Insider Buying Highlights Asian Undervalued Small Caps For January 2026

As we enter January 2026, the Asian markets are capturing investor attention amid a backdrop of mixed global economic signals and modest gains in key indices. While the U.S. economy shows robust growth and China's market maintains steady progress, small-cap stocks in Asia present intriguing opportunities for investors seeking potential value plays, particularly where insider buying may indicate confidence in these companies' prospects. In such an environment, identifying stocks with solid fundamentals and favorable insider activity can be pivotal for those looking to navigate the complexities of undervalued small caps.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| East West Banking | 3.1x | 0.7x | 19.53% | ★★★★☆☆ |

| Chinasoft International | 20.6x | 0.6x | -1150.92% | ★★★★☆☆ |

| BWP Trust | 10.6x | 13.8x | 14.34% | ★★★★☆☆ |

| Dicker Data | 22.5x | 0.8x | -47.39% | ★★★☆☆☆ |

| Nickel Asia | 13.0x | 2.0x | 7.42% | ★★★☆☆☆ |

| Vita Life Sciences | 15.1x | 1.6x | 36.32% | ★★★☆☆☆ |

| Amaero | NA | 68.7x | 27.37% | ★★★☆☆☆ |

| PSC | 9.9x | 0.4x | 18.73% | ★★★☆☆☆ |

| Betr Entertainment | NA | 1.6x | 5.32% | ★★★☆☆☆ |

| Nufarm | NA | 0.3x | -133.75% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Bravura Solutions (ASX:BVS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bravura Solutions is a software provider specializing in wealth management, life insurance, and funds administration services with a market cap of A$0.20 billion.

Operations: Bravura Solutions generates revenue primarily from its operations in the EMEA region, contributing A$186.07 million, and the APAC region with A$72.63 million. The company's cost of goods sold (COGS) has shown fluctuations, reaching A$210.35 million in recent periods, impacting its gross profit margin which was recorded at 43.20% as of June 2025. Operating expenses have been a significant component of costs, with general and administrative expenses being notable within this category.

PE: 15.5x

Bravura Solutions, a player in the tech sector, has caught attention due to insider confidence. Russell Baskerville recently purchased 40,000 shares for A$92,400 in November 2025. This move indicates faith in the company's potential despite its reliance on external borrowing for funding. With anticipated revenues of A$265-275 million for fiscal year 2026 and recent leadership changes—Baskerville as Chair—the company is poised to navigate its growth trajectory amidst evolving market dynamics.

- Unlock comprehensive insights into our analysis of Bravura Solutions stock in this valuation report.

Explore historical data to track Bravura Solutions' performance over time in our Past section.

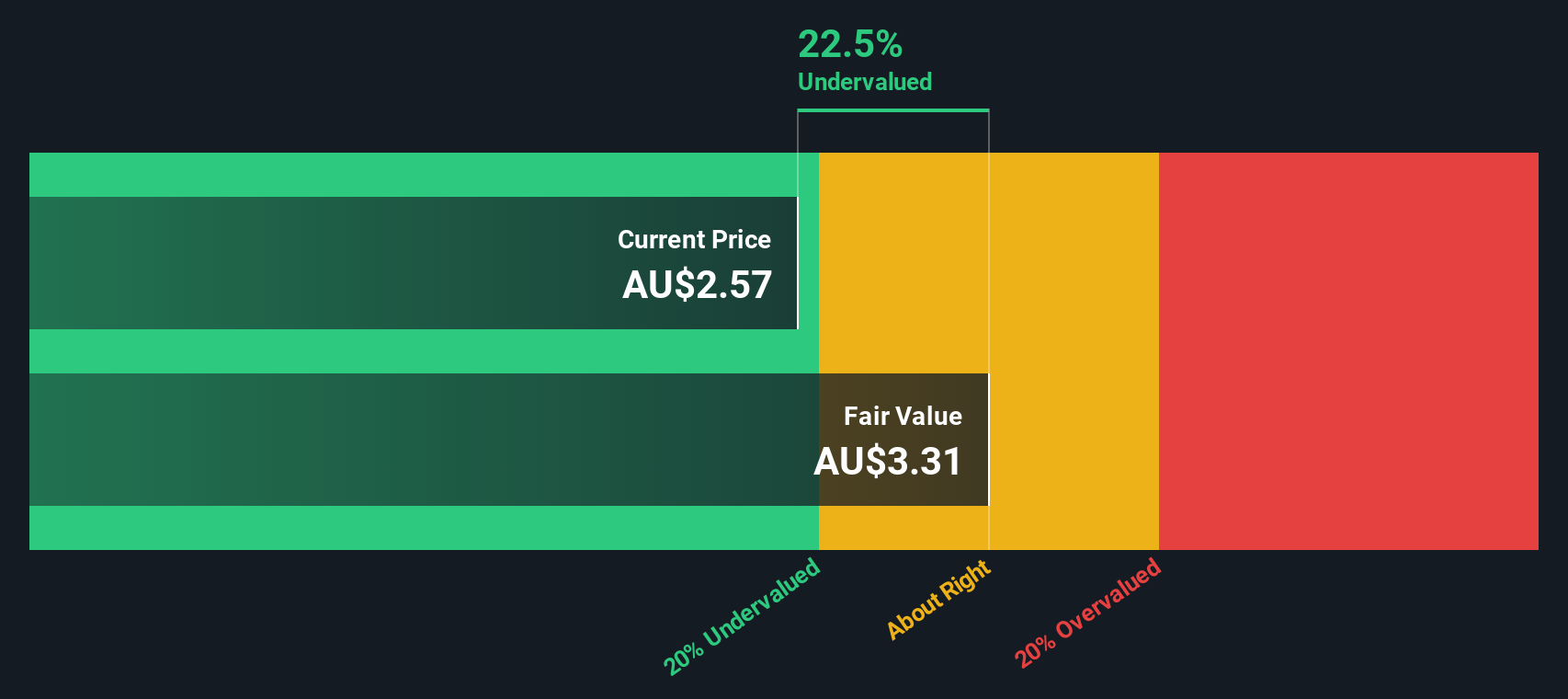

Deterra Royalties (ASX:DRR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Deterra Royalties is a company focused on managing and acquiring royalty interests in the mining sector, with a market capitalization of A$2.52 billion.

Operations: Deterra Royalties generates revenue primarily from its Bulk segment, with significant contributions from the Precious segment. The company has experienced fluctuations in its gross profit margin, which most recently stood at 95.40% as of June 30, 2025. Operating expenses and non-operating expenses are notable cost components, impacting net income levels over time.

PE: 13.8x

Deterra Royalties, a small-cap player in Asia's mining sector, is navigating challenges with its high debt levels and reliance on external borrowing. Despite earnings forecasts predicting a 5.2% annual decline over the next three years, insider confidence has been bolstered by recent share purchases from executives throughout 2025. The company is undergoing leadership changes with Jason Neal stepping in as interim CEO following Julian Andrews' departure. Deterra's strategic focus on multi-commodity exposure offers potential growth avenues amidst these transitions.

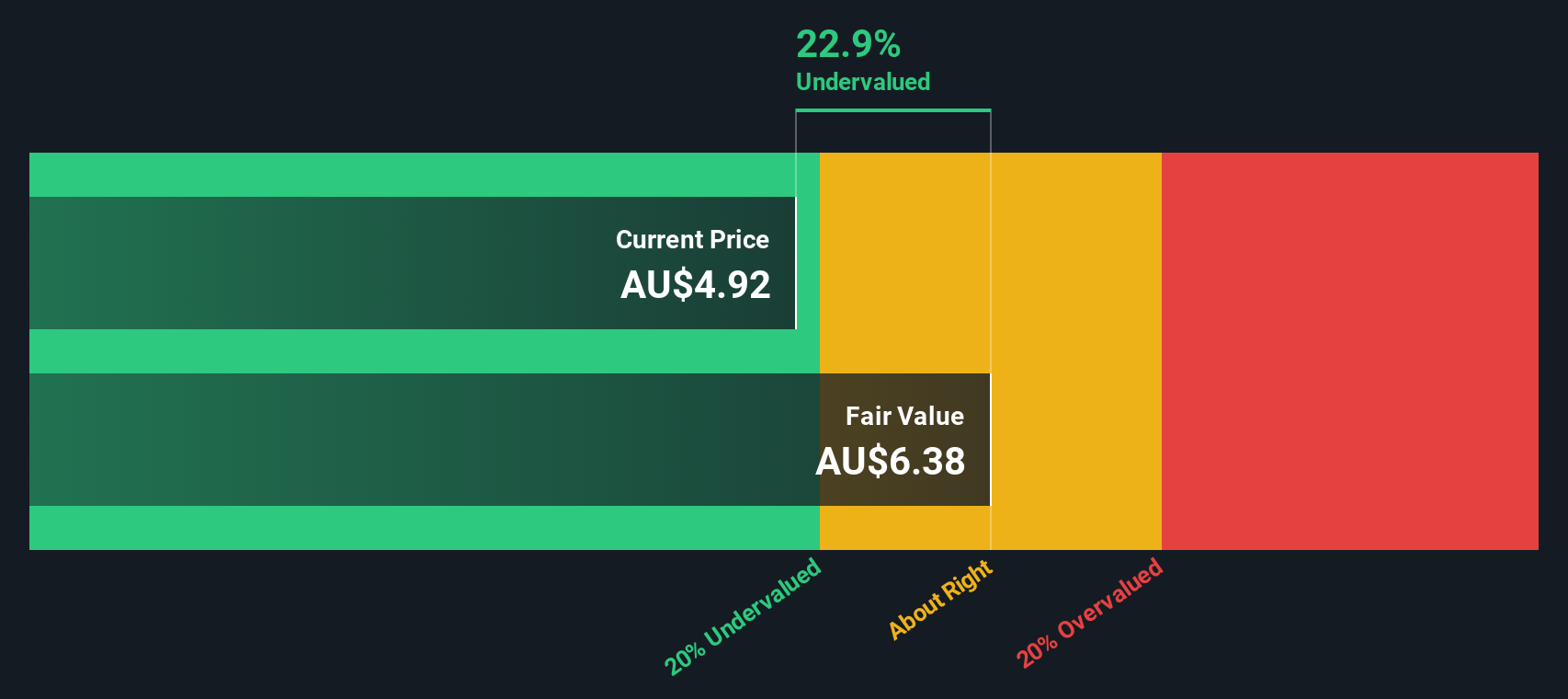

Propel Funeral Partners (ASX:PFP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Propel Funeral Partners operates in the death care industry, providing a range of funeral services and currently has a market cap of A$1.02 billion.

Operations: The company generates revenue primarily from death care related services, amounting to A$225.83 million. Its cost of goods sold is A$68.10 million, leading to a gross profit of A$157.73 million with a gross profit margin of 69.85%. Operating expenses are significant at A$118.36 million, impacting net income which stands at A$20.40 million with a net income margin of 9.03%.

PE: 33.3x

Propel Funeral Partners, a small company in Asia's funeral services sector, is drawing attention due to its potential for growth and insider confidence. Naomi Edwards, the Independent Non-Executive Chairman, recently increased their stake by 40% with an investment of A$75,689. This move suggests strong belief in the company's future prospects. Despite relying on external borrowing for funding, Propel's earnings are projected to grow annually by 12%. Recent board changes may bolster strategic direction as Edwards assumes the role of Chair following the 2025 AGM.

- Navigate through the intricacies of Propel Funeral Partners with our comprehensive valuation report here.

Gain insights into Propel Funeral Partners' past trends and performance with our Past report.

Where To Now?

- Unlock more gems! Our Undervalued Asian Small Caps With Insider Buying screener has unearthed 53 more companies for you to explore.Click here to unveil our expertly curated list of 56 Undervalued Asian Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal