Global Growth Stocks With Strong Insider Ownership

Amidst a backdrop of record highs in U.S. stock indices and optimism fueled by advancements in artificial intelligence, global markets are showing resilience despite mixed economic signals such as declining durable goods orders and weakening consumer confidence. In this environment, identifying growth companies with strong insider ownership can be particularly appealing, as insider stakes often suggest alignment with shareholder interests and confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

EO Technics (KOSDAQ:A039030)

Simply Wall St Growth Rating: ★★★★☆☆

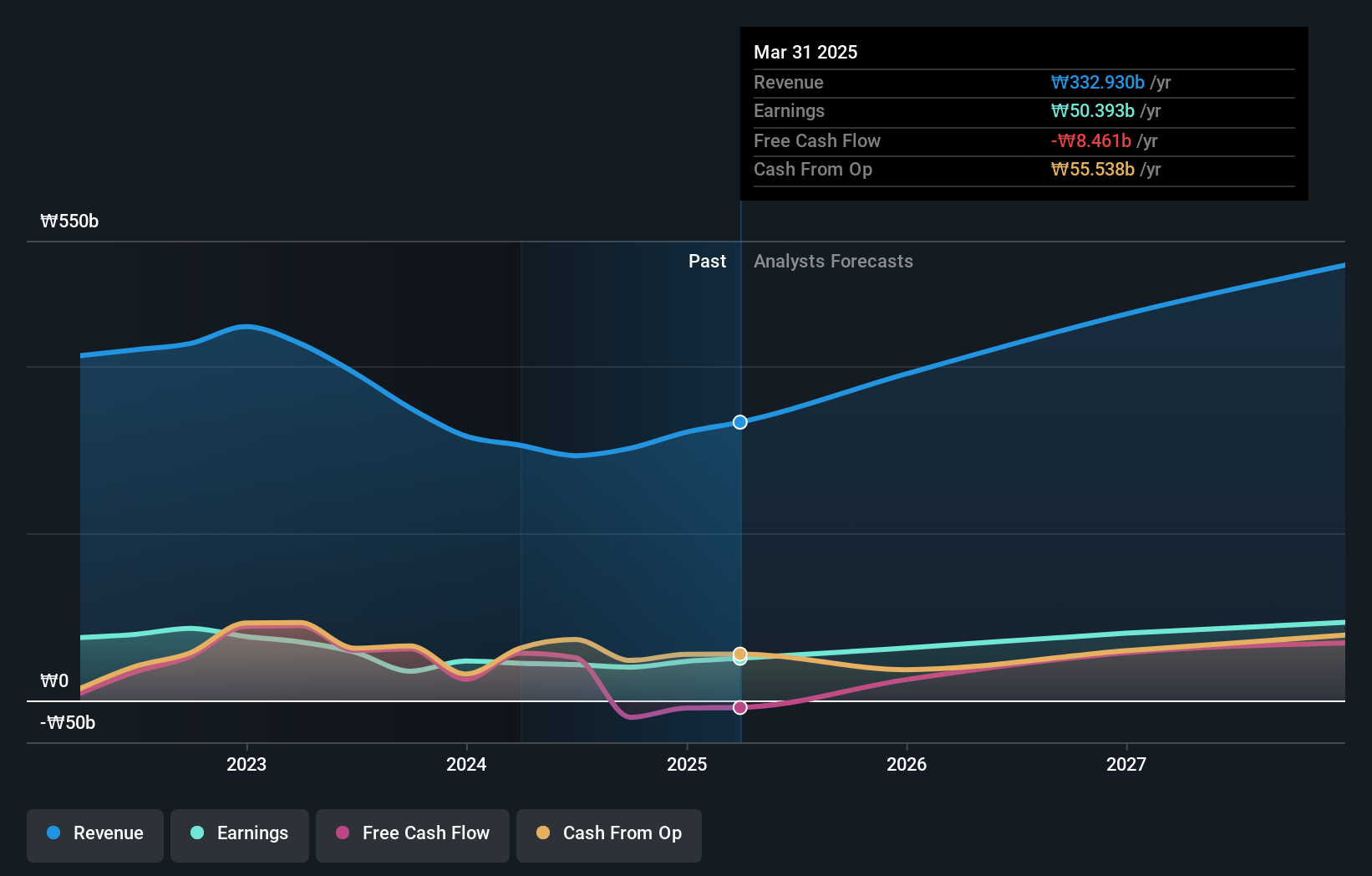

Overview: EO Technics Co., Ltd. manufactures and supplies laser processing equipment globally, with a market cap of ₩3.29 trillion.

Operations: The Semiconductor Machine Division generates revenue of ₩370.32 billion.

Insider Ownership: 30.7%

Earnings Growth Forecast: 31.9% p.a.

EO Technics is poised for robust growth, with forecasted revenue and earnings expected to outpace the Korean market. Revenue is anticipated to grow at 18.4% annually, while earnings are projected to increase significantly by 31.9% per year over the next three years. Despite a highly volatile share price in recent months, insider ownership remains stable with no significant buying or selling activity reported recently. The company announced a KRW 500 dividend per share for April 2026.

- Dive into the specifics of EO Technics here with our thorough growth forecast report.

- Our valuation report unveils the possibility EO Technics' shares may be trading at a premium.

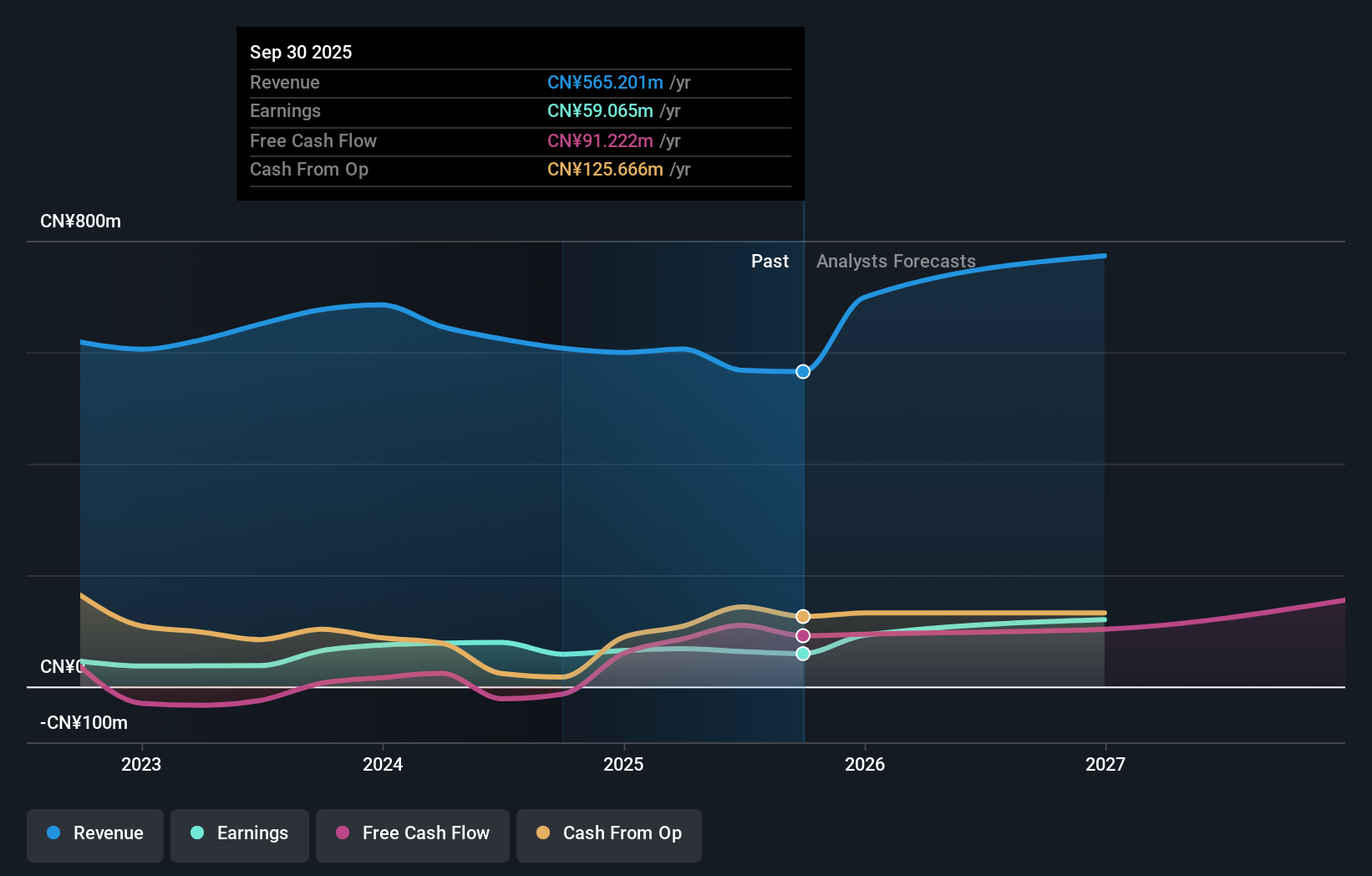

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Willfar Information Technology Co., Ltd. offers smart utility services and IoT solutions both in China and internationally, with a market cap of CN¥19.16 billion.

Operations: Willfar Information Technology Co., Ltd. generates revenue through its provision of intelligent utility services and Internet of Things (IoT) solutions across domestic and international markets.

Insider Ownership: 19.4%

Earnings Growth Forecast: 24% p.a.

Willfar Information Technology is positioned for significant growth, with revenue expected to rise by 24.2% annually, outpacing the broader Chinese market. Earnings are projected to grow at a similar rate, although slightly below market expectations. The company reported CNY 474.19 million in net income for the first nine months of 2025, reflecting steady growth from the previous year. With a price-to-earnings ratio of 28.1x and high forecasted return on equity, it trades at good value relative to peers.

- Get an in-depth perspective on Willfar Information Technology's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Willfar Information Technology is trading behind its estimated value.

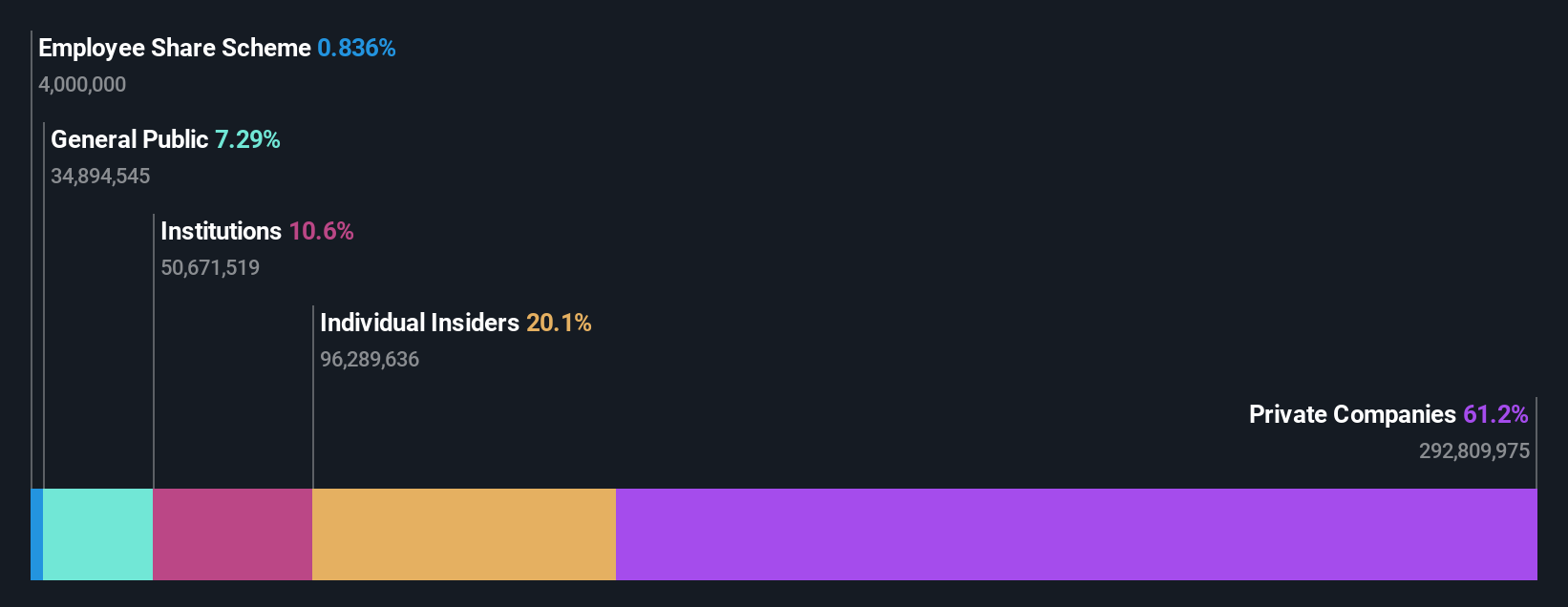

Jiangsu Jujie Microfiber Technology Group (SZSE:300819)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Jujie Microfiber Technology Group Co., Ltd. operates in the microfiber technology sector and has a market cap of CN¥5.16 billion.

Operations: The company generates revenue primarily from its Textile and Clothing Business, amounting to CN¥565.20 million.

Insider Ownership: 12.9%

Earnings Growth Forecast: 47.4% p.a.

Jiangsu Jujie Microfiber Technology Group is poised for robust growth, with earnings projected to increase significantly at 47.39% annually, surpassing the broader Chinese market's expectations. Revenue is also forecasted to grow rapidly at 20.7% per year. Despite a recent decline in sales and net income for the nine months ending September 2025, insider ownership remains high, potentially aligning management interests with shareholders amidst share price volatility.

- Click to explore a detailed breakdown of our findings in Jiangsu Jujie Microfiber Technology Group's earnings growth report.

- According our valuation report, there's an indication that Jiangsu Jujie Microfiber Technology Group's share price might be on the expensive side.

Key Takeaways

- Unlock our comprehensive list of 851 Fast Growing Global Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal