Uncovering Middle East Hidden Gems With Strong Potential

As the Middle East markets kick off 2026 on a positive note, with Saudi Arabia's benchmark index gaining 0.6% and Oman’s stock index edging up by 0.5%, investors are increasingly looking towards the region for promising opportunities amid broad-based buying in sectors like consumer staples and information technology. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden gems that may thrive in the evolving economic landscape of the Middle East.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| MOBI Industry | 13.81% | 5.69% | 19.68% | ★★★★★★ |

| Nofoth Food Products | NA | 21.41% | 25.45% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Amanat Holdings PJSC | 10.86% | 27.51% | -0.92% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Lila Kagit Sanayi Ve Ticaret (IBSE:LILAK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lila Kagit Sanayi Ve Ticaret A.S. is a company that produces and sells roll papers primarily in Turkey, with a market capitalization of TRY17.11 billion.

Operations: Lila Kagit generates revenue primarily from the sale of paper and paper products, totaling TRY10.28 billion. The company's financial performance is influenced by its cost structure and market dynamics in Turkey.

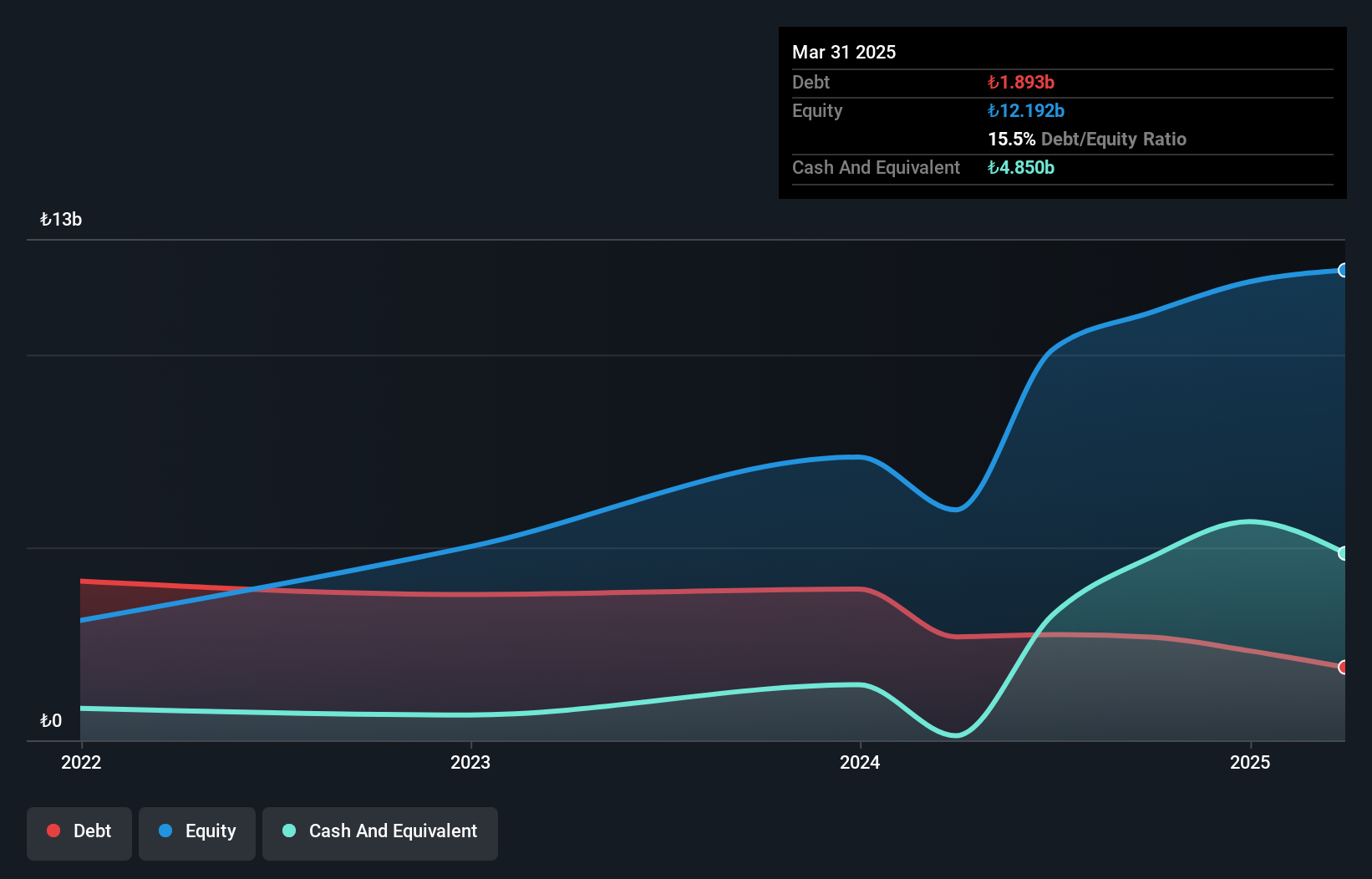

Lila Kagit Sanayi Ve Ticaret, a relatively small player in the household products sector, has seen some mixed results recently. Despite negative earnings growth of -14.8% over the past year, it remains profitable with high-quality earnings and more cash than total debt. The company reported third-quarter sales of TRY 3.19 billion, down from TRY 4.03 billion last year, while net income was TRY 411 million compared to TRY 468 million previously. With a price-to-earnings ratio of 13.4x below the market average and revenue forecasted to grow by over 31% annually, Lila Kagit's potential for future growth seems promising amidst current challenges.

Saudi Real Estate (SASE:4020)

Simply Wall St Value Rating: ★★★★★☆

Overview: Saudi Real Estate Company is a real estate development firm in Saudi Arabia, with a market capitalization of SAR4.84 billion.

Operations: The company's primary revenue streams include property sales (SAR969.32 million) and infrastructure projects (SAR870.00 million), with additional income from rental, facility management, and construction projects. The financial structure is impacted by a segment adjustment of SAR-128.79 million.

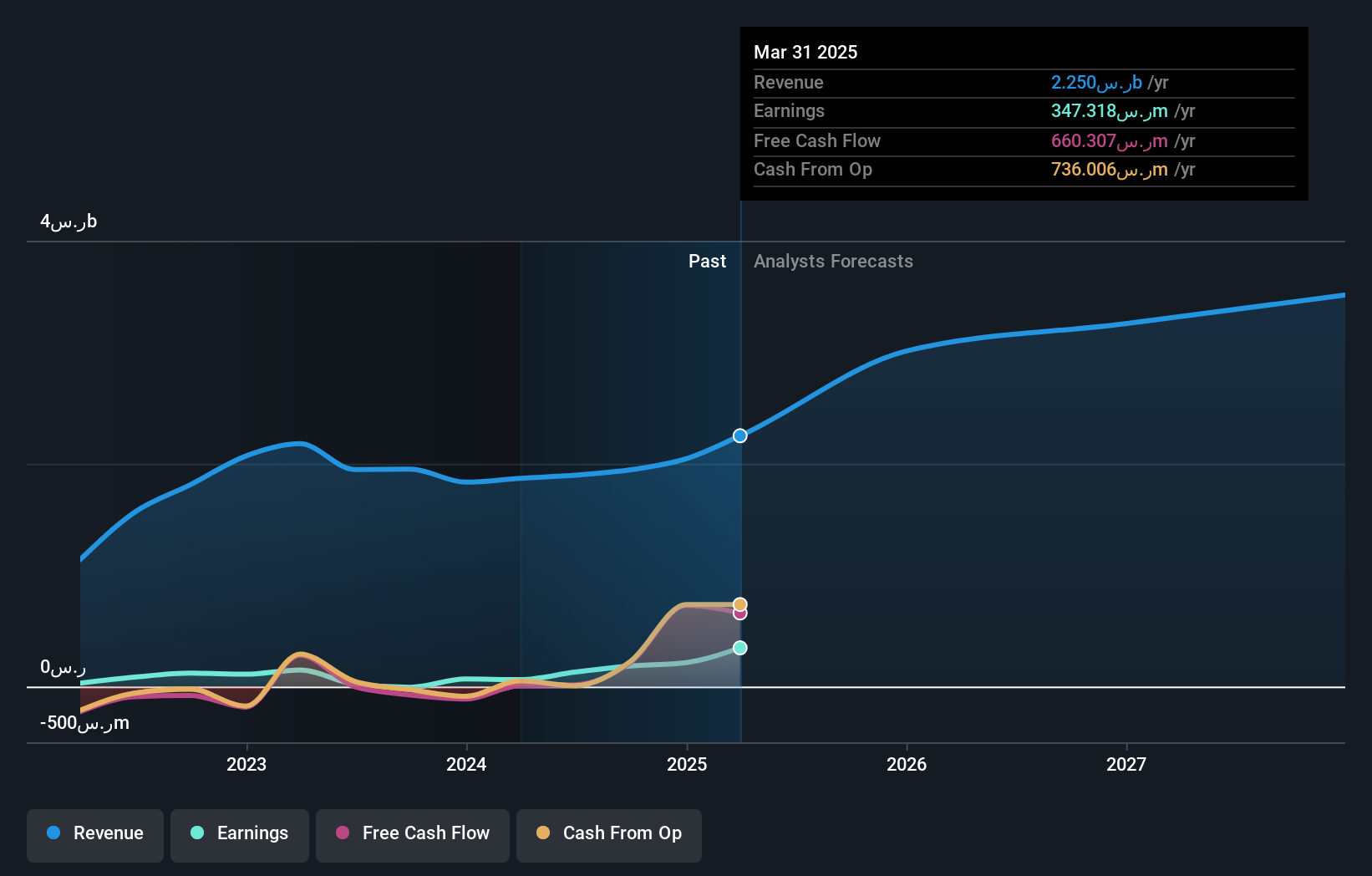

Saudi Real Estate is making waves with its impressive earnings growth of 148.5% over the past year, significantly outpacing the industry's 27.6%. The company recently secured a SAR 425 million contract for the Fai Sedra 2 project in Riyadh, adding to its robust portfolio. With a price-to-earnings ratio of 10.6x, it stands as an attractive value compared to the broader SA market's 17.6x. Its net debt to equity ratio has improved from 137.7% to a satisfactory 50.7% over five years, and interest payments are well-covered by EBIT at four times coverage, reflecting financial stability amidst growth prospects.

- Get an in-depth perspective on Saudi Real Estate's performance by reading our health report here.

Gain insights into Saudi Real Estate's past trends and performance with our Past report.

Al Taiseer Group TALCO Industrial (SASE:4143)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Taiseer Group TALCO Industrial Company specializes in the design, manufacture, and marketing of aluminum products across several Middle Eastern countries and internationally, with a market capitalization of SAR1.40 billion.

Operations: Al Taiseer Group TALCO Industrial generates revenue primarily from its Aluminum Forming and Selling sector, which accounts for SAR705.21 million, followed by the Metal Coating Powder sector at SAR68.51 million. The company's net profit margin is a critical metric to observe as it provides insight into profitability relative to total revenue generated.

Al Taiseer Group TALCO Industrial, a promising player in the Middle East's industrial sector, has demonstrated robust financial health. Its recent earnings report shows net income for Q3 2025 at SAR 21.57 million, up from SAR 16.77 million the previous year, with sales hitting SAR 202.75 million compared to SAR 167.25 million last year. The company's debt management is commendable; it holds more cash than total debt and has reduced its debt-to-equity ratio from 18.4% to 4.3% over five years. Trading at a significant discount of approximately 60% below estimated fair value suggests potential for future growth opportunities in this industry segment.

- Dive into the specifics of Al Taiseer Group TALCO Industrial here with our thorough health report.

Learn about Al Taiseer Group TALCO Industrial's historical performance.

Summing It All Up

- Investigate our full lineup of 185 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal