Global Dividend Stocks To Consider For Your Portfolio

As global markets experience a mixed yet optimistic landscape, with U.S. indices reaching record highs and European stocks nearing similar peaks, investors are increasingly seeking stability amid economic fluctuations. In this context, dividend stocks can offer a reliable income stream and potential growth opportunities, making them an attractive consideration for those looking to balance their portfolios in today's dynamic market environment.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.46% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.42% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.15% | ★★★★★★ |

| NCD (TSE:4783) | 3.99% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.21% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

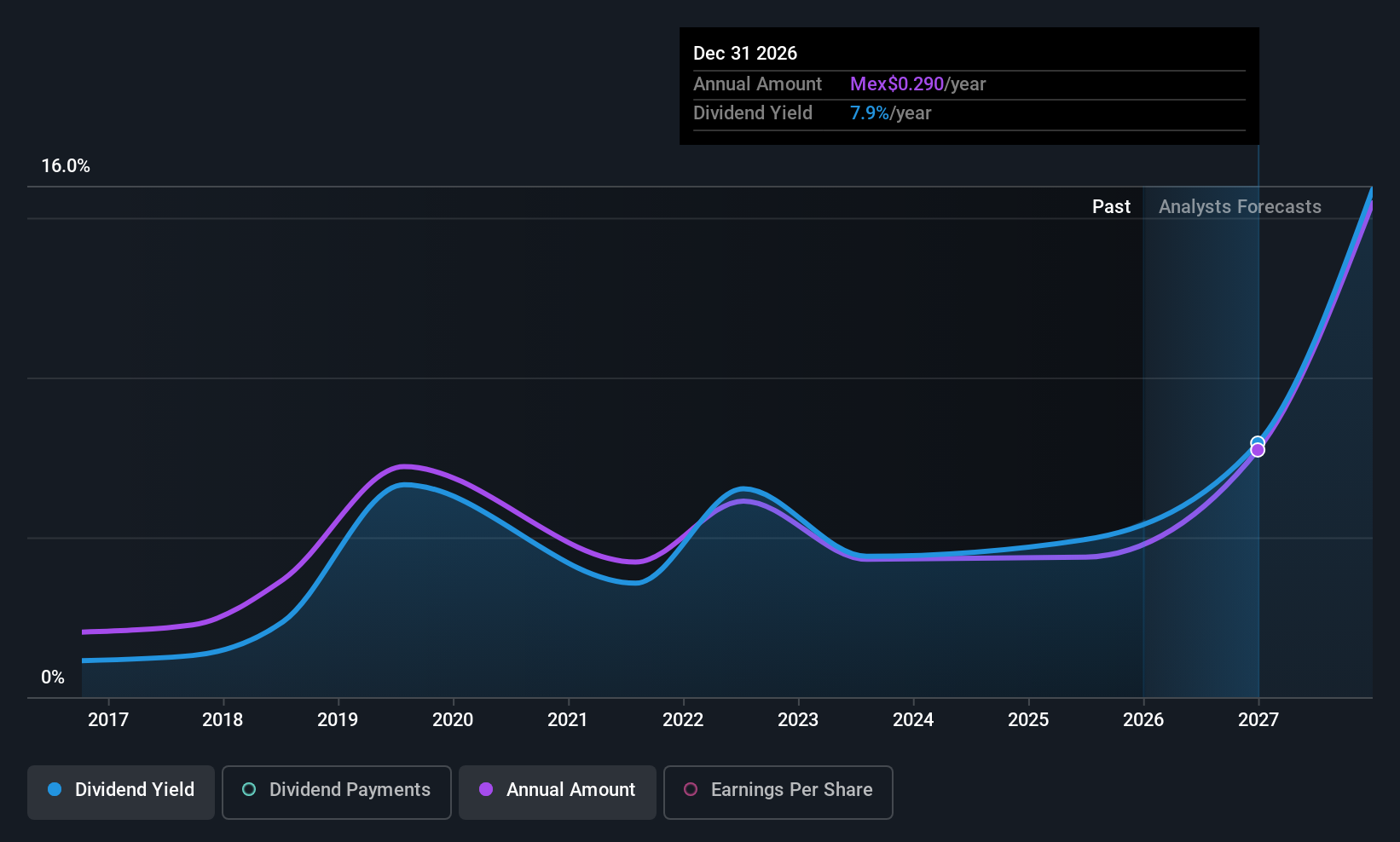

Consorcio ARA S. A. B. de C. V (BMV:ARA *)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Consorcio ARA S. A. B. de C. V., along with its subsidiaries, is involved in designing, promoting, building, and selling housing developments in Mexico and has a market cap of MX$4.35 billion.

Operations: Consorcio ARA S. A. B. de C. V.'s revenue is primarily derived from its Residential segment, which generated MX$7.33 billion, along with Other Real Estate Projects contributing MX$383.11 million.

Dividend Yield: 4.4%

Consorcio ARA's dividend payments, while increasing over the past decade, have been volatile and unreliable. Despite this instability, the dividends are well-covered by earnings with a payout ratio of 26.5% and cash flows at 59.8%. Recent earnings growth supports dividend sustainability; however, its yield of 4.39% is lower than top-tier MX market payers. The stock trades significantly below estimated fair value, which might appeal to value-focused investors despite the inconsistent dividend history.

- Click here and access our complete dividend analysis report to understand the dynamics of Consorcio ARA S. A. B. de C. V.

- The analysis detailed in our Consorcio ARA S. A. B. de C. V valuation report hints at an deflated share price compared to its estimated value.

Meiko Trans (NSE:9357)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Meiko Trans Co., Ltd. is a logistics company based in Japan with a market capitalization of approximately ¥62.87 billion.

Operations: Meiko Trans Co., Ltd. generates revenue primarily from its Port Transportation and Related Business, which amounts to ¥80.23 billion, complemented by its Rent segment contributing ¥2.14 billion.

Dividend Yield: 3.3%

Meiko Trans has delivered stable and reliable dividends over the past decade, supported by a low payout ratio of 29.9% and cash flow coverage at 35.6%. Its earnings have grown annually by 4.4%, enhancing dividend sustainability. Although its yield of 3.33% is slightly below top-tier JP market payers, the stock trades at a discount to its fair value estimate, which could interest value-oriented investors seeking consistent dividend income.

- Dive into the specifics of Meiko Trans here with our thorough dividend report.

- Our valuation report here indicates Meiko Trans may be undervalued.

Mitsubishi Steel Mfg (TSE:5632)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Steel Mfg. Co., Ltd. is involved in the manufacturing and sale of steel products, construction machinery parts, automotive parts, and machinery and equipment, with a market cap of approximately ¥28.38 billion.

Operations: Mitsubishi Steel Mfg. Co., Ltd.'s revenue segments consist of Spring at ¥68.66 billion, Special Steel at ¥78.10 billion, Formed Materials at ¥9.06 billion, and Machinery and Equipment at ¥11.16 billion.

Dividend Yield: 4.3%

Mitsubishi Steel Mfg.'s dividend is well covered by earnings and cash flows, with payout ratios of 37.2% and 18.7%, respectively, and its yield is among the top in Japan. However, dividends have been volatile over the past decade despite recent increases. The company faces financial challenges with high debt levels and lowered earnings forecasts due to operational issues, though asset sales may mitigate some impacts on profitability.

- Delve into the full analysis dividend report here for a deeper understanding of Mitsubishi Steel Mfg.

- In light of our recent valuation report, it seems possible that Mitsubishi Steel Mfg is trading behind its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 1288 Top Global Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal