Mobileye Global Among 3 Stocks Estimated To Be Trading Below Fair Value

As 2025 draws to a close, major U.S. stock indexes have experienced a strong year overall, despite ending with a streak of losses in the final sessions. With the Nasdaq, S&P 500, and Dow Jones Industrial Average posting significant gains for the year, investors are keenly looking for opportunities that might still be trading below their fair value. Identifying undervalued stocks can be particularly appealing in such an environment where technology firms have driven substantial market advances and economic conditions remain closely monitored by investors.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Valley National Bancorp (VLY) | $11.68 | $23.04 | 49.3% |

| SmartStop Self Storage REIT (SMA) | $30.94 | $60.79 | 49.1% |

| Investar Holding (ISTR) | $26.72 | $52.60 | 49.2% |

| Horizon Bancorp (HBNC) | $16.96 | $33.83 | 49.9% |

| Hims & Hers Health (HIMS) | $32.47 | $63.39 | 48.8% |

| Heritage Financial (HFWA) | $23.65 | $46.41 | 49% |

| Gaotu Techedu (GOTU) | $2.32 | $4.56 | 49.1% |

| Dime Community Bancshares (DCOM) | $30.09 | $60.09 | 49.9% |

| CNB Financial (CCNE) | $26.17 | $50.84 | 48.5% |

| BillionToOne (BLLN) | $81.84 | $160.13 | 48.9% |

Let's explore several standout options from the results in the screener.

Mobileye Global (MBLY)

Overview: Mobileye Global Inc. develops and deploys advanced driver assistance systems and autonomous driving technologies worldwide, with a market cap of $8.63 billion.

Operations: The company generates revenue primarily from its Mobileye segment, which accounts for $1.90 billion.

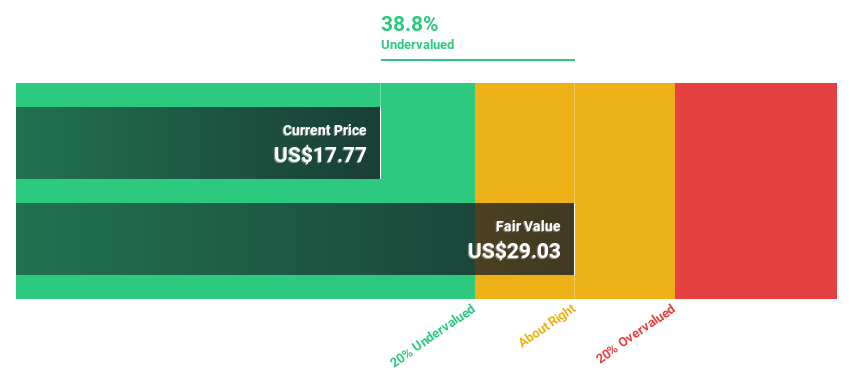

Estimated Discount To Fair Value: 43.2%

Mobileye Global is trading at US$10.44, significantly below its estimated fair value of US$18.39, suggesting it may be undervalued based on cash flows. The company is forecast to achieve profitability within three years with earnings growth expected at 52.71% annually, outpacing the market average. Recent partnerships and technological advancements in autonomous driving systems highlight Mobileye's strategic positioning for future revenue expansion, despite current net losses narrowing from previous years' figures.

- Our comprehensive growth report raises the possibility that Mobileye Global is poised for substantial financial growth.

- Take a closer look at Mobileye Global's balance sheet health here in our report.

monday.com (MNDY)

Overview: monday.com Ltd. develops software applications globally, including in the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market cap of $7.49 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $1.17 billion.

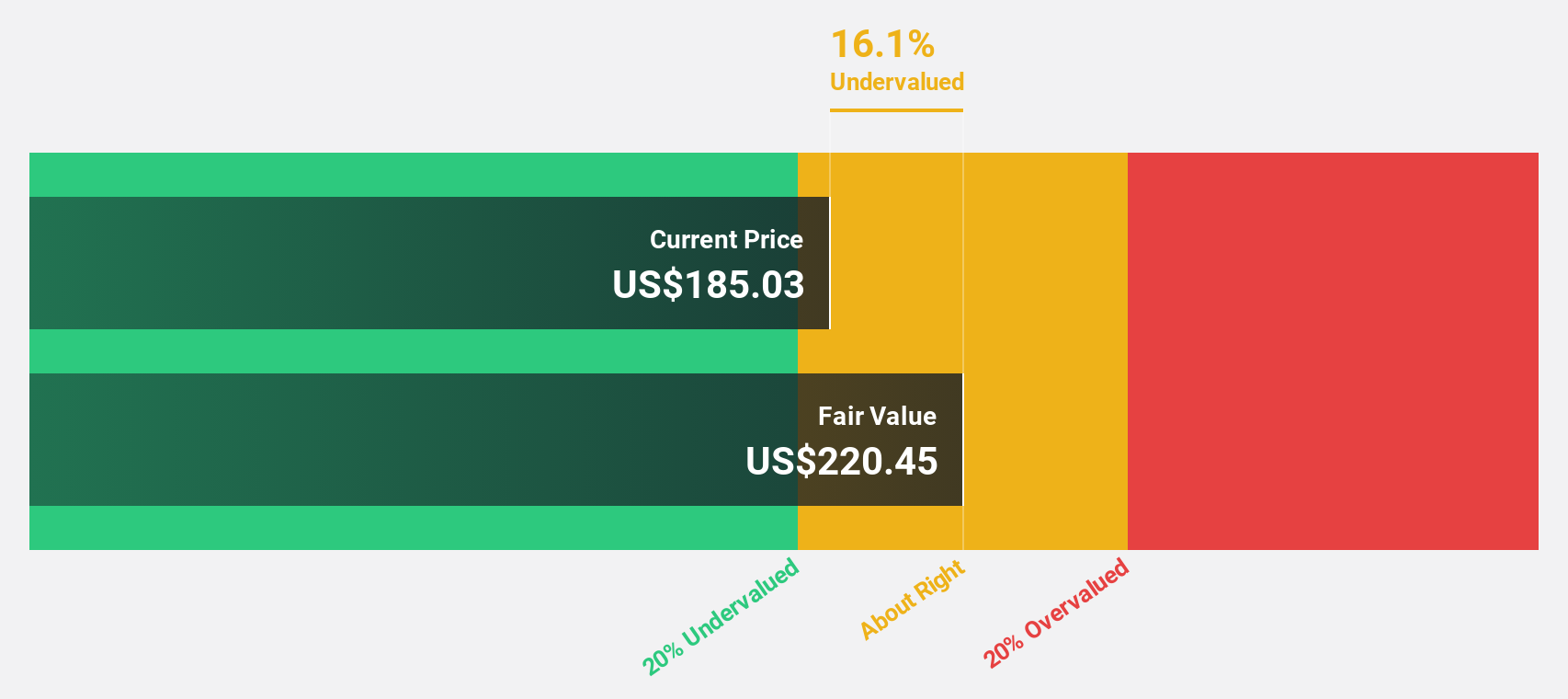

Estimated Discount To Fair Value: 28.3%

monday.com, trading at US$147.56, is valued below its estimated fair value of US$205.94, indicating potential undervaluation based on cash flows. The company's revenue is forecast to grow 15.8% annually, surpassing the broader market's growth rate of 10.4%, with earnings expected to rise significantly over the next three years. Recent partnerships in high-profile events like SailGP enhance brand visibility and operational efficiency, supporting its strategic growth trajectory despite a historically low return on equity forecasted at 19.5%.

- Insights from our recent growth report point to a promising forecast for monday.com's business outlook.

- Click here to discover the nuances of monday.com with our detailed financial health report.

RLX Technology (RLX)

Overview: RLX Technology Inc. develops, manufactures, and sells e-vapor products in China and internationally, with a market cap of approximately $2.79 billion.

Operations: The company's revenue is derived from its Personal Products segment, totaling CN¥3.27 billion.

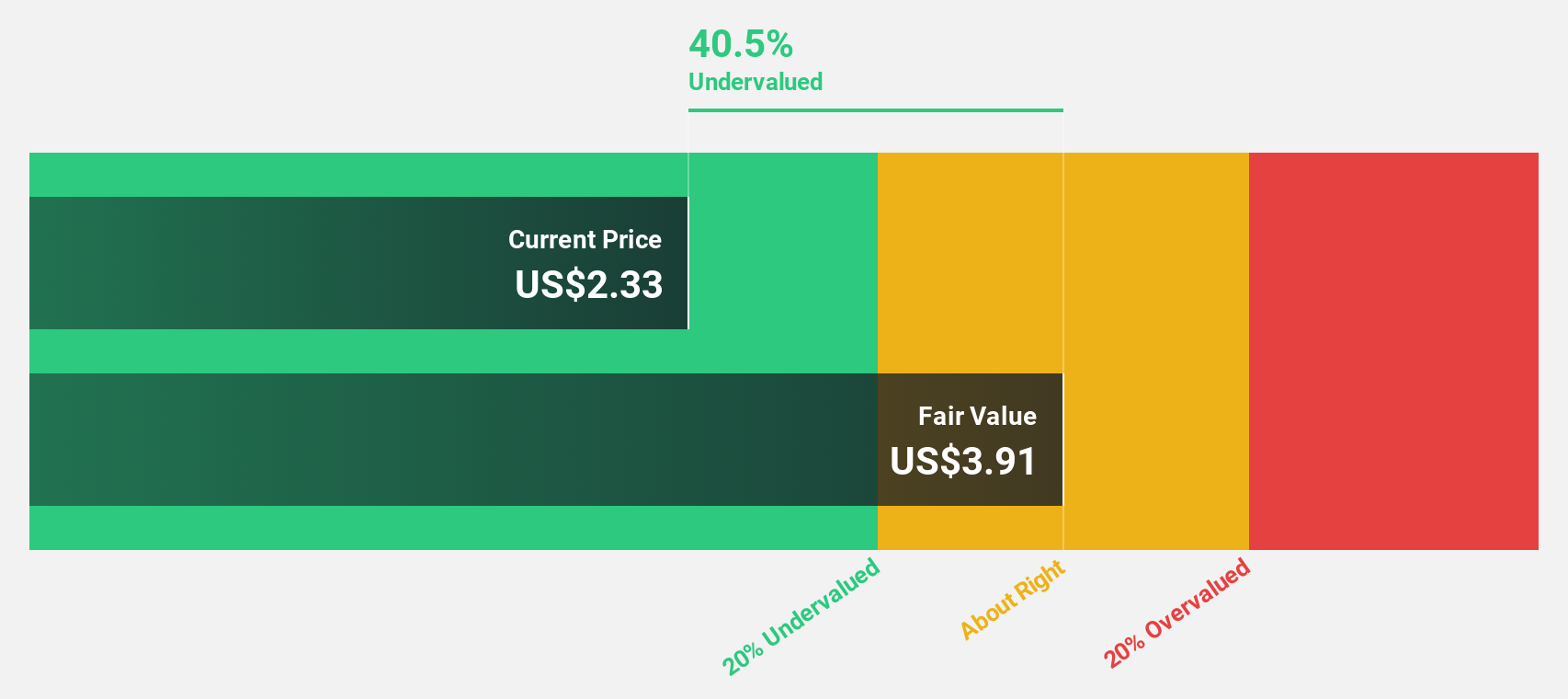

Estimated Discount To Fair Value: 40.9%

RLX Technology, trading at $2.33, is priced significantly below its fair value estimate of $3.94, reflecting substantial undervaluation based on cash flows. The company reported strong financial results with a notable increase in sales and net income for Q3 2025. Revenue growth is projected to outpace the U.S. market at 23.1% annually, although return on equity remains low at an estimated 8%. Despite a dividend yield of 4.72%, it lacks full earnings coverage.

- Our growth report here indicates RLX Technology may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in RLX Technology's balance sheet health report.

Make It Happen

- Discover the full array of 188 Undervalued US Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal