Middle East Hidden Gems Featuring LDR Turizm And 2 Promising Small Caps

The Middle East stock markets have recently experienced diverse movements, with Egypt's bourse outperforming its Gulf peers in 2025 and Saudi Arabia facing challenges due to weak oil prices. In this dynamic environment, identifying promising small-cap stocks can be a strategic move for investors seeking growth opportunities, as these companies often benefit from strong local economic fundamentals and corporate earnings.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| Nofoth Food Products | NA | 21.41% | 25.45% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Amanat Holdings PJSC | 10.86% | 27.51% | -0.92% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

LDR Turizm (IBSE:LIDER)

Simply Wall St Value Rating: ★★★★★☆

Overview: LDR Turizm A.S. is a company that specializes in long-term car rental services in Turkey, with a market capitalization of TRY57.05 billion.

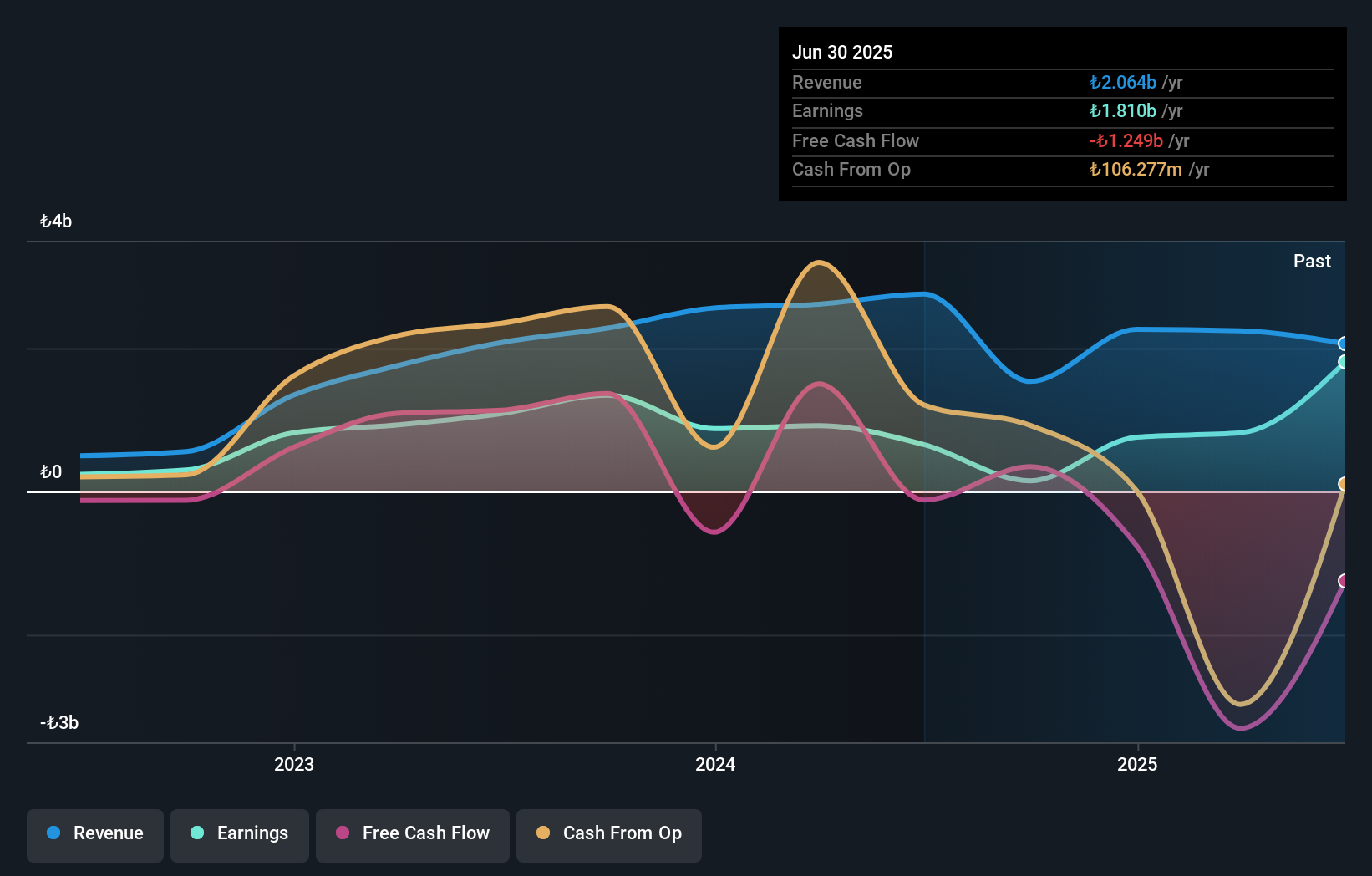

Operations: LDR Turizm generates revenue primarily from its rental and leasing segment, amounting to TRY1.83 billion. The company's financial performance is significantly influenced by this core revenue stream.

LDR Turizm, a nimble player in the Middle Eastern market, showcases intriguing financial dynamics. Despite a dip in third-quarter sales to TRY 423.1 million from TRY 638.6 million last year, net income soared to TRY 208.68 million from TRY 10.89 million, indicating robust profitability improvements with basic earnings per share jumping to TRY 1.26 from TRY 0.014 previously. Over nine months, net income reached a staggering TRY 1,571.19 million against last year's TRY 242.34 million, reflecting substantial operational efficiency gains likely driven by non-cash earnings and reduced debt levels over five years from 316% to just over 23%.

- Click here and access our complete health analysis report to understand the dynamics of LDR Turizm.

Assess LDR Turizm's past performance with our detailed historical performance reports.

Academy of Learning (SASE:9541)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Academy of Learning Company operates education and training institutes in the Kingdom of Saudi Arabia with a market cap of SAR1.04 billion.

Operations: The company generates revenue primarily from its education and training services in Saudi Arabia. It has a market cap of SAR1.04 billion, reflecting its financial standing in the region.

Academy of Learning, a smaller player in the Middle East education sector, showcases robust financial health with its net debt to equity ratio at 21.1%, deemed satisfactory. The company has demonstrated strong earnings growth of 24.7% over the past year, significantly outpacing the Consumer Services industry's modest 0.6% increase. Despite not being free cash flow positive recently, its interest payments are well covered by EBIT at 4.6 times coverage, indicating solid operational performance. Recent activities include an upcoming Annual General Meeting and proposed amendments to company bylaws, hinting at potential strategic shifts on the horizon.

- Get an in-depth perspective on Academy of Learning's performance by reading our health report here.

Explore historical data to track Academy of Learning's performance over time in our Past section.

Emilia Development (O.F.G) (TASE:EMDV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Emilia Development (O.F.G) Ltd. operates as an investment management company focusing on distribution, logistics, and industry services in Israel, with a market capitalization of ₪805.78 million.

Operations: Emilia Development generates revenue primarily from logistics services (₪368.82 million), industrial services (₪701.09 million), and drainage and sanitation (₪1.05 billion).

Emilia Development (O.F.G) showcases a mixed financial landscape, with its debt to equity ratio improving from 60.4% to 45.2% over five years, yet its interest payments remain insufficiently covered by EBIT at a 2.8x coverage. The company has seen earnings decline annually by 7.1%, although it boasts high-quality earnings and remains profitable with positive free cash flow. Recent results highlight challenges, as third-quarter sales dropped to ILS 550 million from ILS 574 million the previous year, and net income fell to ILS 11.66 million from ILS 22.98 million, indicating areas for potential improvement in financial health and operational efficiency moving forward.

- Click to explore a detailed breakdown of our findings in Emilia Development (O.F.G)'s health report.

Gain insights into Emilia Development (O.F.G)'s past trends and performance with our Past report.

Make It Happen

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 182 more companies for you to explore.Click here to unveil our expertly curated list of 185 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal