US High Growth Tech Stocks to Watch

As 2025 drew to a close, major U.S. stock indexes like the Nasdaq and S&P 500 finished the year with impressive double-digit gains despite ending on a four-session losing streak. This performance was largely driven by robust advances in technology stocks, highlighting the sector's potential for high growth even amid broader market fluctuations. In such an environment, identifying promising tech stocks involves looking for companies that are well-positioned to capitalize on emerging trends and demonstrate strong innovation capabilities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 62.86% | 62.39% | ★★★★★★ |

| Palantir Technologies | 26.25% | 30.13% | ★★★★★★ |

| Workday | 11.13% | 32.18% | ★★★★★☆ |

| Kiniksa Pharmaceuticals International | 15.16% | 31.60% | ★★★★★☆ |

| Circle Internet Group | 20.75% | 84.58% | ★★★★★☆ |

| RenovoRx | 59.12% | 64.21% | ★★★★★☆ |

| Viridian Therapeutics | 46.25% | 52.26% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Procore Technologies | 11.70% | 116.48% | ★★★★★☆ |

| Duos Technologies Group | 53.76% | 155.11% | ★★★★★☆ |

Click here to see the full list of 71 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Five9 (FIVN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Five9, Inc. offers intelligent cloud software solutions for contact centers globally and has a market capitalization of approximately $1.56 billion.

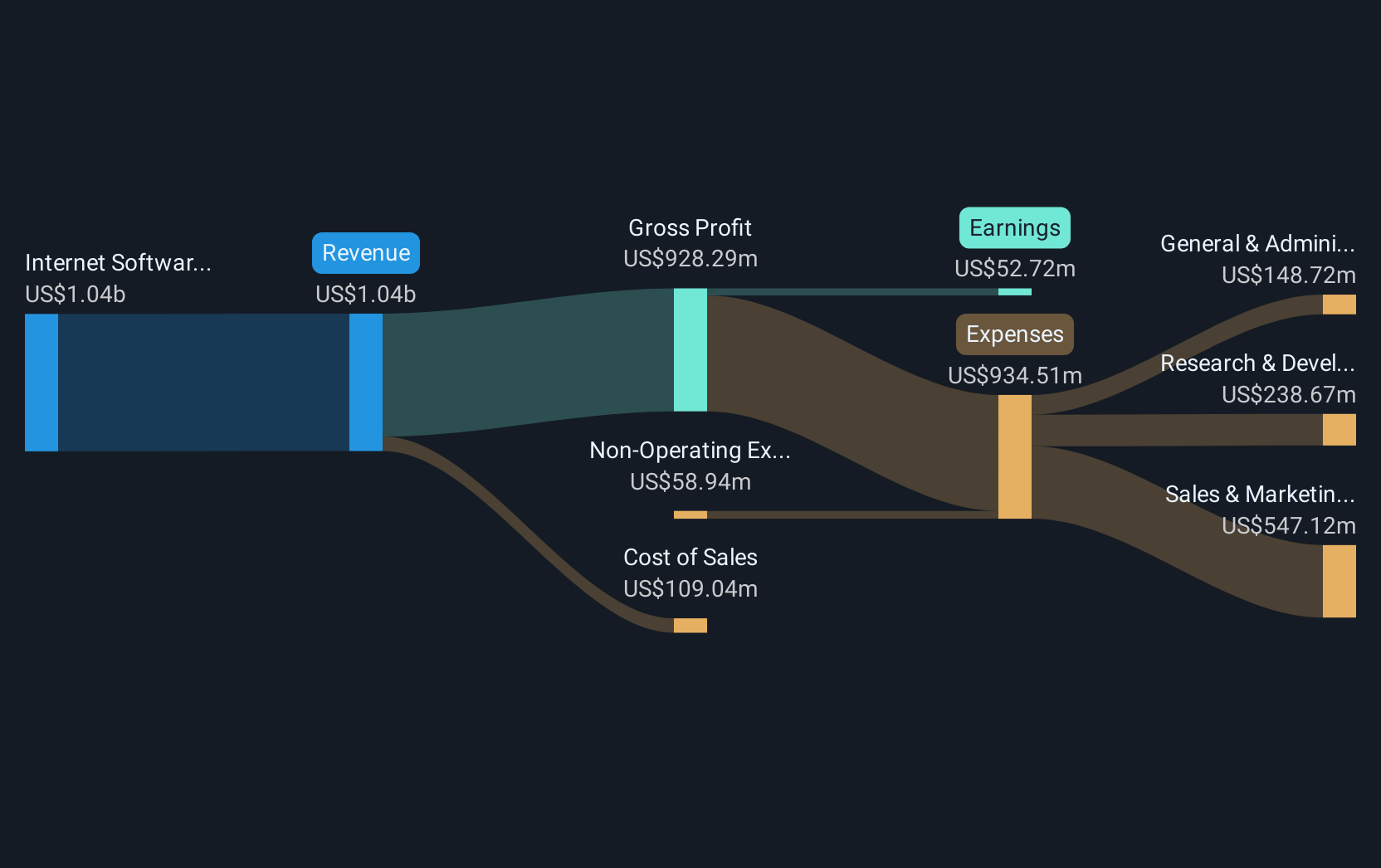

Operations: Five9 generates revenue primarily through its internet software and services segment, which reported $1.13 billion. The company's focus is on providing cloud-based solutions for contact centers across various regions.

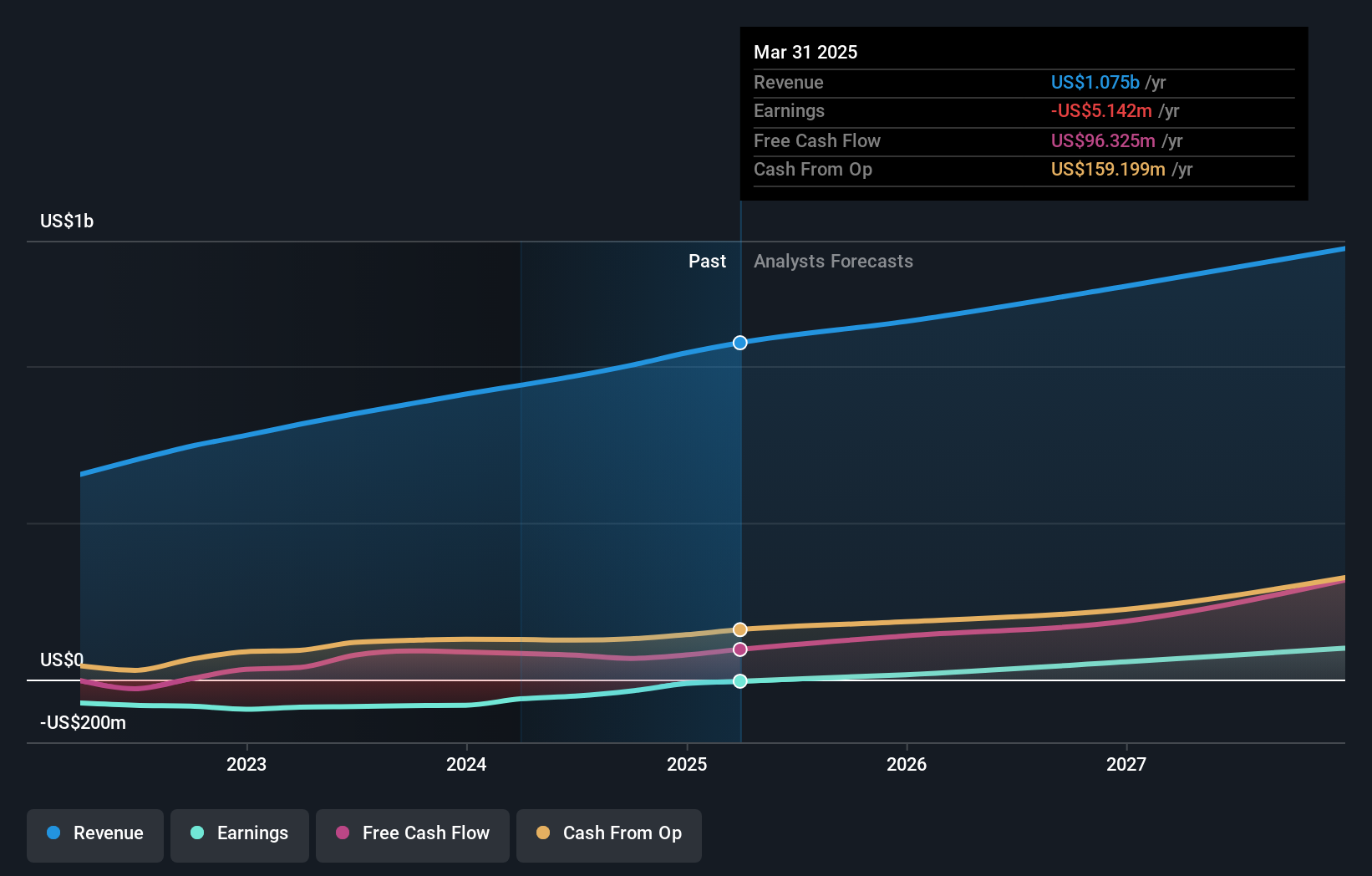

Despite a forecasted revenue growth of 8.1% per year, which trails the US market's 10.4%, Five9 has pivoted towards profitability with a significant improvement in earnings, expected to surge by 30.1% annually. This shift is underscored by strategic executive changes, notably the appointment of Amit Mathradas as CEO, whose prior leadership at Nintex and Avalara catalyzed substantial revenue expansions and innovative leaps in AI-centric platforms. Additionally, Five9's recent product enhancements highlight its commitment to integrating AI across customer experience solutions, promising to refine service quality and operational efficiency in an increasingly digital marketplace.

- Get an in-depth perspective on Five9's performance by reading our health report here.

Assess Five9's past performance with our detailed historical performance reports.

monday.com (MNDY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: monday.com Ltd., along with its subsidiaries, develops software applications globally and has a market capitalization of approximately $7.49 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $1.17 billion. It operates across various regions, including the United States, Europe, the Middle East, Africa, and the United Kingdom.

monday.com, a global software company, has recently demonstrated significant strides in both financial and operational realms. In Q3 2025, the firm reported a robust revenue increase to $316.86 million from $251 million the previous year and turned a net loss into a profit of $13.05 million. This turnaround is underscored by its strategic partnerships, notably with the Bonds Flying Roos, enhancing its visibility and operational dynamics on an international scale. The company's commitment to R&D is evident with substantial investments aimed at refining AI-driven platforms—a move that not only enhances product capabilities but also positions monday.com favorably within the tech ecosystem for continued innovation and growth.

Varonis Systems (VRNS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Varonis Systems, Inc. offers software solutions that utilize AI technology to discover and classify sensitive data, address security vulnerabilities, and detect sophisticated threats across North America, Europe, APAC, and other regions; the company has a market capitalization of approximately $3.90 billion.

Operations: Varonis Systems, Inc. generates revenue primarily through its data processing segment, which contributed $608.68 million. The company focuses on AI-powered software products that help identify and manage critical data while addressing security threats globally.

Varonis Systems, Inc. is carving a niche in the high-growth tech sector with its innovative data security solutions. With an annualized revenue growth of 13.1% and earnings expected to surge by 42.2% per year, Varonis demonstrates robust financial health amid a challenging market landscape. The company's recent integration with AWS Security Hub and Microsoft Purview underscores its strategic focus on enhancing data security across diverse platforms, positioning it well for future scalability. Additionally, Varonis' commitment to R&D is evident from its latest product launches and integrations that streamline threat detection and response capabilities for global enterprises, ensuring it remains at the forefront of technological advancements in cybersecurity.

- Click here to discover the nuances of Varonis Systems with our detailed analytical health report.

Gain insights into Varonis Systems' historical performance by reviewing our past performance report.

Taking Advantage

- Investigate our full lineup of 71 US High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal