Rodna Zemya Holding AD (BUL:HRZ) May Have Run Too Fast Too Soon With Recent 49% Price Plummet

Rodna Zemya Holding AD (BUL:HRZ) shares have had a horrible month, losing 49% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

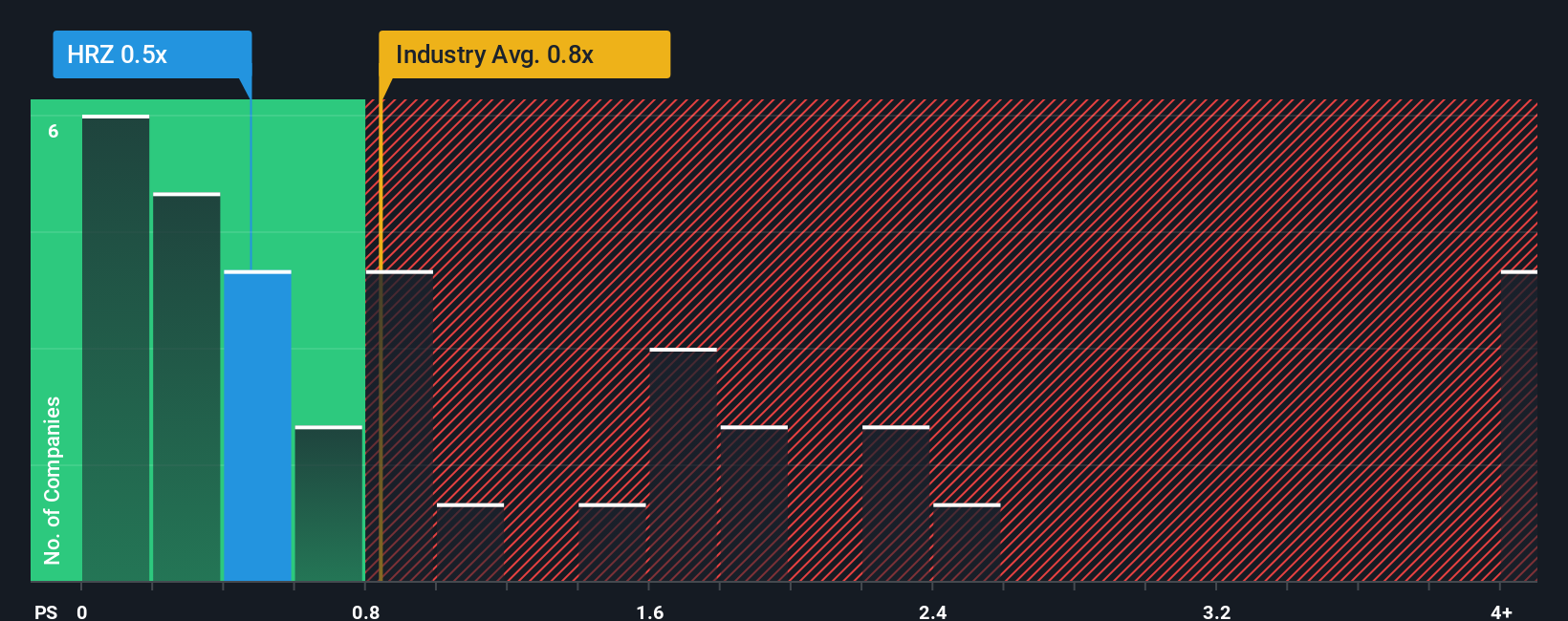

Although its price has dipped substantially, there still wouldn't be many who think Rodna Zemya Holding AD's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Bulgaria's Industrials industry is similar at about 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Rodna Zemya Holding AD

What Does Rodna Zemya Holding AD's Recent Performance Look Like?

For example, consider that Rodna Zemya Holding AD's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Rodna Zemya Holding AD will help you shine a light on its historical performance.How Is Rodna Zemya Holding AD's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Rodna Zemya Holding AD's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 2.3% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 7.6% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 5.5% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Rodna Zemya Holding AD's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From Rodna Zemya Holding AD's P/S?

With its share price dropping off a cliff, the P/S for Rodna Zemya Holding AD looks to be in line with the rest of the Industrials industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Rodna Zemya Holding AD's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You always need to take note of risks, for example - Rodna Zemya Holding AD has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Rodna Zemya Holding AD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal