January 2026's Top Picks: Penny Stocks In Global

As global markets continue to show positive momentum, with U.S. indices reaching record highs and economic growth accelerating, investors are increasingly on the lookout for new opportunities. Penny stocks, although an older term, remain a relevant area of interest due to their potential for significant growth at lower price points. By focusing on companies with robust financials and clear growth trajectories, these stocks can offer compelling opportunities for those willing to explore beyond the large-cap names.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.46 | HK$890.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.30 | £493.82M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$462.61M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.745 | $433.09M | ✅ 3 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.135 | £182.65M | ✅ 6 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,584 stocks from our Global Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Koh Brothers Eco Engineering (Catalist:5HV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Koh Brothers Eco Engineering Limited is an investment holding company that offers engineering, procurement, and construction services for infrastructure, water and wastewater treatment, building, biorefinery, and renewable energy projects with a market cap of SGD228.27 million.

Operations: The company's revenue is primarily derived from its Engineering and Construction segment, which generated SGD124.75 million, and its Bio-Refinery and Renewable Energy segment, contributing SGD69.48 million.

Market Cap: SGD228.27M

Koh Brothers Eco Engineering Limited, with a market cap of SGD228.27 million, primarily generates revenue through its Engineering and Construction segment (SGD124.75 million) and Bio-Refinery and Renewable Energy segment (SGD69.48 million). Despite being unprofitable with declining earnings over the past five years, the company maintains a robust cash position exceeding its total debt, providing a cash runway for over three years due to positive free cash flow growth of 25.7% annually. Recent strategic alliances include forming Tenox Kyusyu Geotek Pte. Ltd., enhancing their foundation works capabilities without materially impacting current financials.

- Navigate through the intricacies of Koh Brothers Eco Engineering with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Koh Brothers Eco Engineering's track record.

Broncus Holding (SEHK:2216)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Broncus Holding Corporation is a medical device company specializing in interventional pulmonology products with operations in Mainland China, the European Union, and internationally, and it has a market cap of approximately HK$1.25 billion.

Operations: The company's revenue is derived from its medical products segment, totaling $6.08 million.

Market Cap: HK$1.25B

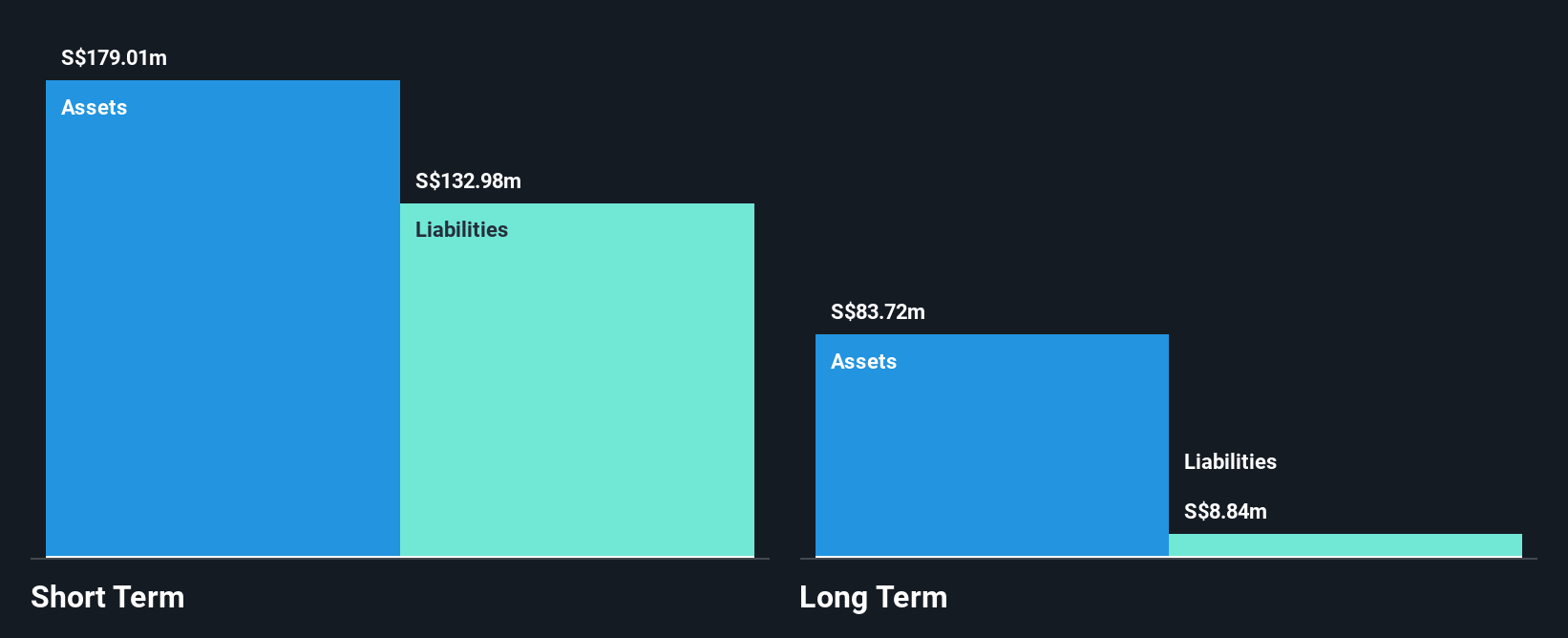

Broncus Holding Corporation, with a market cap of HK$1.25 billion, recently filed a follow-on equity offering amounting to HK$326.89 million. The company remains unprofitable but has reduced its losses by 43.8% annually over the past five years and possesses a cash runway exceeding three years based on current free cash flow trends. Despite negative return on equity, Broncus has no long-term liabilities and more cash than debt, indicating financial resilience. Its board is experienced with an average tenure of 3.9 years, although management experience data is insufficient for assessment at this time.

- Click here and access our complete financial health analysis report to understand the dynamics of Broncus Holding.

- Understand Broncus Holding's track record by examining our performance history report.

IGG (SEHK:799)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGG Inc is an investment holding company that develops and operates mobile and online games across Asia, North America, Europe, and other international markets with a market cap of HK$4.26 billion.

Operations: The company's revenue is primarily derived from its development and operation of online games, totaling HK$5.72 billion.

Market Cap: HK$4.26B

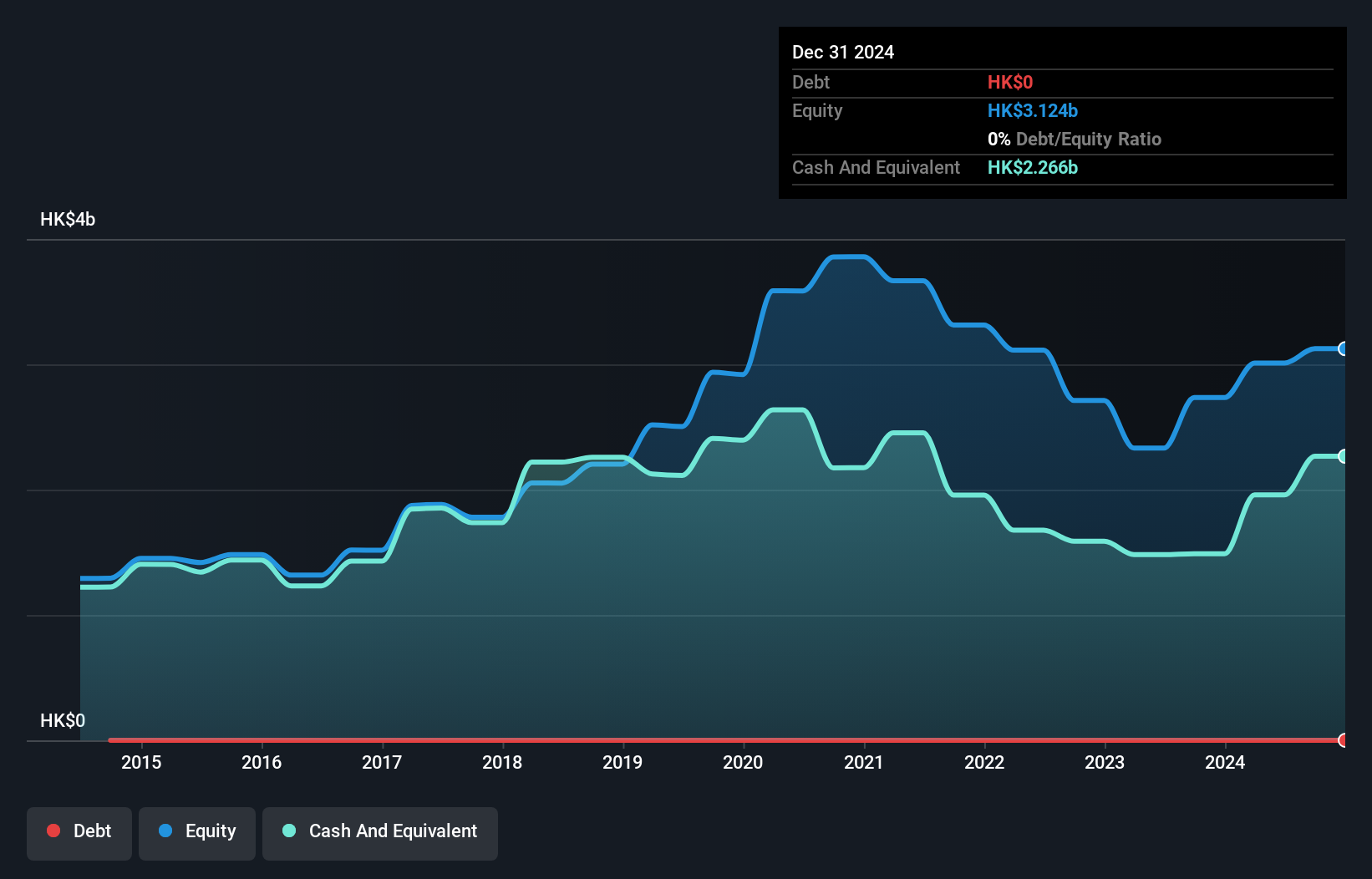

IGG Inc, with a market cap of HK$4.26 billion, is trading at a good value with a price-to-earnings ratio of 7.5x compared to the Hong Kong market's 12x. Despite recent negative earnings growth and declining profit margins, its short-term assets (HK$3 billion) comfortably cover both short-term and long-term liabilities. The company has maintained high-quality earnings without incurring debt over the past five years, which adds financial stability. Although its return on equity is low at 16.8%, analysts predict annual earnings growth of 9.66%. IGG's board is experienced with an average tenure of 9.6 years, though management experience remains unclear.

- Get an in-depth perspective on IGG's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into IGG's future.

Summing It All Up

- Investigate our full lineup of 3,584 Global Penny Stocks right here.

- Want To Explore Some Alternatives? Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal