Jim Cramer Points To Bob Swan Bet On Nike Amid Elliott Hill, Tim Cook's Purchases: Set To 'Win Now'

CNBC's Jim Cramer has singled out a specific insider purchase at Nike Inc. (NYSE:NKE) as a critical bullish signal, urging investors not to overlook former Intel Corp. (NASDAQ:INTC) CEO Bob Swan's recent bet on the sneaker giant amidst a wave of high-profile buying.

Check out NKE’s stock price here.

The ‘Savvy’ Finance Play

While headlines have been dominated by Apple Inc. (NASDAQ:AAPL) CEO Tim Cook's massive $3 million stock purchase, Cramer took to X to highlight a smaller but potentially more significant move. He pointed to the acquisition of roughly 8,700 shares by Nike Director Swan.

Cramer described Swan, the former CEO and CFO of Intel, as “quite savvy about finance,” suggesting that his decision to buy is a heavily calculated vote of confidence.

According to Cramer, the convergence of buys from Swan, Cook, and Nike CEO Elliott Hill creates a rare “trifecta” of insider activity that typically signals a strong year ahead.

See Also: Nike An Attractive Buy? Value Percentile Rises As Tim Cook Buys 50,000 Shares

Vote Of Confidence

The insider activity comes at a pivotal moment for Nike. Cook recently purchased 50,000 shares—his first open-market purchase in his two decades on the board—while Swan acquired 8,691 shares at an average price of $57.54.

“You don’t often see three insiders buy unless the next year is going to be a great one,” Cramer noted, adding that the company's “Win Now” strategy in China will be a key driver for the “tremendous, innovative team.”

Turnaround In Progress

This vote of confidence from leadership arrives as Nike attempts to rebound from a challenging period. The stock was down by 13.52% in 2025, battling tariff concerns and slowing momentum.

However, with CEO Hill declaring the company is in the “middle innings” of its comeback, and key directors putting their own capital on the line, Cramer believes the floor may finally be in.

The stock closed 4.12% higher on the last trading day of 2025 at $63.71 apiece. It was down by 16.60% over the last six months.

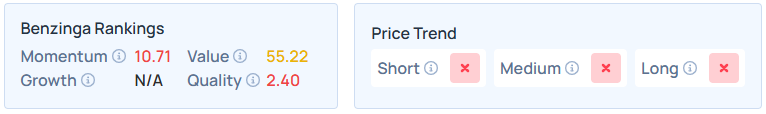

It maintains a weaker price trend over the short, medium, and long terms, with poor quality. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: TY Lim / Shutterstock.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal