Asian Growth Companies With High Insider Ownership To Watch

As Asian markets continue to navigate a complex economic landscape, characterized by mixed signals from major economies like China and Japan, investors are increasingly focusing on companies with strong fundamentals and strategic insider ownership. In this environment, growth companies with significant insider stakes may offer unique insights into potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 93.1% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

AprilBioLtd (KOSDAQ:A397030)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AprilBio Co., Ltd. develops long-acting biobetter and antibody biologics and has a market cap of ₩1.27 trillion.

Operations: AprilBio Co., Ltd.'s revenue segments focus on the development of long-acting biobetter and antibody biologics.

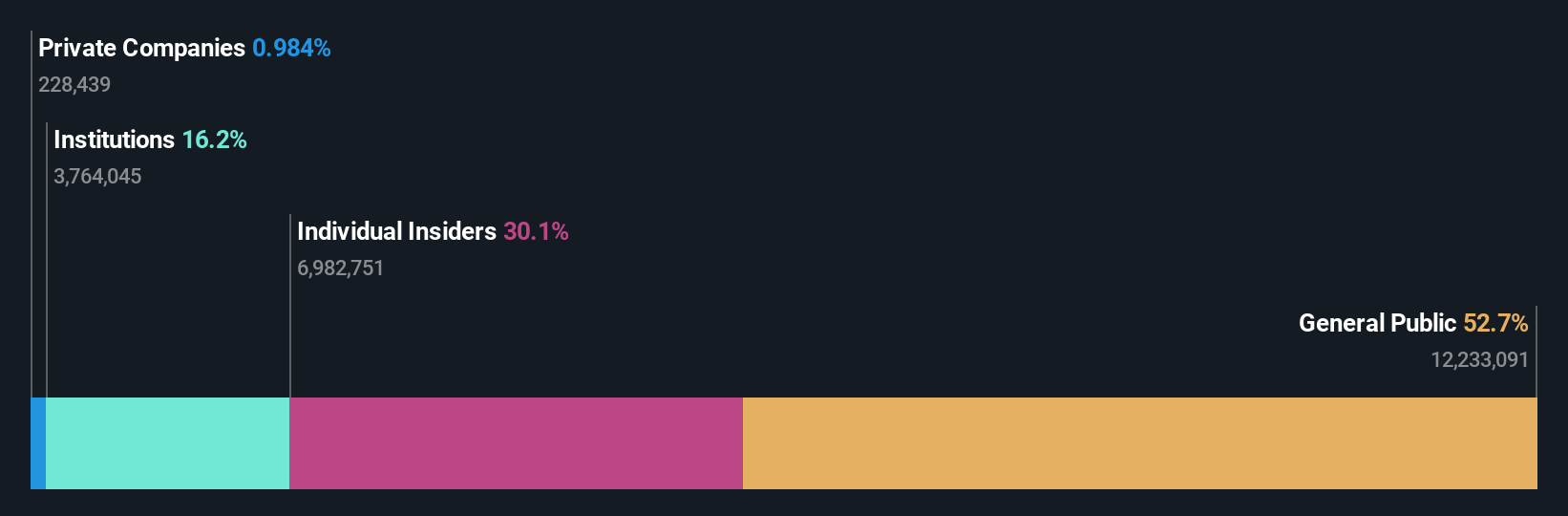

Insider Ownership: 30.1%

Earnings Growth Forecast: 137.3% p.a.

AprilBio Ltd. is poised for significant growth, with revenue expected to increase at a very high rate of 79.2% annually, outpacing the broader Korean market's 10.9%. The company is trading at nearly 10% below its estimated fair value and is projected to become profitable within three years, surpassing average market growth expectations. Despite recent share price volatility and low forecasted return on equity, insider ownership remains substantial without notable recent buying or selling activity.

- Dive into the specifics of AprilBioLtd here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that AprilBioLtd is priced higher than what may be justified by its financials.

Leader Harmonious Drive Systems (SHSE:688017)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leader Harmonious Drive Systems Co., Ltd. operates in the field of precision drive systems and has a market cap of CN¥35.22 billion.

Operations: Leader Harmonious Drive Systems Co., Ltd. generates its revenue through its operations in precision drive systems, contributing to its market presence with a valuation of CN¥35.22 billion.

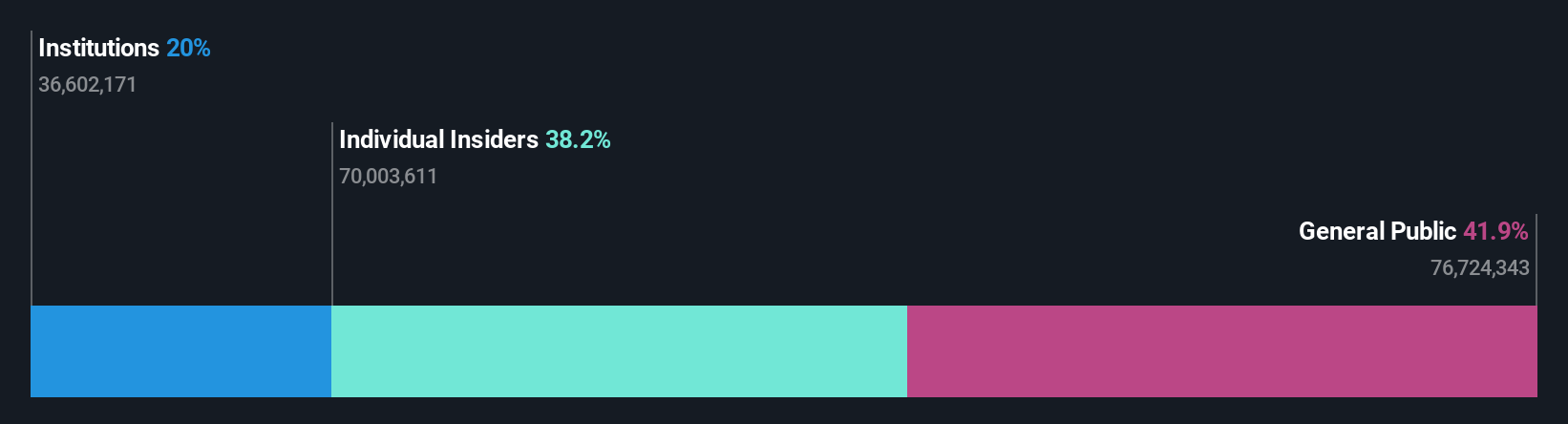

Insider Ownership: 38.2%

Earnings Growth Forecast: 25.6% p.a.

Leader Harmonious Drive Systems is positioned for robust growth, with revenue projected to rise by 31.3% annually, surpassing the broader Chinese market's 14.5%. Recent earnings showed a significant increase in sales to CNY 406.65 million from CNY 275.96 million year-over-year, while net income improved to CNY 93.67 million. Although earnings growth of 25.6% annually lags behind the market's forecast, substantial insider ownership aligns interests despite no recent insider trading activity reported.

- Get an in-depth perspective on Leader Harmonious Drive Systems' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Leader Harmonious Drive Systems' share price might be too optimistic.

Bozhon Precision Industry TechnologyLtd (SHSE:688097)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bozhon Precision Industry Technology Co., Ltd. operates in the precision manufacturing sector and has a market cap of approximately CN¥16.68 billion.

Operations: Bozhon Precision Industry Technology Co., Ltd. generates its revenue primarily from the Industrial Automation & Controls segment, amounting to CN¥5.33 billion.

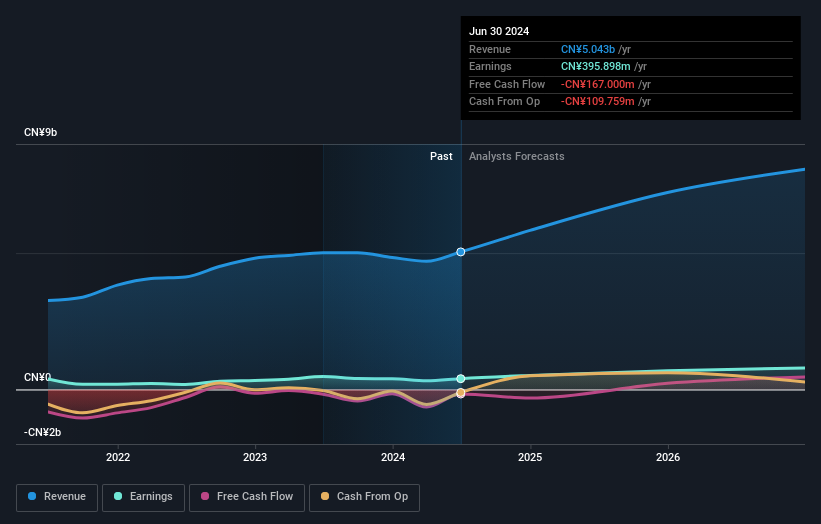

Insider Ownership: 30%

Earnings Growth Forecast: 23.9% p.a.

Bozhon Precision Industry Technology Ltd. demonstrates strong growth potential with revenue expected to increase by 20.7% annually, outpacing the broader Chinese market's 14.5%. Recent earnings showed sales rising to CNY 3.65 billion from CNY 3.27 billion year-over-year, and net income reaching CNY 332.38 million, reflecting a solid performance despite low forecasted return on equity of 12.9%. High insider ownership aligns management interests with shareholders, though no recent insider trading activity was reported.

- Navigate through the intricacies of Bozhon Precision Industry TechnologyLtd with our comprehensive analyst estimates report here.

- The analysis detailed in our Bozhon Precision Industry TechnologyLtd valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Click this link to deep-dive into the 630 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Seeking Other Investments? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal