Exploring Europe's Undiscovered Gems This January 2026

As we enter January 2026, the European market is showing resilience with the STOXX Europe 600 Index nearing record highs amid positive earnings sentiment and economic outlooks. In this environment, identifying potential hidden opportunities becomes crucial, as investors seek stocks that demonstrate strong fundamentals and adaptability to evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Envirotainer | 43.54% | -23.63% | nan | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Darwin | 3.03% | 50.55% | 46377.71% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

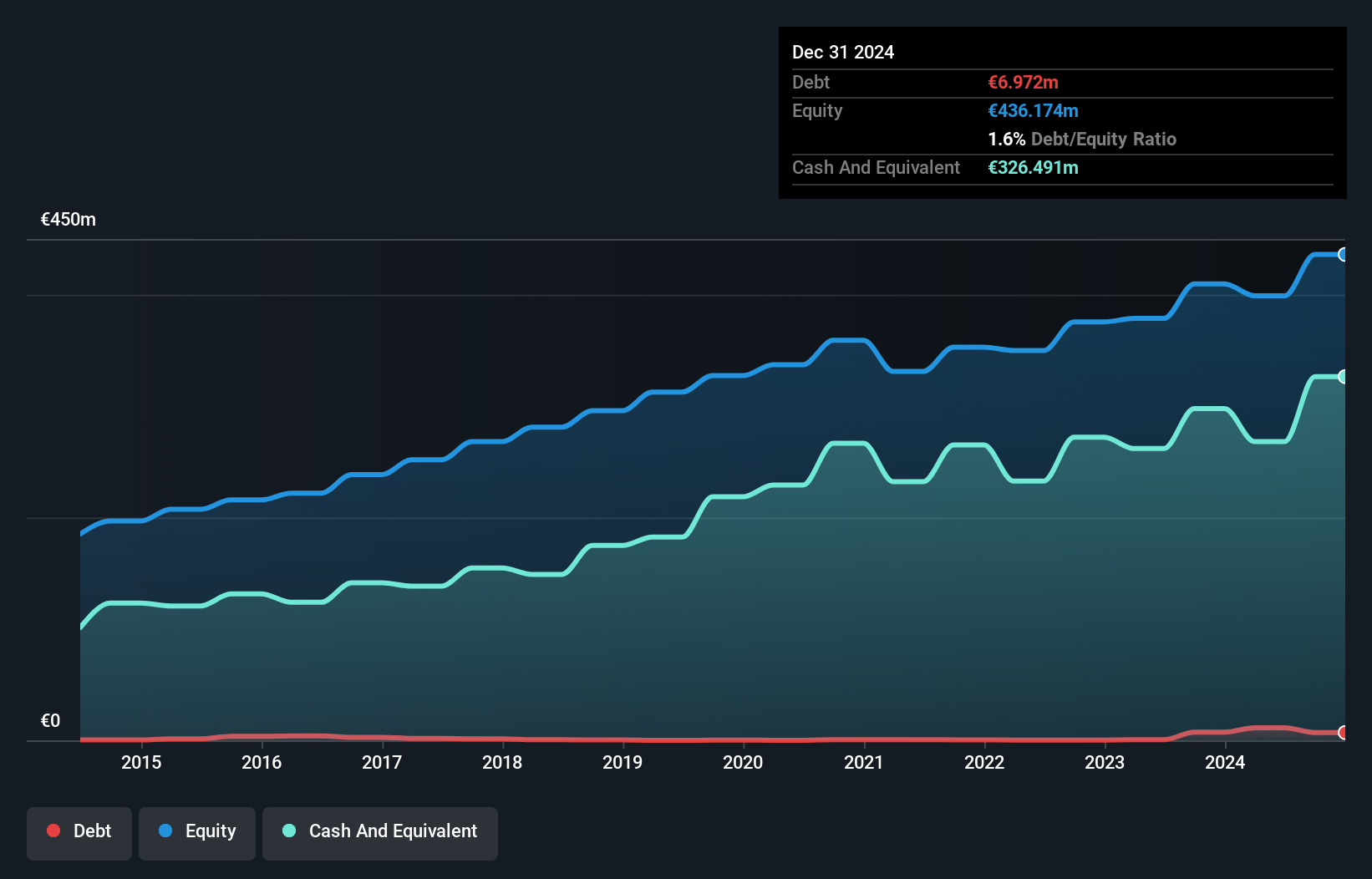

Overview: Neurones S.A. is a French company specializing in infrastructure, application, and consulting services with a market cap of €1.05 billion.

Operations: Revenue for Neurones primarily comes from infrastructure services (€510.40 million), application services (€271.70 million), and consulting (€50.08 million). The company has a market cap of approximately €1.05 billion, reflecting its significant presence in the French market for these services.

Neurones, a nimble player in the IT sector, has shown promising growth with earnings climbing 4.6% over the past year, outpacing the industry’s -5.6%. The company boasts high-quality earnings and maintains a robust financial position with more cash than total debt. Recent announcements reveal third-quarter revenues of €207.9 million, up from €196.7 million last year, and they aim for annual revenues beyond €850 million with an operating profit of at least 8%. Despite a rise in its debt to equity ratio from 0.02% to 1.5% over five years, Neurones remains free cash flow positive and profitable.

- Navigate through the intricacies of Neurones with our comprehensive health report here.

Understand Neurones' track record by examining our Past report.

Nordrest Holding (OM:NREST)

Simply Wall St Value Rating: ★★★★★☆

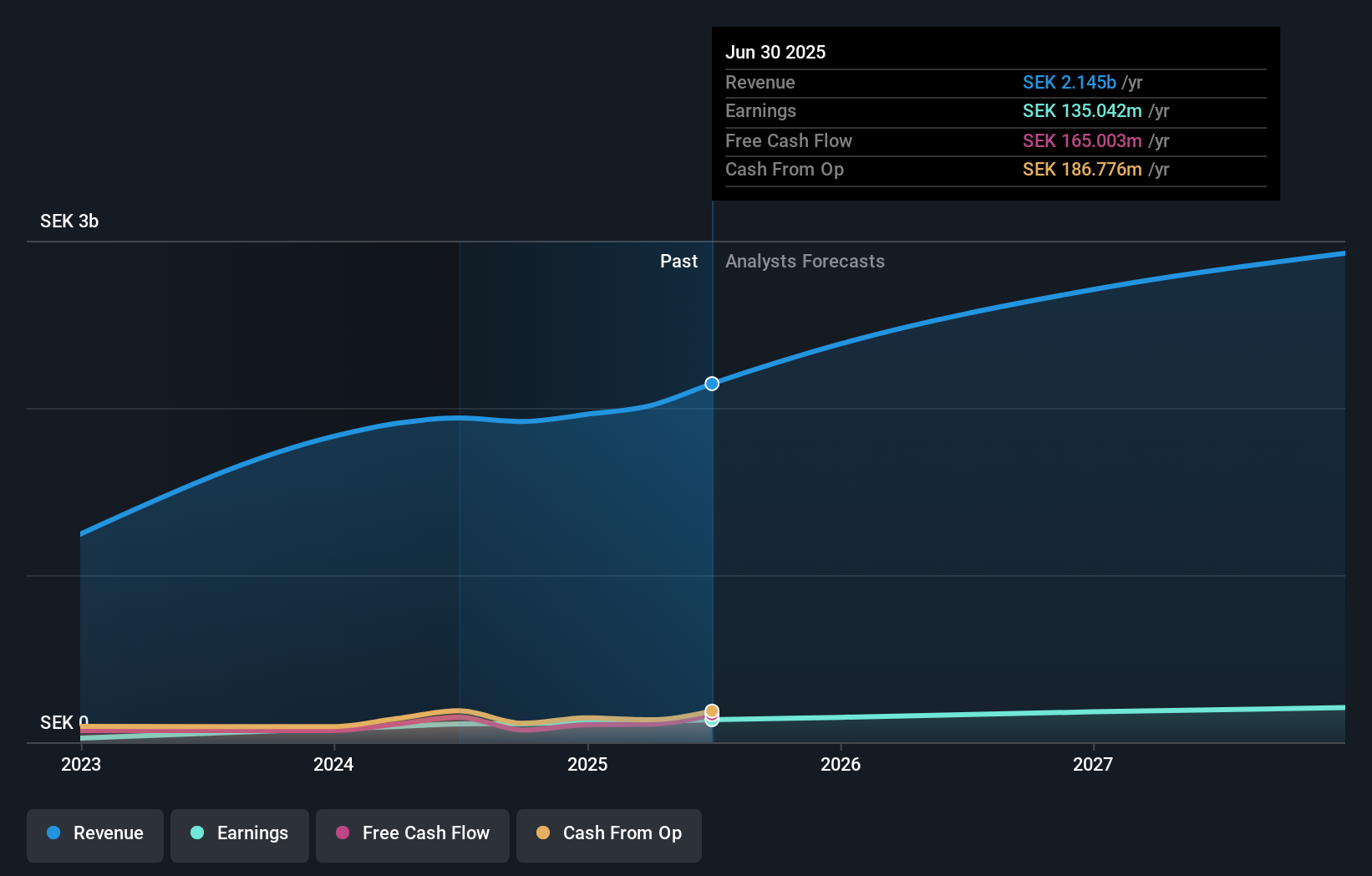

Overview: Nordrest Holding AB (publ) is a foodservice company that operates in Sweden and internationally with a market capitalization of approximately SEK3.16 billion.

Operations: Nordrest Holding generates revenue primarily from its restaurant segment, amounting to SEK2.31 billion. The company's financial performance is highlighted by a net profit margin trend that reflects its operational efficiency in the competitive foodservice industry.

Nordrest Holding, a relatively small player in the hospitality sector, is showing promising signs. Trading at 59.1% below its estimated fair value, it seems undervalued by market standards. Over the past year, revenue jumped 20.3%, with net income reaching SEK 106.2 million for the first nine months of 2025 compared to SEK 85.27 million previously. The company boasts high-quality earnings and maintains sufficient cash to cover its debt obligations comfortably, with interest payments covered 12 times over by EBIT. Despite not outpacing industry growth last year, earnings are projected to grow annually by over 18%.

- Delve into the full analysis health report here for a deeper understanding of Nordrest Holding.

Examine Nordrest Holding's past performance report to understand how it has performed in the past.

Orell Füssli (SWX:OFN)

Simply Wall St Value Rating: ★★★★★★

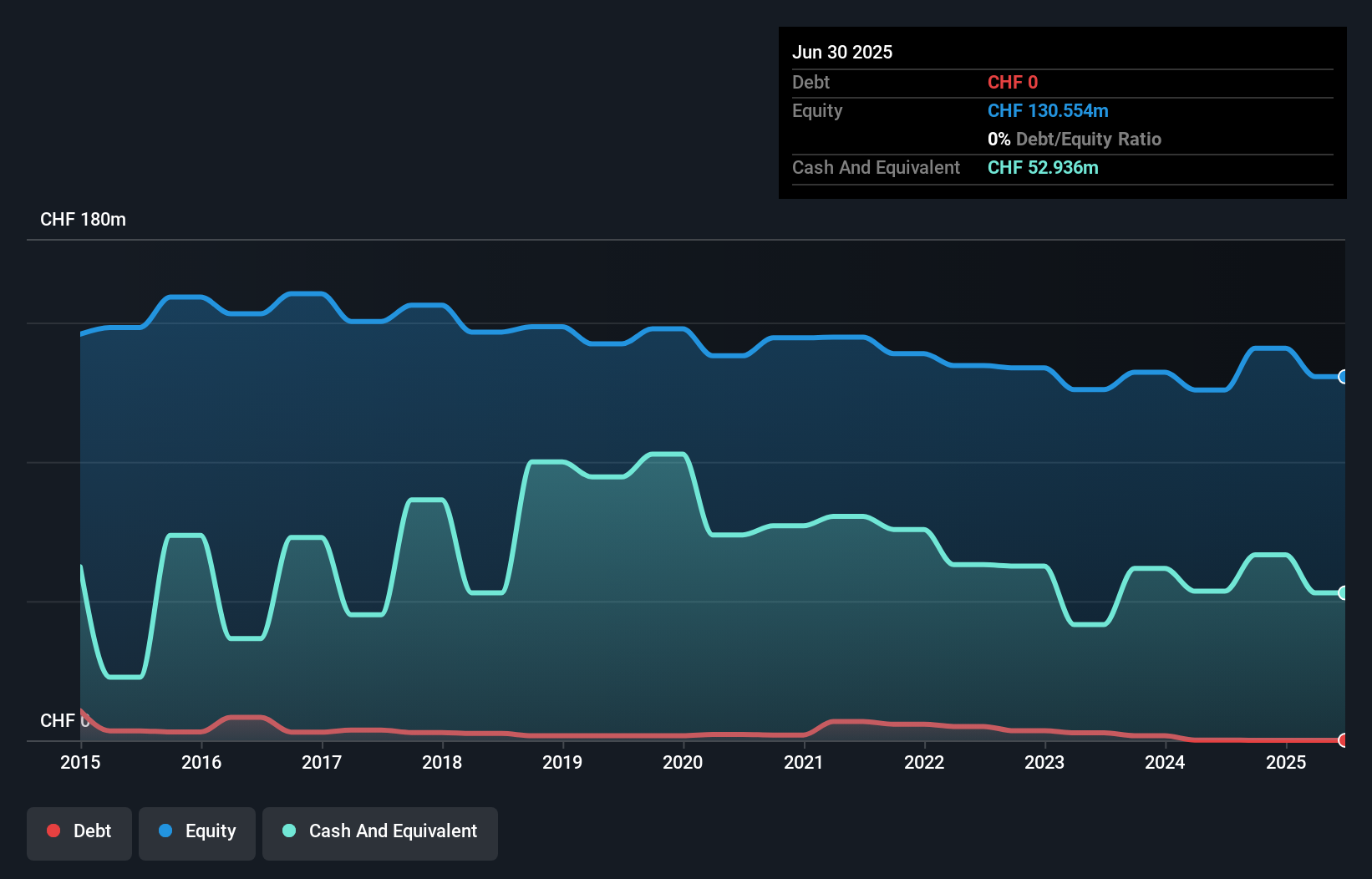

Overview: Orell Füssli AG is a Swiss company that operates in security printing and technology, book retailing, and publishing across various regions including Europe, Africa, the Americas, Asia, and Oceania with a market capitalization of CHF234.22 million.

Operations: Orell Füssli AG generates revenue primarily from book retailing (CHF127.49 million) and security printing (CHF95.80 million), with industrial systems contributing CHF22.73 million. The company's focus on these core segments highlights its diverse revenue streams across various regions, enhancing its market presence in Switzerland and beyond.

Orell Füssli, a smaller player in the European market, showcases impressive financial health with no debt, a stark contrast to five years ago when its debt-to-equity ratio stood at 1.5. This company has delivered high-quality earnings and experienced an exceptional 117.9% growth in earnings over the past year, significantly outpacing the Commercial Services industry average of 7.9%. Trading at 62.5% below its estimated fair value, Orell Füssli appears to offer substantial upside potential for investors seeking undervalued opportunities in Europe’s niche segments while maintaining positive free cash flow throughout recent periods.

Next Steps

- Investigate our full lineup of 299 European Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal