3 Middle Eastern Penny Stocks With Market Caps Up To US$50M

As the Middle Eastern stock markets begin 2026 on a positive note, with Saudi Arabia's bourse showing gains and Oman approving its budget, investors are closely watching emerging opportunities. Penny stocks, although an older term, remain a relevant investment area for those interested in smaller or newer companies that might offer surprising value. This article will explore several penny stocks that exhibit strong financial foundations and potential for significant returns.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.39 | SAR1.35B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.882 | ₪206.03M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.04 | AED2.18B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.78 | SAR954M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED384.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.57 | AED15.22B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.829 | AED504.24M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.635 | ₪205.67M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Duran Dogan Basim ve Ambalaj Sanayi (IBSE:DURDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Duran Dogan Basim ve Ambalaj Sanayi A.S., along with its subsidiaries, offers packaging products across various regions including Turkey, Europe, the United States, the Middle East, Africa, and the Asia Pacific with a market capitalization of TRY1.82 billion.

Operations: The company generates revenue of TRY2.03 billion from its Packaging & Containers segment.

Market Cap: TRY1.82B

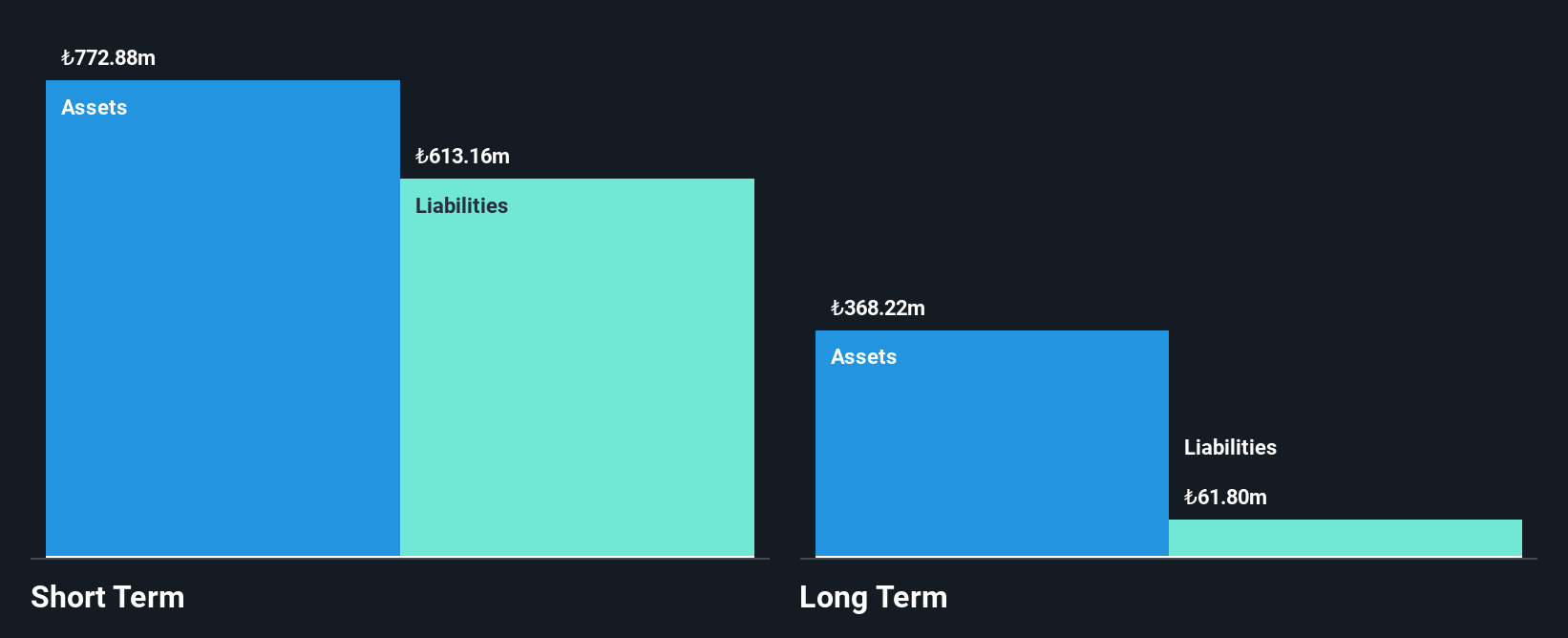

Duran Dogan Basim ve Ambalaj Sanayi A.S. faces challenges as a penny stock, with recent earnings reports highlighting a net loss of TRY 29.24 million for Q3 2025 and increased losses over the past five years at an annual rate of 14.3%. Despite unprofitability, the company maintains strong asset coverage over both short-term (TRY1.2 billion) and long-term liabilities (TRY325 million), while its debt to equity ratio has significantly improved from 344.1% to 45% in five years. However, high debt levels persist, impacting financial stability amid volatile market conditions typical for penny stocks.

- Click here to discover the nuances of Duran Dogan Basim ve Ambalaj Sanayi with our detailed analytical financial health report.

- Learn about Duran Dogan Basim ve Ambalaj Sanayi's historical performance here.

Ihlas Yayin Holding (IBSE:IHYAY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ihlas Yayin Holding A.S. operates in the media, publishing, and advertising sectors in Turkey through its subsidiaries, with a market cap of TRY882 million.

Operations: The company's revenue is primarily derived from Journalism and Printing Works at TRY1.89 billion, followed by News Agencies with TRY380.41 million, and TV Services and Other contributing TRY259.40 million.

Market Cap: TRY882M

Ihlas Yayin Holding A.S. operates with a market cap of TRY882 million, primarily generating revenue from Journalism and Printing Works (TRY1.89 billion). Despite this, the company remains unprofitable, with net losses increasing over recent years. Its financial position shows short-term assets exceeding short-term liabilities (TRY1.4 billion vs. TRY1.2 billion), though long-term liabilities remain uncovered by these assets (TRY1.6 billion). The debt to equity ratio has improved significantly to 3.5%, and the company holds more cash than total debt, offering some financial resilience in a challenging penny stock environment despite ongoing earnings declines and volatility stability at 6%.

- Navigate through the intricacies of Ihlas Yayin Holding with our comprehensive balance sheet health report here.

- Gain insights into Ihlas Yayin Holding's past trends and performance with our report on the company's historical track record.

Orçay Ortaköy Çay Sanayi ve Ticaret Anonim Sirketi (IBSE:ORCAY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Orçay Ortaköy Çay Sanayi ve Ticaret Anonim Sirketi is involved in the manufacture and sale of various tea products both in Turkey and internationally, with a market cap of TRY288 million.

Operations: The company generates revenue of TRY554.10 million from its food processing segment.

Market Cap: TRY288M

Orçay Ortaköy Çay Sanayi ve Ticaret Anonim Sirketi, with a market cap of TRY288 million, has shown significant sales growth in its recent earnings report, reaching TRY160.13 million for Q3 2025 from TRY33.88 million the previous year. Despite this revenue increase, the company remains unprofitable with a net loss of TRY21.3 million for the quarter. It maintains a positive cash flow and sufficient cash runway exceeding three years, although it faces high debt levels with a net debt to equity ratio of 108%. The company's short-term assets comfortably cover both its short-term and long-term liabilities.

- Click to explore a detailed breakdown of our findings in Orçay Ortaköy Çay Sanayi ve Ticaret Anonim Sirketi's financial health report.

- Understand Orçay Ortaköy Çay Sanayi ve Ticaret Anonim Sirketi's track record by examining our performance history report.

Where To Now?

- Navigate through the entire inventory of 80 Middle Eastern Penny Stocks here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal