IPO News | Diaoyuan Technology Announces Hong Kong Stock Exchange as the World's Largest Spatio-temporal Intelligence Solution Provider for the Global Automotive Industry

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on January 1, Guangdong Diaoyuan Technology Co., Ltd. (abbreviation: Diaoyuan Technology) submitted a listing application to the main board of the Hong Kong Stock Exchange, with CICC and CITIC Construction Investment International as co-sponsors. According to Insight Consulting, the company is the first company in the world to mass-produce automotive-grade MEMS combined spatio-temporal intelligence solutions and apply them to the field of intelligent driving. Based on the load volume of spatio-temporal intelligent solutions in 2024, the company is the largest provider of spatio-temporal intelligence solutions in the global automotive industry, with a market share of 27.6%.

Company profile

According to the prospectus, as a global leader and technology leader in the field of spatio-temporal intelligence, Diaoyuan Technology enables intelligent machines to accurately and sensitively sense, locate, and interact with the physical world.

The core competitiveness of Diaoyuan Technology lies in its full-stack self-developed technical ecosystem. It has independently mastered the entire technical chain of spatio-temporal intelligence, from underlying chip capabilities, algorithms and software to product design and precision engineering. The company's full-stack solutions cover inertial chips, advanced modules and integrated systems, injecting a reliable cornerstone of spatial and temporal intelligence into physical AI applications in the fields of automobiles, robotics, construction machinery, and renewable energy systems.

According to Insight Consulting, Diaoyuan Technology is one of the few companies in the world that can combine advanced spatio-temporal intelligence technology with deep engineering capabilities, achieving a balance between leading performance and cost efficiency. Through vertical integration and digital intelligent manufacturing, the company has mastered every production process from chip design and packaging, module calibration to system assembly and final testing, ensuring the consistency, traceability and high yield of large-scale mass production. As of September 30, 2025, the company has obtained mass production projects from more than 30 top international and domestic OEMs, and has verified the vehicle-level reliability of the company's products in millions of intelligent driving units. This ability to maintain continuous high-precision output in a complex reality environment is a key differentiating advantage and barrier for the company.

With its successful experience in the automotive field, Diaoyuan Technology is rapidly expanding its technology into emerging fields such as robotics, construction machinery, and renewable energy systems. The company's solution is a “vestibule” system that empowers intelligent spatio-temporal intelligence, enabling humanoid robots to walk in balance, industrial machinery to operate autonomously, and renewable energy systems to accurately align components. The company is committed to driving physical AI transformation by providing scalable, secure, and cost-effective spatio-temporal intelligence solutions on a global scale.

Financial data

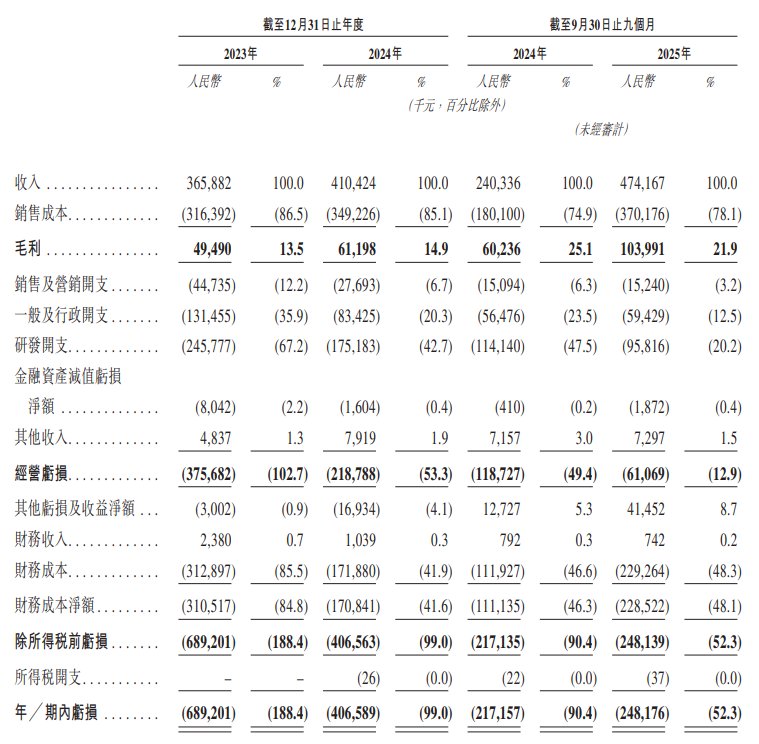

revenue

During the track record period, Diaoyuan Technology has driven rapid business expansion with technological leadership and successful commercialization. The sharp increase in shipment volume contributed to a strong increase in the company's revenue. In 2023, 2024, the nine months ended September 30 in 2024, and the nine months ended September 30 in 2025, the company achieved revenue of approximately 366 million yuan (RMB, same below), 410 million yuan, 240 million yuan, and 474 million yuan, respectively.

Gross profit and gross profit margin

In 2023, 2024, and 2024 for the nine months ended September 30, and 2025 for the nine months ending September 30, the company recorded gross margins of approximately RMB 49.49 million, RMB 60.188 million, RMB 60.236 million, and RMB 104 million, respectively, with corresponding gross margins of 13.5%, 14.9%, 25.1%, and 21.9%.

Annual/period loss

In 2023, 2024, 2024 for the nine months ended September 30, and 2025 for the nine months ended September 30, and 2025, the company recorded annual/period losses of approximately $689 million, $407 million, $217 million, and $248 million respectively. Losses are due to the following factors: continued investment in R&D, the company is still in the business expansion phase, and financial costs associated with debt redemption.

Industry Overview

Spatio-temporal intelligence solutions are the core technology that realizes physical AI perception and execution capabilities. With the continuous development of artificial intelligence, key applications such as automobiles, robot systems, construction machinery, and renewable energy systems have become the core fields of implementation of physical AI, driving the growing demand for spatio-temporal intelligence solutions.

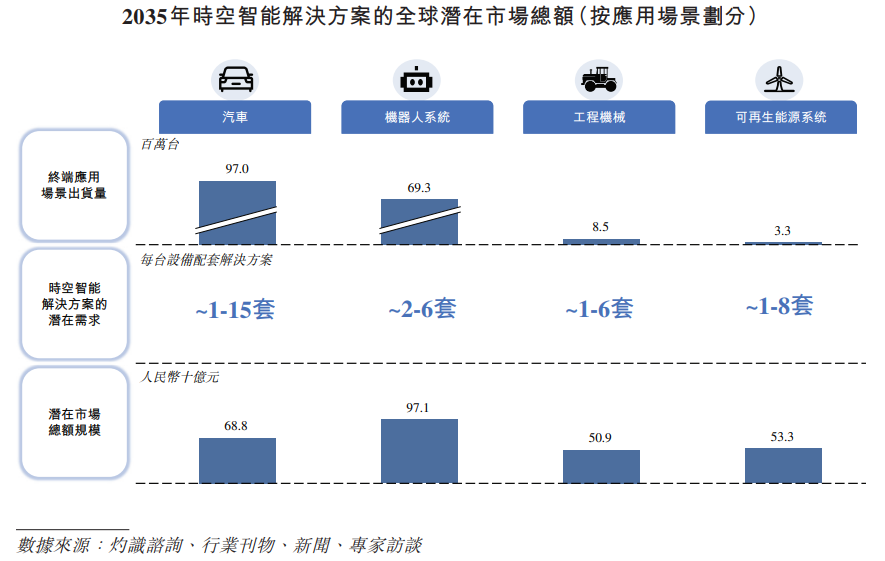

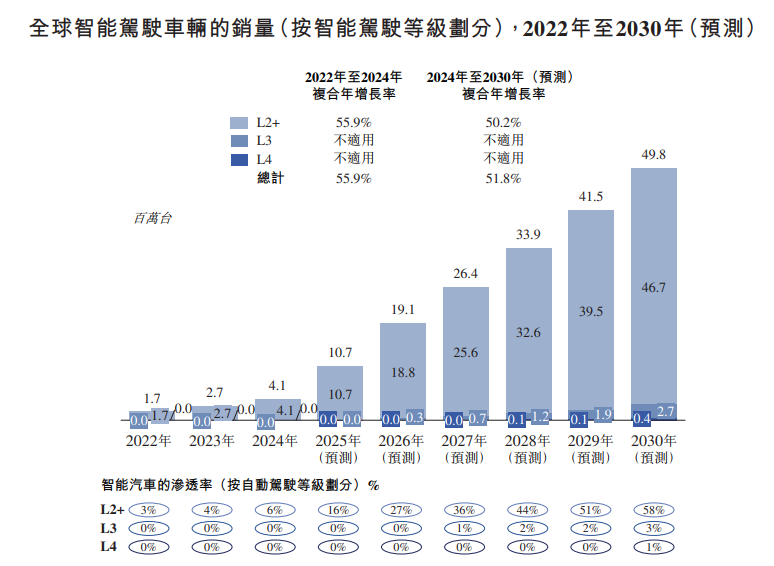

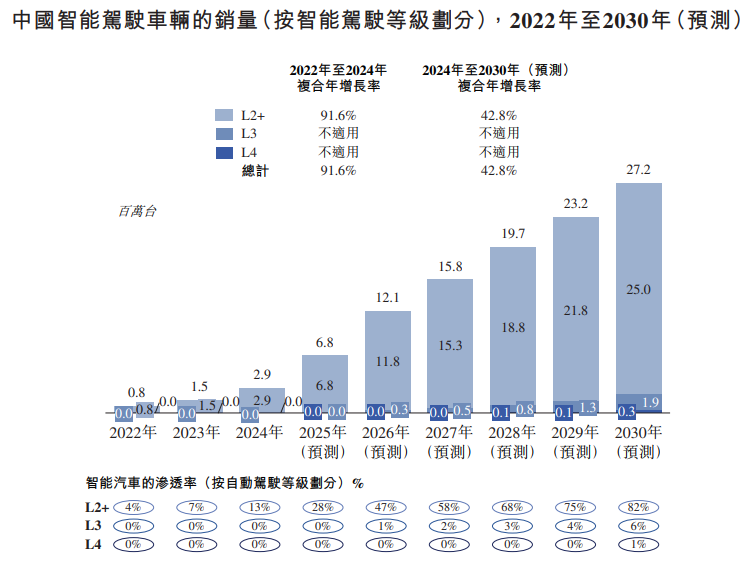

Automobiles: Global passenger car sales are expected to grow from 62.9 million units in 2024 to 97.0 million units in 2035. At that time, 85% of vehicles are expected to have L2+ or higher intelligent driving capabilities. Spatio-temporal intelligence solutions are becoming standard in these vehicles, providing critical real-time data for intelligent driving and safety. In addition to core driving functions, these solutions are being extended to active suspension, brake control, and airbag deployment systems to ensure timely triggering of safety functions. Potential demand in the global automotive sector will reach RMB 68.8 billion by 2035.

Robotic systems: Spatio-temporal intelligence solutions play a key role in various robotic systems, mainly including: physical robots, such as humanoid robots, four-legged robots, wheeled robots, etc.; mobile robots, such as automated guided vehicles (AGVs) /autonomous mobile robots (AMR), lawn mowers, food delivery robots, etc.; and unmanned vehicles, including robot taxis, robot buses, etc.

For mowing robots, the technology enables them to navigate efficiently in complex garden environments, avoid flowers and shrubs, and optimize coverage paths. For humanoid robots, it can provide real-time full-body posture tracking to achieve dynamic balance control, human-like gait planning, fall prevention, and accurate control tasks. Humanoid robots usually require 2-6 spatio-temporal intelligence solutions to track head, torso, and limb movements and maintain balance. By 2035, the total potential global market demand for spatio-temporal intelligence solutions for robotic systems will reach RMB 97.1 billion.

Construction machinery: Highly reliable spatio-temporal intelligent solutions are the foundation for stable, accurate and autonomous operation of construction machinery such as ships, intelligent agricultural equipment, intelligent mining vehicles and cranes in complex environments. In agricultural applications, these solutions can detect airframe inclination and vibration, counteract the impact of terrain on spray/harvest quality, reduce the risk of rollover, and improve work efficiency. At the same time, it can achieve linear autonomous navigation, accurate trenching and accurate sowing, and avoid playback or missed broadcasts. In nautical applications, it can compensate for ship movements caused by waves and wind to ensure the stability of offshore lifting and exploration operations. For other machines such as cranes, these solutions can accurately measure the angle of rotation and significantly reduce the swing of the boom and hook, thereby reducing difficulty in operation, improving positioning accuracy, and preventing collisions. By 2035, the potential global demand for this sector will reach RMB 50.9 billion.

Renewable energy systems: Spatio-temporal intelligence solutions are increasingly being used in renewable energy systems, such as wind turbines, utility-grade photovoltaic power plants, and water and hydropower facilities to achieve high-precision attitude and motion monitoring, increase energy production, and support predictive maintenance. In the field of wind power generation, such solutions provide real-time measurement parameters for tower inclination, vibration characteristics, and structural dynamics to help maintain optimal operating conditions, enhance stability, and maximize power generation efficiency. In photovoltaic applications, such solutions can be used to monitor the angular accuracy, structural settlement, and wind vibration data of the bracket, help achieve optimal sun tracking results, and identify problems such as bracket deviation or mechanical deterioration at an early stage. In the field of water conservancy and hydropower infrastructure, such solutions help track the deformation of dams and dams, improve the level of safety monitoring, and identify faults early before performance declines or unplanned shutdowns. By 2035, the global demand for such solutions in the energy sector will reach RMB 53.3 billion.

Other applications: Spatio-temporal intelligence solutions can also rapidly expand into the low-space economy and consumer electronics fields, driven by physical AI, multi-sensor fusion, and edge computing integration. In low-altitude applications, including drones and electric vertical take-off and landing vehicles, such solutions can provide measurement services such as precise positioning, attitude perception, and global time synchronization to achieve stable flight control, accurate route tracking, and high-precision data collection. Especially in environments with limited signals, this technology is critical to ensure mission continuity. At the same time, consumer electronic devices such as smartphones, XR headsets, wearables, and 3D scanners are transforming from low-accuracy, low-cost motion sensing to high-precision, real-time spatio-temporal intelligence platforms. In the past, basic sensors only met functional requirements such as screen rotation, step count, and basic image stabilization. As application scenarios evolve to physical AI-driven experiences, such as immersive XR interaction, real-time spatial mapping, 3D reconstruction, and all-weather health monitoring, the demand for continuous perception and adaptive response capabilities of various devices is increasing, thus achieving advanced functions such as image stabilization, accurate spatial mapping, immersive XR interaction, and health monitoring.

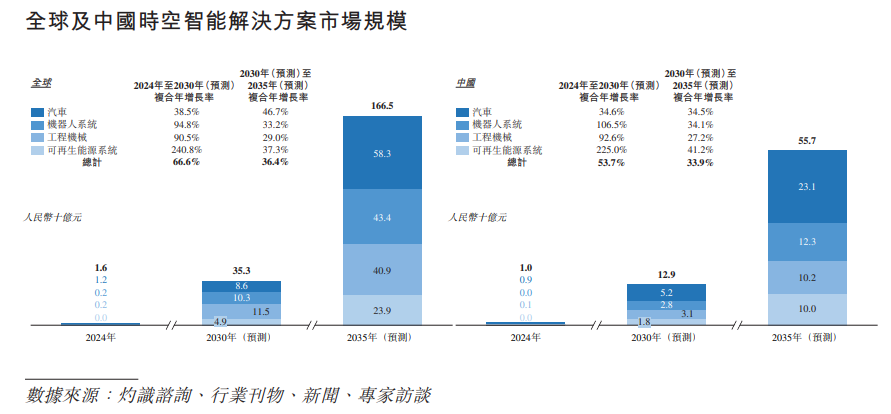

Driven by the rapid spread of downstream applications, the global market for space-time intelligence solutions is expected to grow significantly from RMB 1.6 billion in 2024 to RMB 35.3 billion in 2030, and further reach RMB 166.5 billion by 2035. This means that the CAGR from 2024 to 2030 is as high as 66.6%, and the CAGR from 2030 to 2035 is 36.4%.

In this context, the Chinese market is expected to rise from RMB 1 billion in 2024 to RMB 12.9 billion in 2030, with a compound annual growth rate of 53.7%, and further accelerated to RMB 55.7 billion in 2035, which means a compound annual growth rate of 33.9% between 2030 and 2035. This rapid market expansion is due to the high and continuously increasing penetration rate of spatio-temporal intelligence solutions in various downstream fields; by 2035, the penetration rate of spatio-temporal intelligence solutions in various fields around the world will be about 85% in the automotive field, 45% in the field of robotics systems, 80% in the field of construction machinery, and 45% in the field of renewable energy systems. Behind the numbers, it highlights widespread implementation in mature fields and huge growth potential in emerging fields.

According to SAE classification standards, intelligent driving is divided into six levels from L0 to L5. The L0 level only provides early warning functions, while the L1 and L2 levels provide limited driving assistance functions such as adaptive cruise control and lane keeping. Level L3 represents conditional automation, and driving responsibility begins to shift to the system. Level L4 and above fall under the category of full automation. Based on this framework, the industry further proposed the L2+ level concept. Functionally positioned between L2 and L3, it provides an experience close to human driving and enables point-to-point navigation and assisted driving.

As intelligent driving vehicles move to a higher level, spatio-temporal intelligence solutions have become a prerequisite for achieving L2+, L3 and above functions.

Board Information

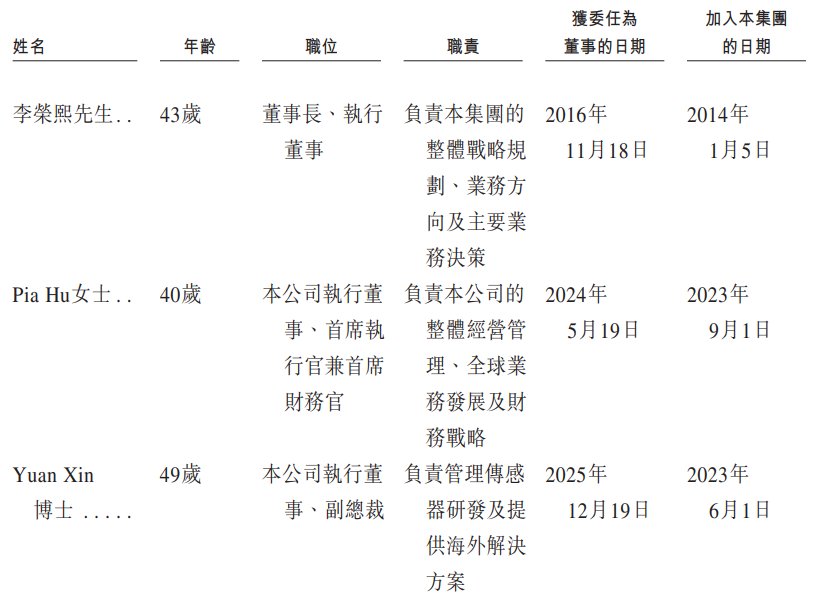

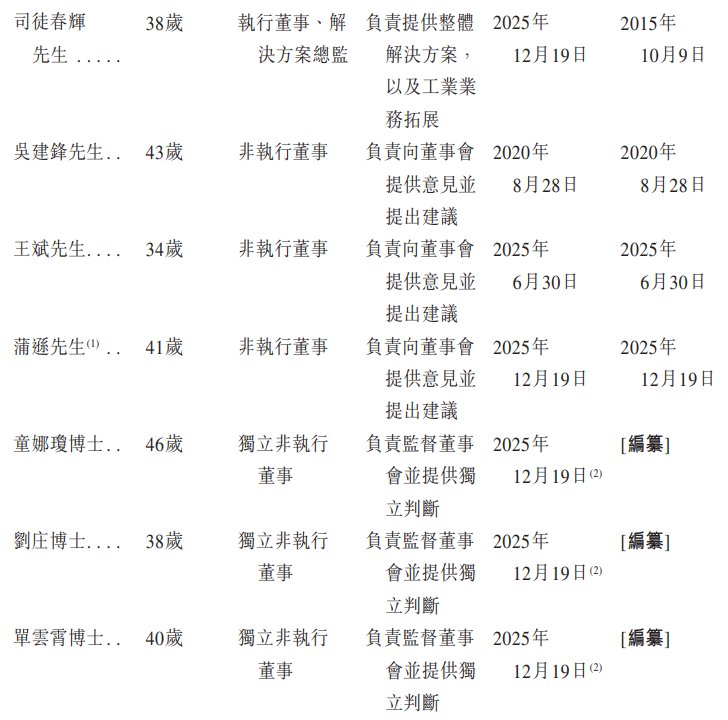

After the listing, the board of directors will be composed of nine directors, including four executive directors, two non-executive directors and three independent non-executive directors. The term of office of directors is three years, and they can be re-elected after the term expires. The board of directors is responsible for and has full authority over the management and operation of the company's business, including formulating business strategies and investment plans, implementing shareholders' meeting resolutions, and exercising other powers, functions and responsibilities conferred by the company's articles of association. The board of directors is also responsible for formulating and reviewing the company's daily policies and practices for corporate governance, risk management, internal control, and compliance with legal and regulatory requirements.

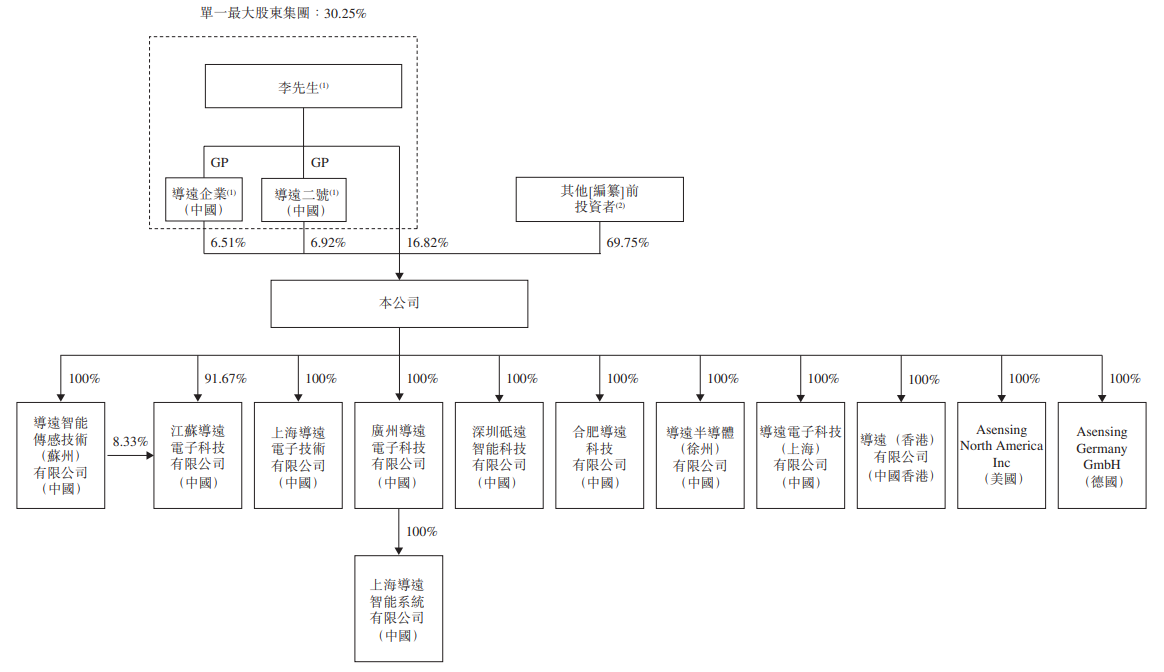

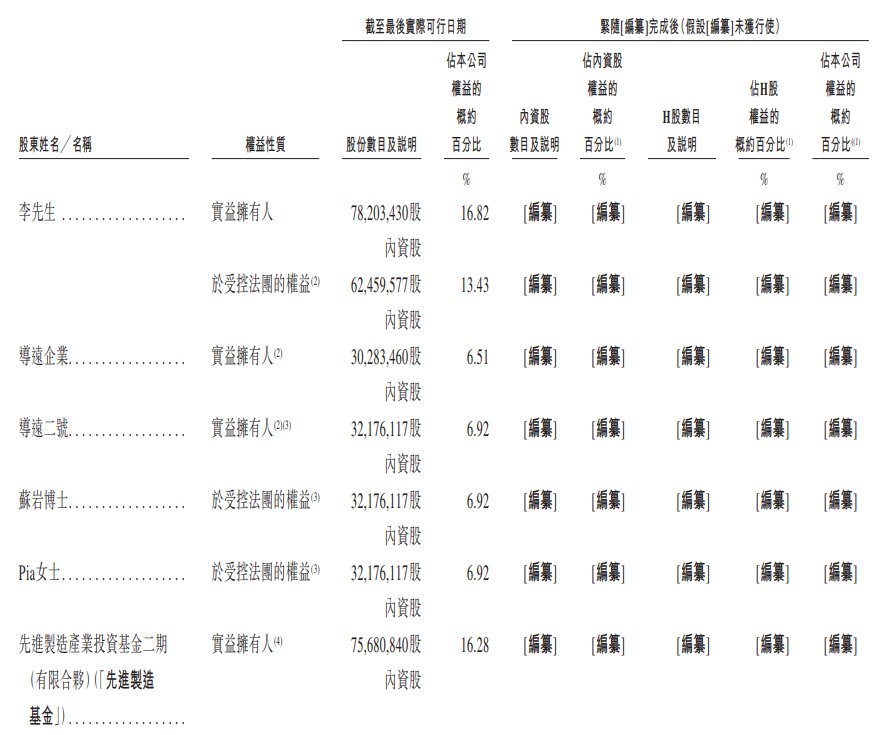

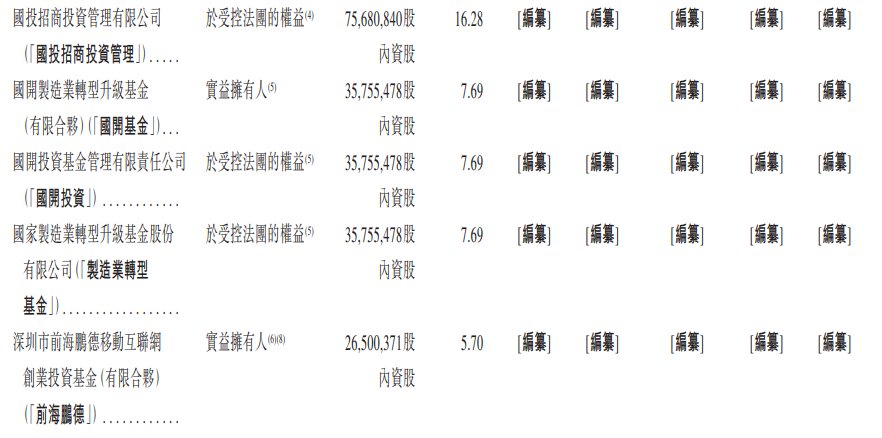

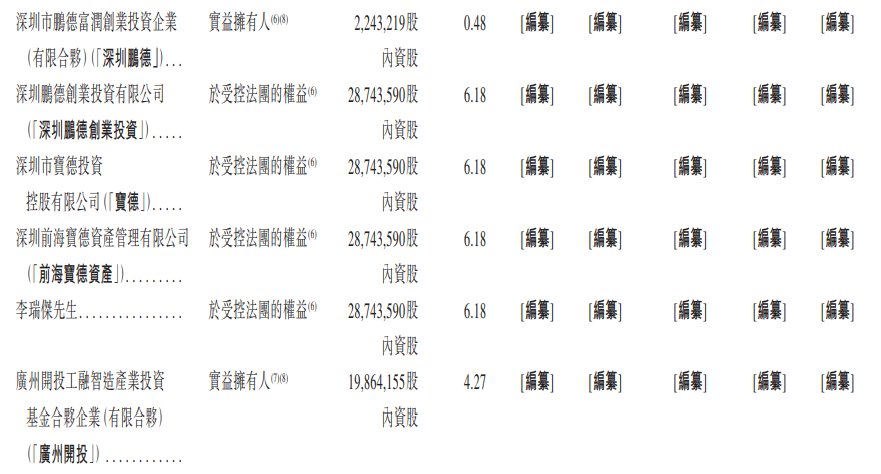

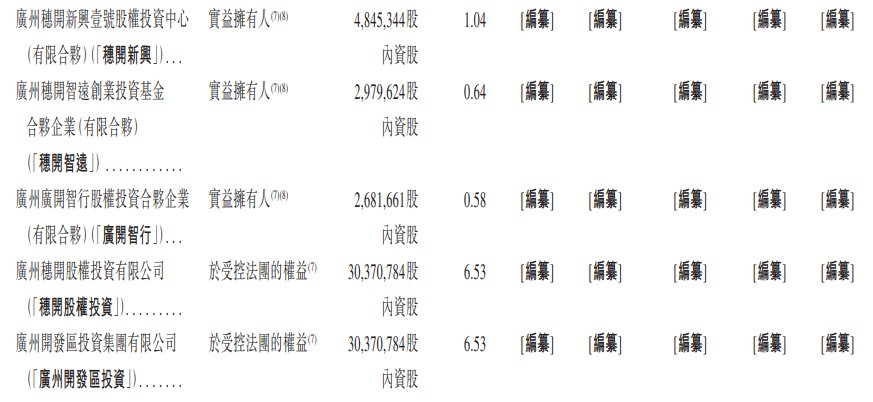

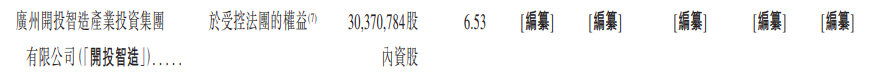

Shareholding structure

Mr. Li Rongxi, Diaoyuan Enterprise and Diaoyuan 2 formed the single largest shareholder group, holding a total of 30.25% of the shares; other pre-listing investors such as Advanced Manufacturing Fund, CDF, and Shenzhen Hanchen held a total of 69.75% of the shares.

Diaoyuan Enterprise and Diaoyuan 2 are employee motivation platforms for the Group. The general partner of each platform is Mr. Lee Young-hee.

As of the last practical date, Mr. Li is the general partner of Diaoyuan Enterprise and Daiyuan No. 2. Therefore, according to the Securities and Futures Ordinance, Mr. Li is deemed to have an interest in a total of 140,663,007 shares held by him, Diaoyuan Enterprise, and Diaoyuan 2.

Intermediary team

Co-sponsor, sponsor and overall coordinator, and overall coordinator: China International Finance Hong Kong Securities Co., Ltd., CITIC Construction Investment (International) Finance Co., Ltd.

Company Legal Adviser: On Hong Kong and US Law: Clyde Hong Kong Law Firm; On Chinese Law: Fangda Law Firm.

Co-sponsor Legal Adviser: On Hong Kong and US Law: Ouhua Law Firm; On Chinese Law: Beijing Deheng (Shenzhen) Law Firm.

Reporting accountant and independent auditor: PricewaterhouseCoopers.

Industry Advisor: Insight Industry Consulting Co., Ltd.

Compliance Advisor: Maxi Capital Ltd.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal