Asian Market Insights Neo-Neon Holdings And Two Other Penny Stocks To Consider

As the Asian markets continue to navigate a landscape marked by technological advancements and economic shifts, investors are keenly observing opportunities in various sectors. Penny stocks, though an older term, still capture the essence of investing in smaller or newer companies that may offer significant growth potential at lower price points. By focusing on robust financials and clear growth trajectories, these stocks can present valuable opportunities for investors seeking to uncover hidden gems within the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Oiltek International (SGX:HQU) | SGD0.68 | SGD291.72M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.44 | HK$890.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.60 | THB1.09B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.66 | HK$20.61B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$137.01M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.46 | HK$51.78B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.91 | NZ$244.72M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 963 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Neo-Neon Holdings (SEHK:1868)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Neo-Neon Holdings Limited is an investment holding company involved in the R&D, manufacturing, distribution, and sale of lighting products across North America, Europe, China, and other international markets with a market cap of HK$837.79 million.

Operations: The company's revenue is primarily generated from North America (CN¥715.53 million), followed by Europe (CN¥12.03 million), Asia excluding the PRC (CN¥11.78 million), and the People's Republic of China (CN¥1.64 million).

Market Cap: HK$837.79M

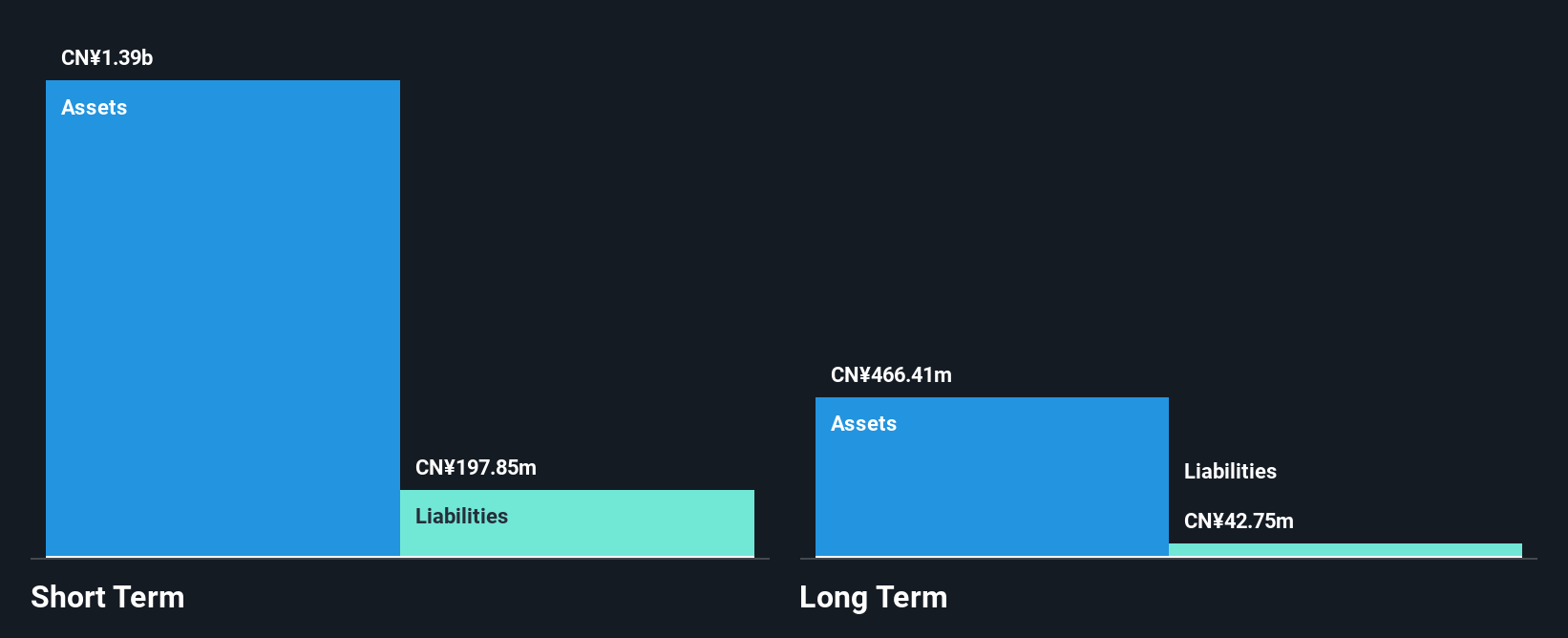

Neo-Neon Holdings Limited has demonstrated consistent earnings growth, with a 31.3% increase over the past year, outpacing the Electrical industry's 10.5%. The company maintains a stable financial position with CN¥1.4 billion in short-term assets exceeding its liabilities and no debt obligations, alleviating concerns about interest coverage or cash flow issues. Recent share repurchase initiatives aim to enhance net asset and earnings per share value, reflecting confidence in future performance despite low return on equity (1.9%). However, the board's limited experience may present challenges in strategic decision-making moving forward.

- Dive into the specifics of Neo-Neon Holdings here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Neo-Neon Holdings' track record.

Phoenix Media Investment (Holdings) (SEHK:2008)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Phoenix Media Investment (Holdings) Limited is an investment holding company that offers satellite television broadcasting services in China and internationally, with a market capitalization of approximately HK$913.84 million.

Operations: The company's revenue is primarily derived from Internet Media (HK$796.03 million), Television Broadcasting - Primary Channels (HK$540.06 million), Outdoor Media (HK$357.78 million), and Television Broadcasting - Others (HK$315.21 million).

Market Cap: HK$913.84M

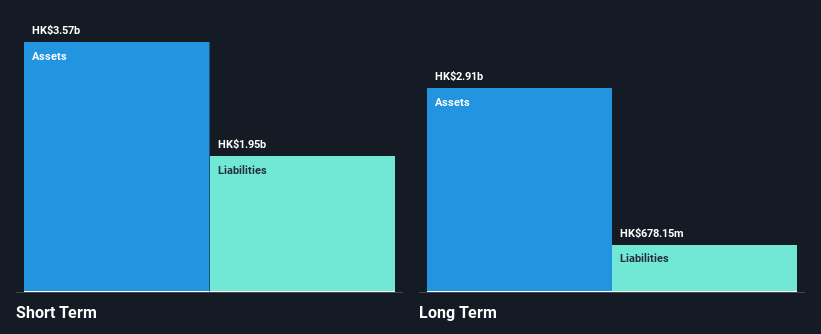

Phoenix Media Investment (Holdings) Limited, despite being unprofitable, has a strong financial position with short-term assets of HK$3.1 billion exceeding its liabilities and more cash than debt. The company has shown progress by reducing losses at 25.6% annually over five years and maintaining a positive free cash flow, ensuring a cash runway for over three years. Recent developments include executive changes and an expanded program license agreement with Phoenix TV, enhancing revenue potential through new fields like AI applications. Trading significantly below estimated fair value may attract attention from value-focused investors seeking growth prospects in the media sector.

- Get an in-depth perspective on Phoenix Media Investment (Holdings)'s performance by reading our balance sheet health report here.

- Evaluate Phoenix Media Investment (Holdings)'s historical performance by accessing our past performance report.

Digital China Holdings (SEHK:861)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise customers in Mainland China, with a market cap of HK$4.44 billion.

Operations: The company's revenue is primarily derived from three segments: Big Data Products and Solutions (CN¥3.40 billion), Software and Operating Services (CN¥5.82 billion), and Traditional and Localization Services (CN¥8.37 billion).

Market Cap: HK$4.44B

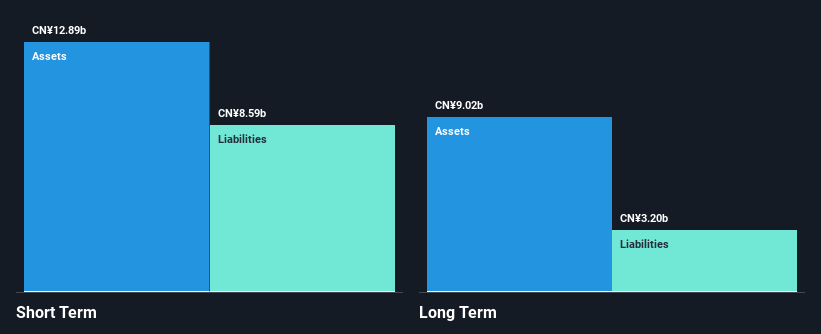

Digital China Holdings Limited, while unprofitable with a negative return on equity of -6.22%, maintains a satisfactory net debt to equity ratio of 30% and has sufficient cash runway for over three years. Recent strategic moves include a partnership with Wuxi Uqi Intelligent Technology to enhance unmanned logistics operations, potentially improving operational efficiency. The company's board is relatively new, averaging 2.6 years in tenure, but the management team is experienced with an average tenure of 4.5 years. Despite its challenges, Digital China trades at good value compared to peers and the industry, offering potential interest for investors focused on turnaround stories in IT solutions.

- Click to explore a detailed breakdown of our findings in Digital China Holdings' financial health report.

- Gain insights into Digital China Holdings' outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Gain an insight into the universe of 963 Asian Penny Stocks by clicking here.

- Curious About Other Options? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal