Global Market Stocks That Might Be Trading Below Estimated Value

Amid a period of robust economic growth and record highs in major indices, global markets have been buoyed by optimism around artificial intelligence and favorable economic data. As investors navigate these conditions, identifying stocks that may be trading below their estimated value can offer opportunities for those seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Visional (TSE:4194) | ¥10010.00 | ¥19860.82 | 49.6% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1578.87 | 49.6% |

| Kuraray (TSE:3405) | ¥1587.00 | ¥3166.05 | 49.9% |

| Kreate Group Oyj (HLSE:KREATE) | €12.55 | €24.87 | 49.5% |

| KB Components (OM:KBC) | SEK41.90 | SEK83.17 | 49.6% |

| JINS HOLDINGS (TSE:3046) | ¥5530.00 | ¥11054.20 | 50% |

| Fodelia Oyj (HLSE:FODELIA) | €5.40 | €10.72 | 49.6% |

| Dynavox Group (OM:DYVOX) | SEK102.00 | SEK203.01 | 49.8% |

| Andes Technology (TWSE:6533) | NT$242.00 | NT$481.81 | 49.8% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Here's a peek at a few of the choices from the screener.

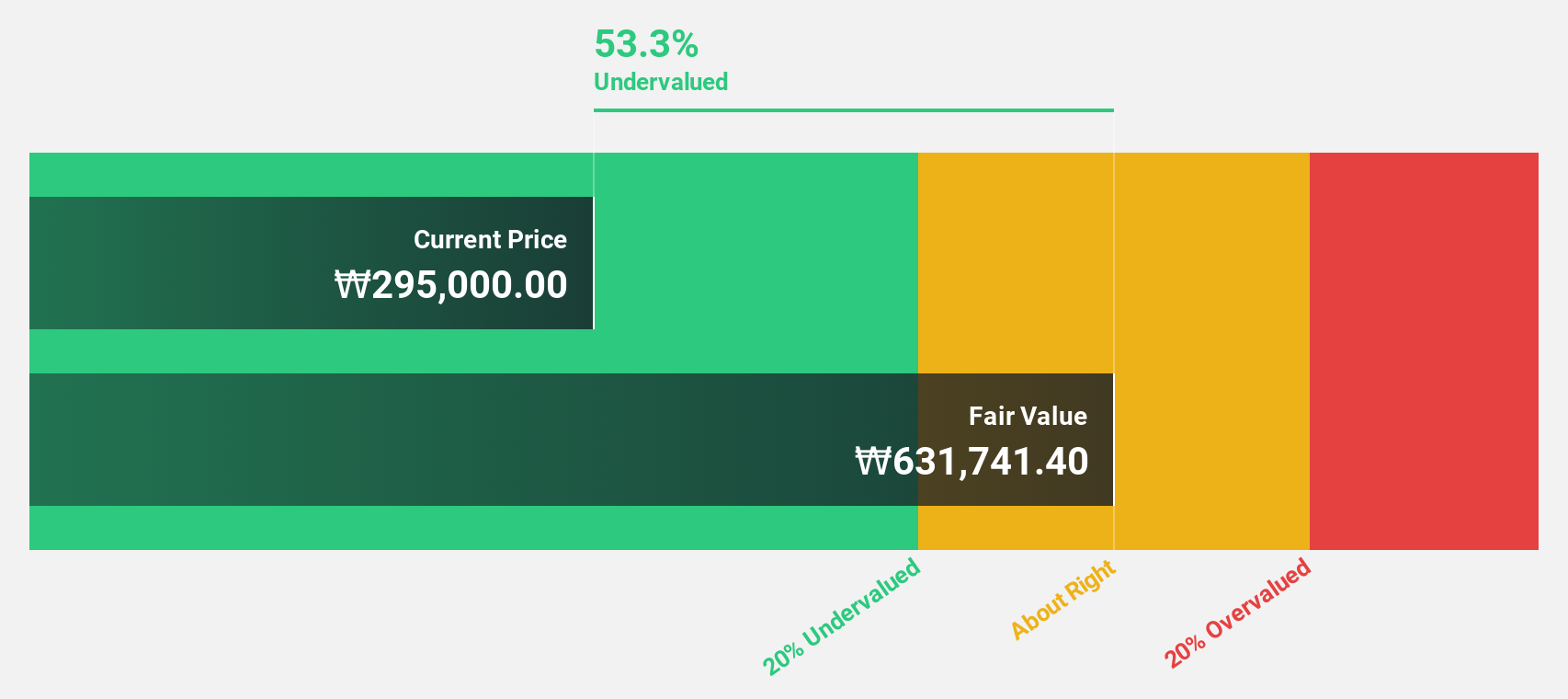

SK hynix (KOSE:A000660)

Overview: SK hynix Inc. is a global company that manufactures, distributes, and sells semiconductor products across Korea, China, the rest of Asia, the United States, and Europe with a market cap of approximately ₩449.49 trillion.

Operations: The company's revenue primarily comes from the manufacture and sale of semiconductor products, amounting to approximately ₩84.09 billion.

Estimated Discount To Fair Value: 49.5%

SK hynix is trading at ₩677,000, significantly below its estimated fair value of ₩1,339,832.59. The company reported strong third-quarter earnings with net income rising to ₩12.60 trillion from ₩5.75 trillion a year prior. Recent product advancements in high-capacity DDR5 modules and strategic partnerships highlight SK hynix's technological leadership and potential to capitalize on growing AI-driven memory demand, despite a volatile share price and lower forecasted return on equity in the future.

- Insights from our recent growth report point to a promising forecast for SK hynix's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of SK hynix.

Flynas (SASE:4264)

Overview: Flynas operates airlines in Saudi Arabia and the Middle East, with a market cap of SAR11.19 billion.

Operations: The company's revenue segments include Flynas LCC at SAR6.97 billion, Flynas Hajj & Umrah at SAR826.06 million, and Flynas General Aviation at SAR169.91 million.

Estimated Discount To Fair Value: 36.3%

Flynas is trading at SAR65.5, significantly below its estimated fair value of SAR102.77, highlighting potential undervaluation based on cash flows. Analysts expect a 33% rise in stock price, with revenue projected to grow 15.9% annually, outpacing the SA market's growth rate. Earnings are forecast to increase by 47.31% per year as the company becomes profitable within three years. Recent inclusion in major indices like S&P Pan Arab Composite underscores its growing market presence despite recent share price volatility.

- Our expertly prepared growth report on Flynas implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Flynas here with our thorough financial health report.

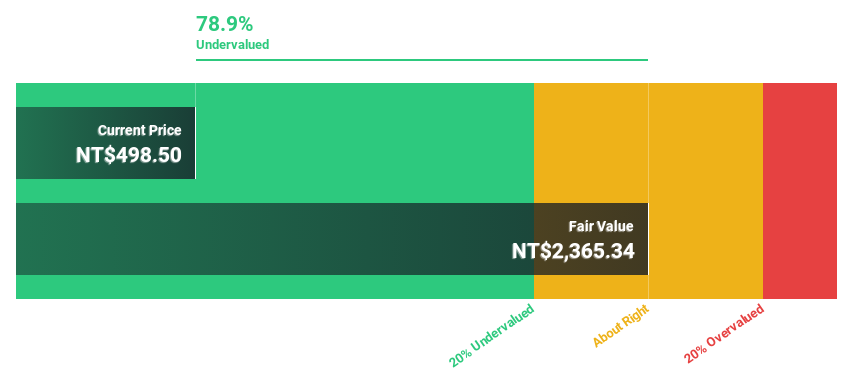

PharmaEssentia (TWSE:6446)

Overview: PharmaEssentia Corporation is a biopharmaceutical company focused on developing treatments for human diseases in Taiwan and internationally, with a market cap of NT$173.83 billion.

Operations: The company generates revenue primarily from its Research and Development of New Drugs segment, which amounted to NT$13.82 billion.

Estimated Discount To Fair Value: 47.8%

PharmaEssentia, trading at NT$495, is significantly undervalued compared to its estimated fair value of NT$947.63. Analysts anticipate a 29.6% increase in stock price as earnings and revenue are projected to grow annually by 51.5% and 34.4%, respectively, surpassing market averages in Taiwan. Recent developments include the FDA's acceptance of a supplemental Biologics License Application for BESREMi, which may enhance future cash flows if approved for expanded indications in essential thrombocythemia treatment.

- The growth report we've compiled suggests that PharmaEssentia's future prospects could be on the up.

- Get an in-depth perspective on PharmaEssentia's balance sheet by reading our health report here.

Seize The Opportunity

- Embark on your investment journey to our 481 Undervalued Global Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal