Alphabet Went From AI Victim To AI Leader In 12 Months: Can Google's Strategy Topple ChatGPT?

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) has successfully flipped the script on Wall Street, transforming from a tech giant threatened by artificial intelligence (AI) to a potential “King of AI” in just one year.

The Great Narrative Shift

According to Landon Swan, co-founder of LikeFolio, a massive change in investor sentiment has fueled Alphabet's recent stock surge. Since hitting lows of roughly $140 in April, shares have climbed more than 120%.

Swan notes that Wall Street has moved from fearing AI as a “giant threat” to Google's search monopoly to viewing it as a “giant opportunity.”

Swan admits that while he once viewed AI as a danger to the company, Alphabet is now proving it can leverage the technology better than almost anyone else, driving a transition from skepticism to “very, very bullish optimism.”

‘In Your Face’ Strategy

Central to this resurgence is Gemini, Alphabet's answer to OpenAI. While ChatGPT remains the dominant market leader with an estimated 85% share, Swan points out that Gemini is “closing fast.”

LikeFolio data indicates Gemini's user interest grew over 300% year-over-year, compared to 67% for ChatGPT.

Swan attributes this rapid catch-up to Google's “in your face” strategy—integrating Gemini directly into the default search engine used by billions.

However, a gap in engagement remains: ChatGPT daily users average 7.5 queries per day compared to just 4 for Gemini users.

Dominance Beyond Search

The bullish case extends beyond chatbots. Swan highlights that Google Cloud is “crushing it,” with revenue up 34% year-over-year—outpacing growth from competitors Amazon.com Inc. (NASDAQ:AMZN) and Microsoft Corp. (NASDAQ:MSFT).

Furthermore, YouTube continues to dominate the living room, commanding 13% of U.S. TV time versus Netflix Inc.'s (NASDAQ:NFLX) 8%.

With its “content machine” model and expanding cloud dominance, Alphabet is effectively firing on all cylinders.

Alphabet Delivers About 65% Returns In 2025

GOOG shares have surged by 64.78% in 2025, outpacing the gains of all its Magnificent 7 peers during the same period.

On the last trading day of the year, the stock closed 0.28% lower at $313.80 apiece on Wednesday.

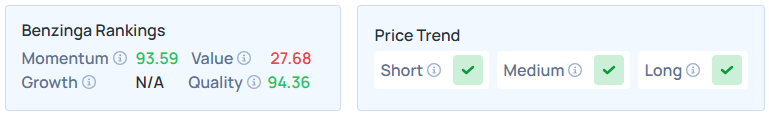

Benzinga’s Edge Stock Rankings indicate that GOOG maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal