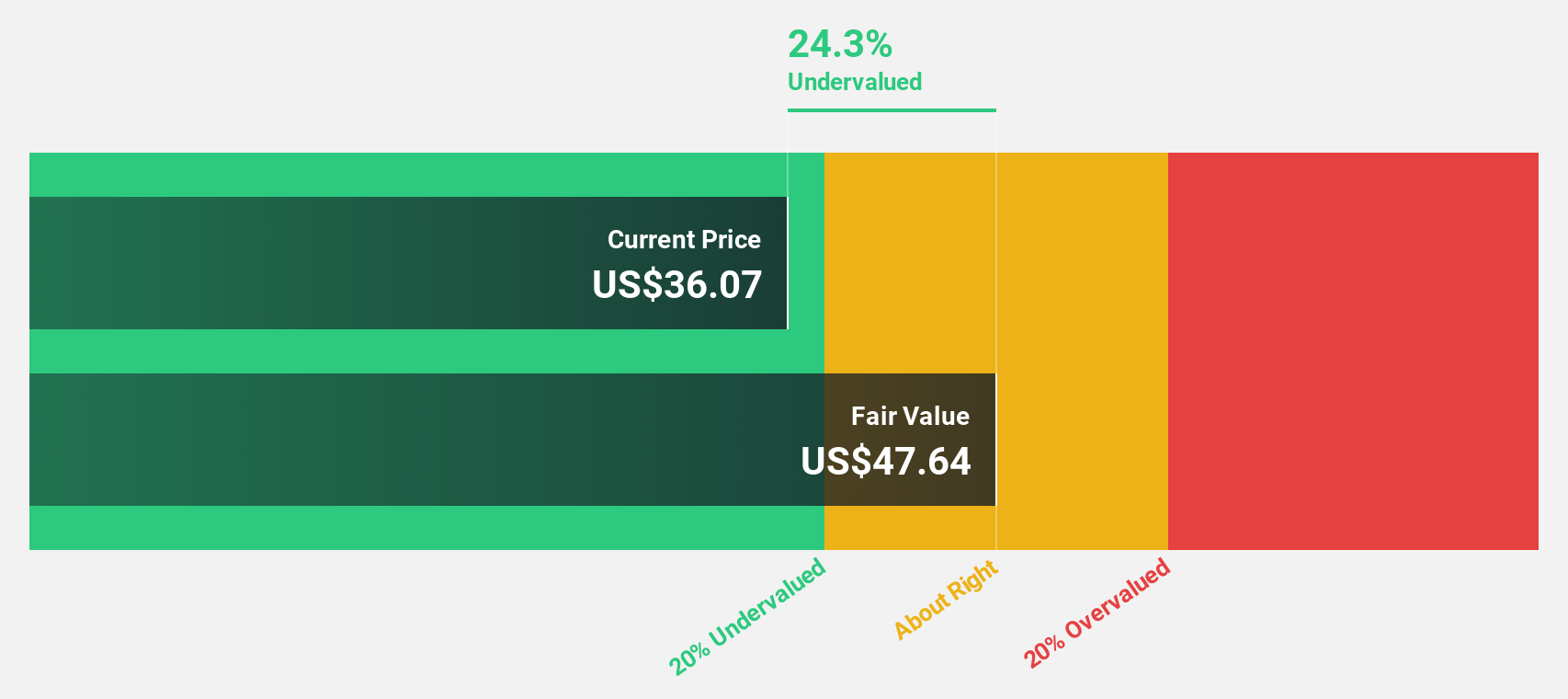

Fiverr International (FVRR)

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of approximately $729.79 million.

Operations: The company generates revenue of $427.40 million from its Internet Software & Services segment.

Estimated Discount To Fair Value: 41.2%

Fiverr International is trading at US$19.76, which is 41.2% below its estimated fair value of US$33.6, reflecting potential undervaluation based on cash flows. Recent earnings reports show a significant increase in net income to US$5.54 million for Q3 2025 from US$1.35 million the previous year, with earnings per share rising accordingly. Despite slower forecasted revenue growth of 6.3% annually, expected annual profit growth remains robust at 47.47%, surpassing the U.S market average.

- Our comprehensive growth report raises the possibility that Fiverr International is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Fiverr International.

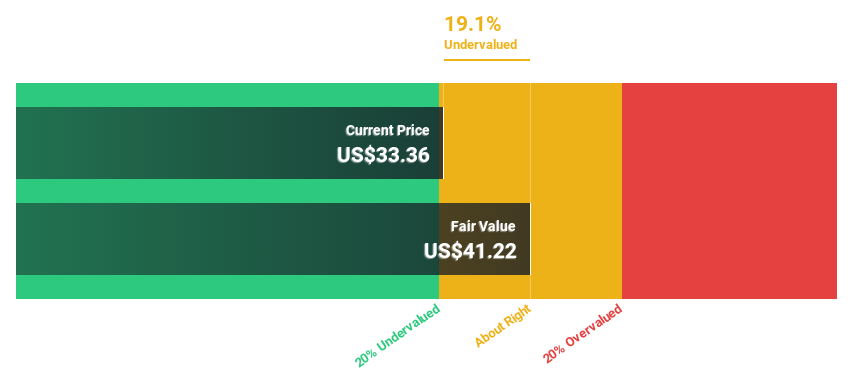

Redwood Trust (RWT)

Overview: Redwood Trust, Inc. is a specialty finance company operating in the United States with a market cap of approximately $700.55 million.

Operations: Redwood Trust generates revenue through its segments, including Redwood Investments at $97.78 million, Sequoia Mortgage Banking at $164.18 million, and CoreVest Mortgage Banking at $60.16 million.

Estimated Discount To Fair Value: 25.6%

Redwood Trust is trading at US$5.53, significantly below its estimated fair value of US$7.43, indicating potential undervaluation based on cash flows. Despite a recent net loss of US$7.7 million in Q3 2025, revenue growth is forecasted at 16.1% annually, outpacing the U.S market average. However, the dividend yield of 13.02% isn't well supported by earnings or cash flows, and debt coverage by operating cash flow remains inadequate despite anticipated profitability within three years.

- Insights from our recent growth report point to a promising forecast for Redwood Trust's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Redwood Trust.

Next Steps

- Access the full spectrum of 187 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal