Premier Energy Leads These 3 Undiscovered European Gems Backed By Strong Fundamentals

As the pan-European STOXX Europe 600 Index edges closer to record highs amid positive sentiment about future earnings and economic prospects, investors are increasingly turning their attention to small-cap stocks that may offer untapped potential. In this environment, identifying companies with strong fundamentals becomes crucial, as they are better positioned to navigate market fluctuations and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Envirotainer | 43.54% | -23.63% | nan | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| Darwin | 3.03% | 50.55% | 46377.71% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

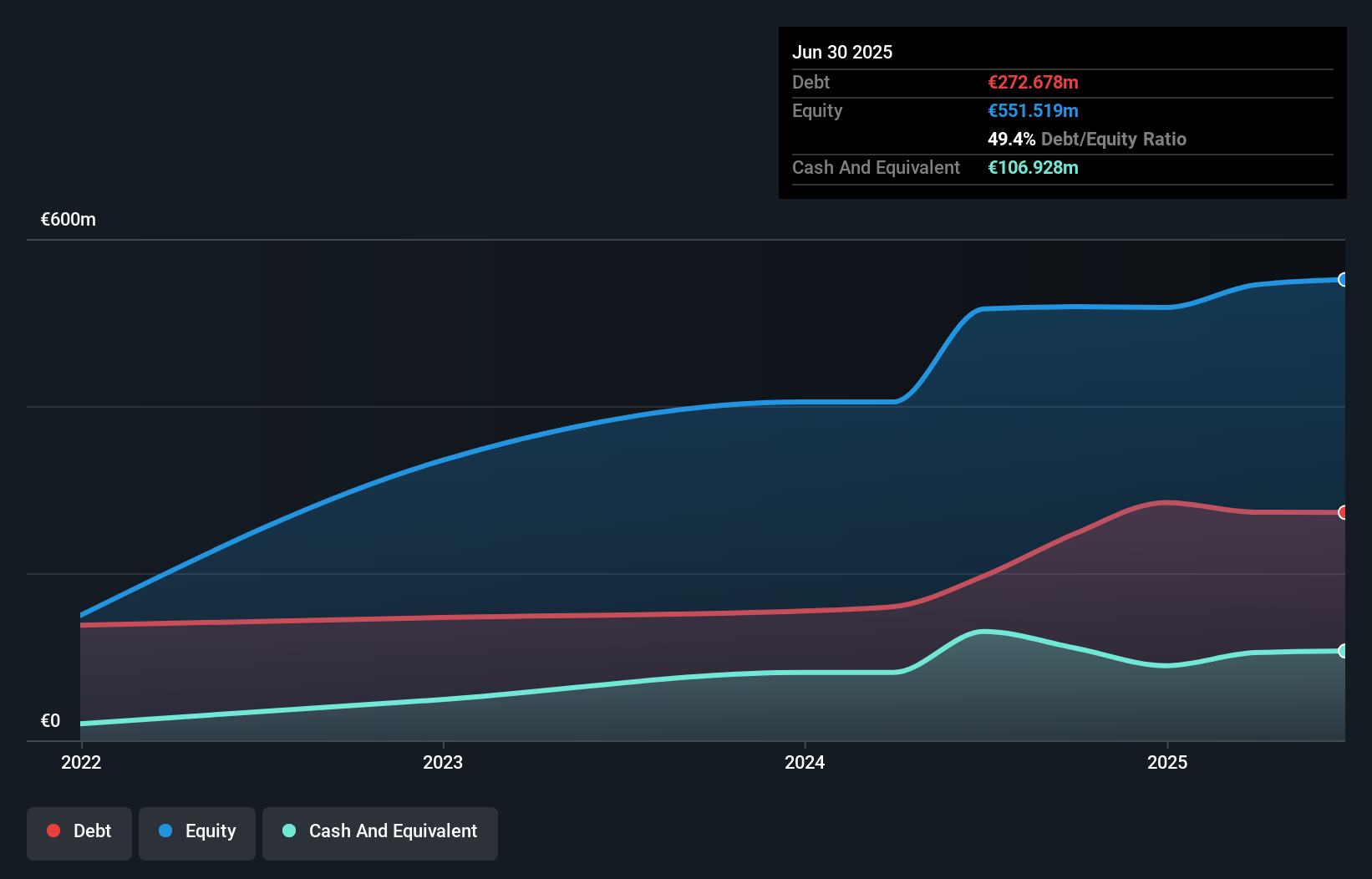

Premier Energy (BVB:PE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Premier Energy PLC is an integrated energy and power infrastructure company operating in Romania, Moldova, Hungary, and Serbia with a market capitalization of RON3.66 billion.

Operations: Premier Energy generates revenue primarily from its energy and power infrastructure operations across Romania, Moldova, Hungary, and Serbia. The company reported a segment adjustment of €1.63 billion.

Premier Energy, a small player in the energy sector, has shown impressive financial strides recently. The company's net income for Q3 2025 soared to €32.98 million from €6.5 million the previous year, with sales jumping to €398.17 million from €303.34 million. Its net debt to equity ratio stands at a satisfactory 34.2%, indicating prudent financial management. Despite earnings declining by 6% annually over the past five years, recent growth of 135% outpaces industry norms significantly, suggesting potential for future expansion and value realization in this under-the-radar stock.

- Navigate through the intricacies of Premier Energy with our comprehensive health report here.

Explore historical data to track Premier Energy's performance over time in our Past section.

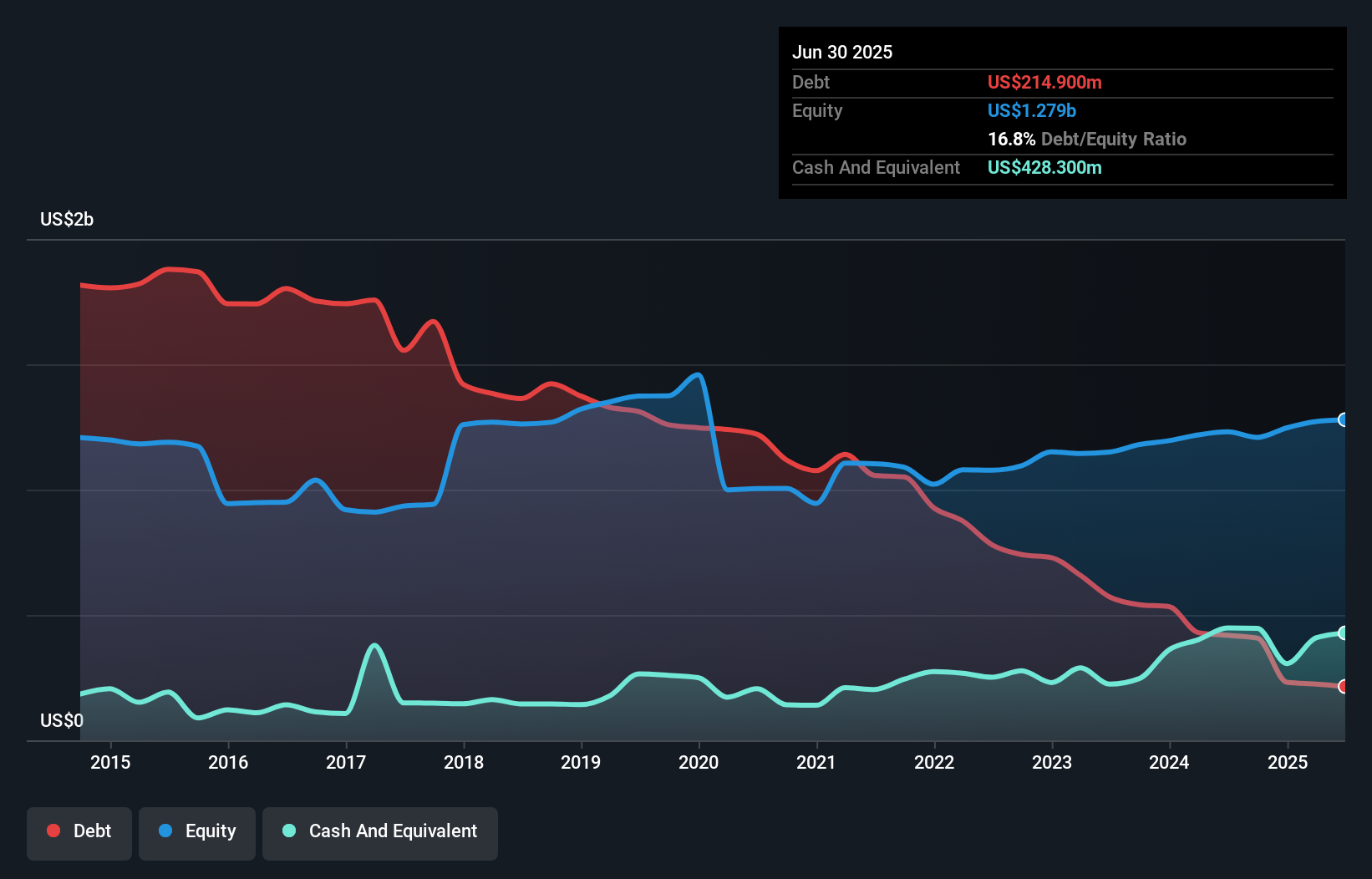

BW Offshore (OB:BWO)

Simply Wall St Value Rating: ★★★★★☆

Overview: BW Offshore Limited specializes in the engineering of offshore production solutions across multiple continents, with a market capitalization of NOK8.22 billion.

Operations: BW Offshore generates revenue primarily from its offshore production solutions. The company experienced a net profit margin of 10% in the most recent fiscal year.

BW Offshore, a noteworthy player in the energy services sector, has shown impressive earnings growth of 45.6% annually over the past five years. Despite its recent earnings growth of 26%, which trailed behind the industry average of 28.7%, BWO's interest payments are well-covered by EBIT at a robust 25.9 times coverage. The company's debt situation has significantly improved with a reduction in its debt to equity ratio from 111.3% to just 15.8%. Recently, BWO reported Q3 net income rising to US$23.5 million from US$13.7 million last year and announced an innovative joint venture for floating desalination units aimed at addressing water scarcity issues globally, highlighting its strategic adaptability and potential for future value creation.

- Dive into the specifics of BW Offshore here with our thorough health report.

Review our historical performance report to gain insights into BW Offshore's's past performance.

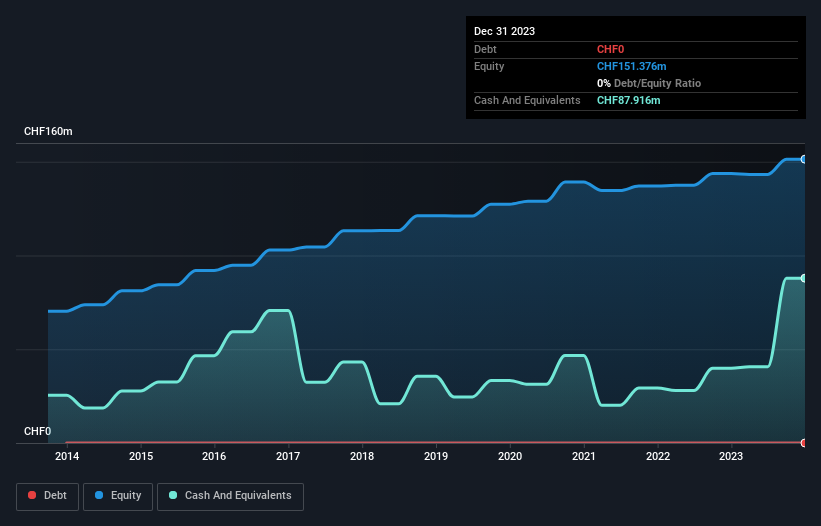

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Value Rating: ★★★★★★

Overview: IVF Hartmann Holding AG is a company that supplies medical consumer goods both in Switzerland and internationally, with a market capitalization of CHF340.53 million.

Operations: The company's revenue is primarily derived from its Infection Management segment, contributing CHF 60.39 million, followed by Wound Care at CHF 41.36 million and Incontinence Management at CHF 35.49 million.

Earnings for IVF Hartmann Holding have increased by 7.8% over the past year, showcasing its solid performance in the medical equipment industry. With a price-to-earnings ratio of 17.9x, it offers better value than the Swiss market average of 20.4x, indicating potential undervaluation. The company is debt-free and has not carried any debt for five years, which likely contributes to its high-quality earnings and robust financial health. Additionally, positive free cash flow suggests strong operational efficiency and financial stability without concerns about interest coverage due to zero debt obligations.

- Unlock comprehensive insights into our analysis of IVF Hartmann Holding stock in this health report.

Assess IVF Hartmann Holding's past performance with our detailed historical performance reports.

Make It Happen

- Click here to access our complete index of 299 European Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal