3 Promising Penny Stocks With Market Caps Under $90M

As 2025 draws to a close, major U.S. stock indexes have posted impressive double-digit gains for the year despite ending with a streak of losses. In this context, identifying stocks with strong financials becomes crucial, particularly when considering investment opportunities in smaller or newer companies. While the term "penny stocks" might seem outdated, these investments can still offer significant potential for growth and value when backed by robust financial health.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.49 | $533.62M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8251 | $142.68M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.27 | $553.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.11 | $1.29B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.07 | $550.42M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Nephros (NEPH) | $4.88 | $50.16M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.99105 | $7.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.95 | $89.94M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 344 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Anghami (ANGH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anghami Inc. operates a music-streaming platform in the Middle East and North Africa with a market cap of $15.52 million.

Operations: Anghami Inc. has not reported any specific revenue segments.

Market Cap: $15.52M

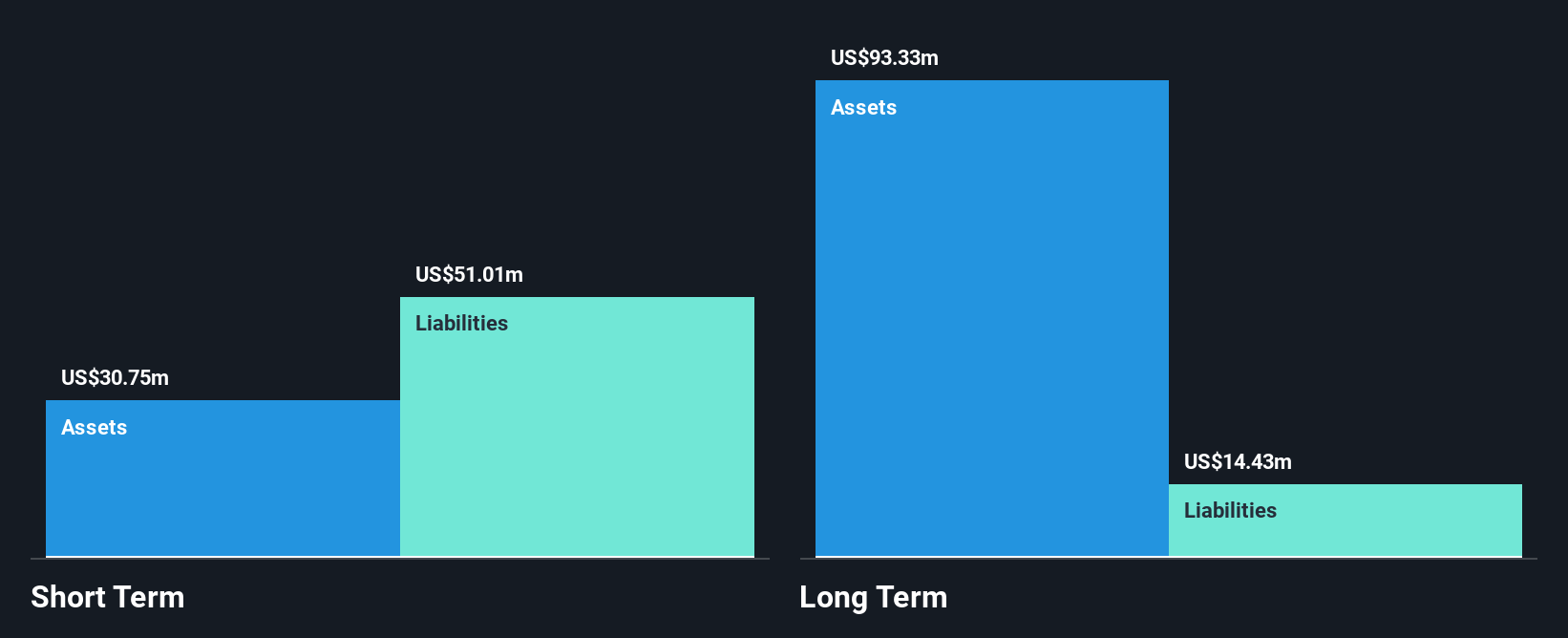

Anghami Inc., with a market cap of US$15.52 million, operates in the music-streaming sector and has recently reported sales of US$48.44 million for the half year ending June 30, 2025, up from US$29.8 million the previous year. Despite this revenue growth, Anghami remains unprofitable with a net loss of US$37.06 million and high volatility in its share price over recent months. The company faces liquidity challenges as short-term assets (US$38.7M) do not cover short-term liabilities (US$71.9M), though it has improved shareholder equity from negative to positive over five years through capital raises and debt management efforts.

- Click to explore a detailed breakdown of our findings in Anghami's financial health report.

- Evaluate Anghami's historical performance by accessing our past performance report.

Identiv (INVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Identiv, Inc. develops, manufactures, and supplies specialty IoT products across various regions including the United States, Europe, the Middle East, and the Asia-Pacific with a market cap of $82.67 million.

Operations: The company's revenue is primarily generated from its IoT Business segment, which reported $22.02 million.

Market Cap: $82.67M

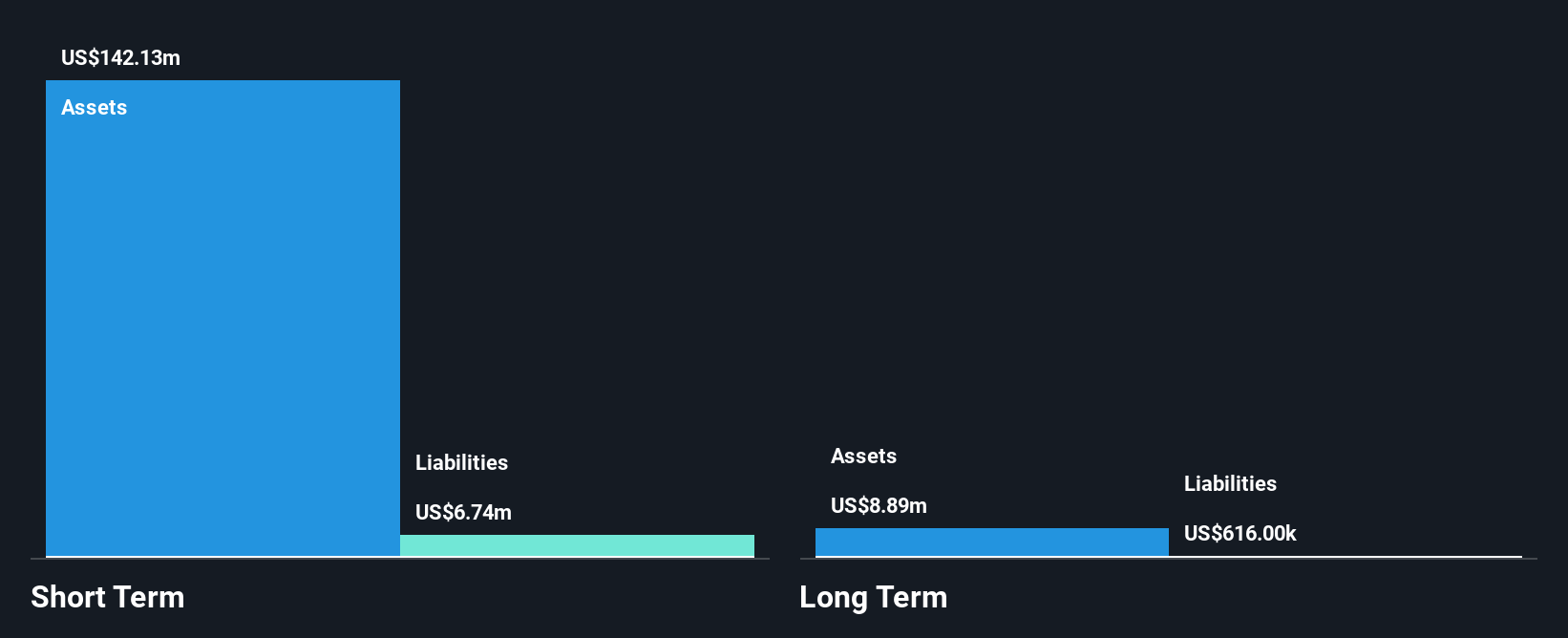

Identiv, Inc. is navigating the penny stock landscape with a market cap of US$82.67 million and reported third-quarter sales of US$5.01 million, though it remains unprofitable with a net loss of US$3.45 million for the same period. The company recently completed a strategic manufacturing transition to Thailand, enhancing its capabilities in multicomponent manufacturing (MCM) for advanced IoT solutions—a move expected to bolster operational efficiency and growth potential in high-value applications like healthcare and logistics. Despite its challenges, Identiv benefits from having no debt and ample short-term assets exceeding liabilities by a substantial margin.

- Click here and access our complete financial health analysis report to understand the dynamics of Identiv.

- Explore Identiv's analyst forecasts in our growth report.

PodcastOne (PODC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PodcastOne, Inc. operates as a podcast platform and publisher with a market cap of $57.05 million.

Operations: The company generates revenue from its Internet Information Providers segment, totaling $56.96 million.

Market Cap: $57.05M

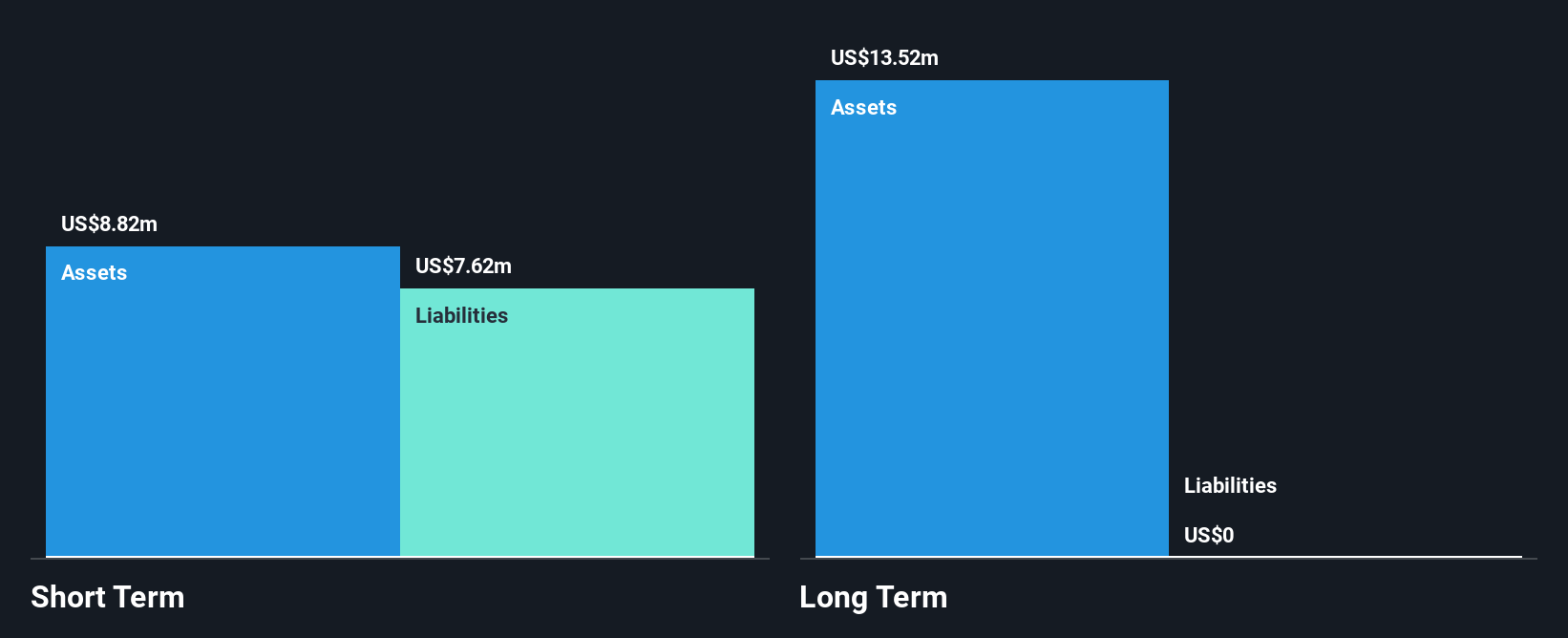

PodcastOne, Inc., with a market cap of US$57.05 million, operates in the podcasting sector and recently announced significant partnerships, including renewing its agreement with LadyGang and securing exclusive rights for Clint Frazier's podcast. Despite being unprofitable, PodcastOne shows potential with revenue from its Internet Information Providers segment reaching US$56.96 million. The company is debt-free and has sufficient cash runway for over three years due to positive free cash flow growth. However, it faces challenges such as high share price volatility and a board considered inexperienced due to short average tenure.

- Click here to discover the nuances of PodcastOne with our detailed analytical financial health report.

- Understand PodcastOne's earnings outlook by examining our growth report.

Taking Advantage

- Unlock more gems! Our US Penny Stocks screener has unearthed 341 more companies for you to explore.Click here to unveil our expertly curated list of 344 US Penny Stocks.

- Searching for a Fresh Perspective? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal