Not Many Are Piling Into Holding Nov Vek AD (BUL:HNVK) Stock Yet As It Plummets 45%

The Holding Nov Vek AD (BUL:HNVK) share price has fared very poorly over the last month, falling by a substantial 45%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

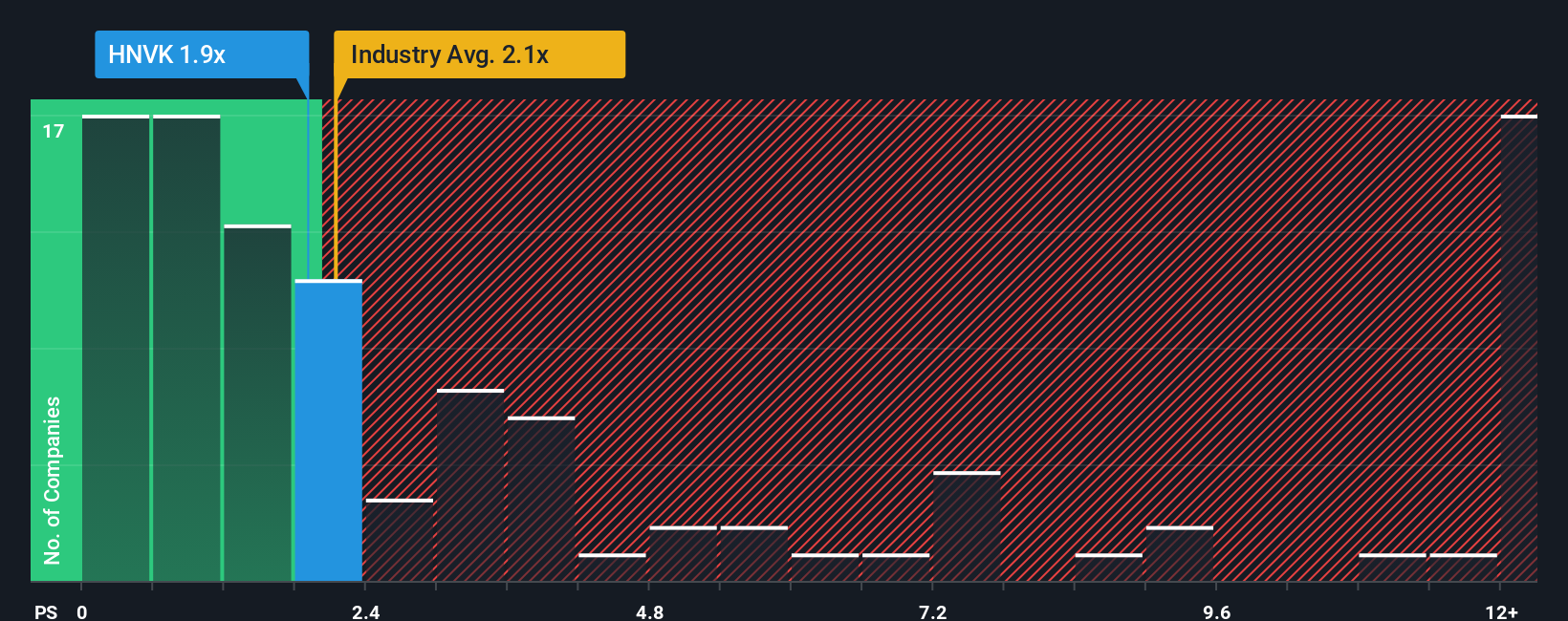

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Holding Nov Vek AD's P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the Diversified Financial industry in Bulgaria is also close to 2.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Holding Nov Vek AD

What Does Holding Nov Vek AD's Recent Performance Look Like?

The revenue growth achieved at Holding Nov Vek AD over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Holding Nov Vek AD will help you shine a light on its historical performance.How Is Holding Nov Vek AD's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Holding Nov Vek AD's to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. The latest three year period has also seen a 9.5% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to shrink 8.0% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's peculiar that Holding Nov Vek AD's P/S sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From Holding Nov Vek AD's P/S?

With its share price dropping off a cliff, the P/S for Holding Nov Vek AD looks to be in line with the rest of the Diversified Financial industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Holding Nov Vek AD revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 4 warning signs we've spotted with Holding Nov Vek AD (including 3 which are significant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal