Musk's “Autopilot Mania” can't hide the cold winter of sales! Tesla (TSLA.US) faces a more severe test in 2026

The Zhitong Finance App learned that Tesla (TSLA.US) ended 2025 with a share price increase of over 11% as investors increasingly trust Elon Musk's passionate portrayal of autonomous vehicles. The stock price of the world's highest automaker by market capitalization rose sharply in the second half of 2025, mainly due to Musk's strong promotion of Tesla's progress in artificial intelligence and robotics technology. However, to really impress car consumers is another matter. Musk's high-profile breakthroughs didn't translate into the same level of success in the showroom — although third-quarter deliveries set a record, the company's car sales over the past six months are likely to be lower than the same period a year ago.

According to data compiled by the media, Tesla is expected to announce the delivery of about 440,900 vehicles in the fourth quarter on Friday, a year-on-year decrease of 11%. However, Tesla took an unusual step this week and took the initiative to release the average expectations of analysts compiled by itself. This figure is even more pessimistic than market expectations, and deliveries in the fourth quarter are expected to drop 15% year over year.

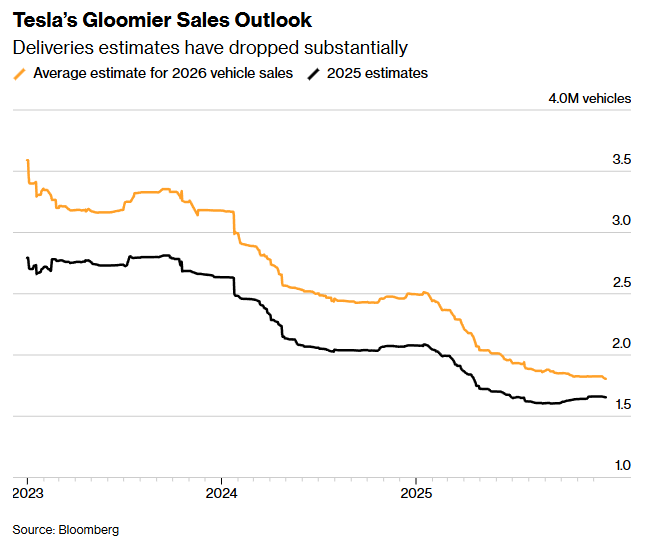

Wall Street is also increasingly pessimistic about Tesla's 2026 car sales prospects. Just two years ago, analysts also expected Tesla to deliver more than 3 million vehicles a year. Today, the average forecast for 2026 deliveries has plummeted to around 1.8 million vehicles.

CFRA Research stock analyst Garrett Nelson (Garrett Nelson) said, “Tesla investors are concerned about what the company will look like in the next 5, 10, or even 15 years, rather than what they will see in the short term. But the question is whether this expectation will continue, especially as we think headwinds will become more apparent in financial data.”

Tesla's sales prospects are getting bleak

turbulent and uneasy

Even with Musk and Tesla — two names almost equated with “turbulence” — 2025 will still be an extremely uncertain year. The car company's car sales performance was poor at the beginning of the year, partly because the company remodeled production lines at all of its car factories to meet the facelift of its best-selling model, the Model Y. Another important factor is the strong backlash from the outside world against Musk's political actions.

By early April 2025, when Musk publicly clashed with Trump administration insiders over tariff policies, Tesla's stock price had already plummeted 45%. Musk then drove the stock price rebound by phasing out of government affairs and re-investing in a long-term goal — starting an online car-hailing business that he said would eventually achieve autonomous driving.

In June, Tesla launched an invite-only Robotaxi service in Austin, where security officers accompanied the vehicle to supervise every Model Y to pick up and drop off Musk fans. Although these vehicles violated traffic regulations on the first day, attracted the attention of a federal regulator, and carried out multiple investigations into Tesla's driving system, investors were unimpressed by these safety issues.

In September, Tesla's board of directors proposed a new Musk compensation package. The potential return of the plan could be as high as $1 trillion, based on milestones including the delivery of millions of robot taxis. Soon after, this “reversal” was announced to be complete — Tesla's stock price once again rose during the year. When the stock price closed at a record high on December 16, Tesla's market capitalization increased by more than $915 billion in just over eight months.

Consumers still need to be persuaded

However, while investors are fascinated by Tesla's autonomous taxi prospects, ordinary car consumers are relatively cautious. Musk himself has acknowledged that there are challenges in persuading consumers to buy what Tesla calls “full self-driving” (FSD for short). This set of features still requires manual supervision. There are allegations that Tesla misled California consumers by exaggerating the autonomous driving capabilities of its vehicles, which could cause the state to suspend Tesla's sales license for 30 days at the beginning of this year.

Tesla tried to stand out in China's crowded electric vehicle market with driver assistance features, but this strategy also failed. Competitors, including BYD and Xiaomi, are already offering similar systems as standard configurations.

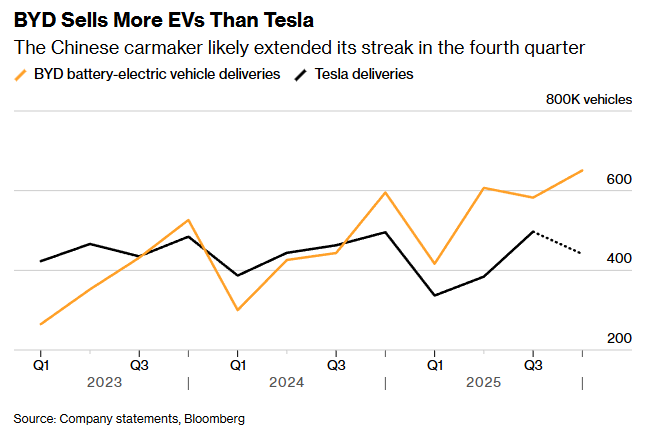

With BYD's sales volume in China far higher than Tesla's, and strong momentum in the European market — and Tesla has yet to receive FSD's regulatory approval in Europe — analysts expect that BYD's electric vehicle sales will surpass Tesla for the fifth consecutive quarter worldwide.

BYD surpasses Tesla in electric vehicle sales

Where is the way forward

After the market generally expected Tesla's sales volume to decline again in 2025 — this will be the second consecutive year of decline — Tesla will still face additional hurdles in 2026. The US has stopped providing federal tax credits for electric vehicle purchases and leases, and Musk has warned that this could lead to “several difficult quarters.”

However, there are also people who see a “glimmer of hope” from the withdrawal of US policy support. Due to declining support, many large manufacturers have cut back on investment in electric vehicles. Ford Motor Company (F.US) said last month that it expects to charge about 19.5 billion US dollars to abandon electric vehicle and battery projects that are destined to lose money.

Musk appealed to the market by rendering Cybercab's prospects at the end of last year. This is a small two-seater car with butterfly doors. Although the prototype he first showed at the end of 2024 did not have a steering wheel or pedals, Tesla Chairman Robyn Denholm (Robyn Denholm) said in October that the company would equip the model with these parts if required by regulators.

Gene Munster (Gene Munster), managing partner at Deepwater Asset Management, said: “Investors have fully accepted his vision of autonomous driving, and this is just the right time, as Tesla's electric vehicle business is likely to remain flat or grow by 5% next year.” He added: “At this stage, Elon only needs to keep the automotive business stable for the next year, which is enough to satisfy investors.”

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal