Middle Eastern Opportunities: 3 Penny Stocks With Market Caps Below US$1B

The Middle Eastern stock markets have shown varied performances, with Egypt's bourse notably surpassing its Gulf counterparts in 2025, while oil prices have exerted pressure on the Saudi market. Despite the vintage feel of the term "penny stocks," these investment opportunities remain significant for those interested in smaller or newer companies. By focusing on penny stocks with strong financial foundations, investors can uncover potential growth opportunities amidst current economic conditions.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.35 | SAR1.35B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.811 | ₪201.59M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.04 | AED2.18B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.70 | SAR946M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED384.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.57 | AED15.22B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.829 | AED504.24M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.532 | ₪198.76M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ajman Bank PJSC offers a range of banking products and services to individuals, businesses, and government institutions in the United Arab Emirates with a market capitalization of AED3.58 billion.

Operations: Ajman Bank's revenue is primarily derived from its Wholesale Banking segment at AED447.74 million, followed by Consumer Banking at AED279.19 million and Treasury operations contributing AED184.52 million.

Market Cap: AED3.58B

Ajman Bank PJSC, with a market capitalization of AED3.58 billion, has shown profitability in the past year despite challenges such as a high bad loans ratio of 8.9%. The bank's financial stability is supported by an appropriate Loans to Deposits ratio of 69% and primarily low-risk funding from customer deposits. Its price-to-earnings ratio of 7.3x suggests it may be undervalued compared to the AE market average. While its Return on Equity is relatively low at 14.6%, Ajman Bank benefits from experienced management and board members, contributing to stable weekly volatility and high-quality earnings growth over recent years.

- Click to explore a detailed breakdown of our findings in Ajman Bank PJSC's financial health report.

- Gain insights into Ajman Bank PJSC's past trends and performance with our report on the company's historical track record.

Arabian Pipes (SASE:2200)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arabian Pipes Company is involved in the production and marketing of steel tubes in Saudi Arabia, with a market capitalization of SAR946 million.

Operations: The company's revenue is derived entirely from its steel pipe production segment, amounting to SAR895.51 million.

Market Cap: SAR946M

Arabian Pipes Company, with a market capitalization of SAR946 million, faces challenges as recent earnings show a decline in both sales and net income compared to the previous year. Despite this, the company trades at a favorable price-to-earnings ratio of 8.2x, below the Saudi Arabian market average. Its debt is well managed, with operating cash flow covering 317.3% of its debt and short-term assets exceeding liabilities significantly. The company's return on equity is high at 23.9%, indicating effective use of equity capital despite lower profit margins than last year and negative earnings growth over the past year.

- Unlock comprehensive insights into our analysis of Arabian Pipes stock in this financial health report.

- Assess Arabian Pipes' future earnings estimates with our detailed growth reports.

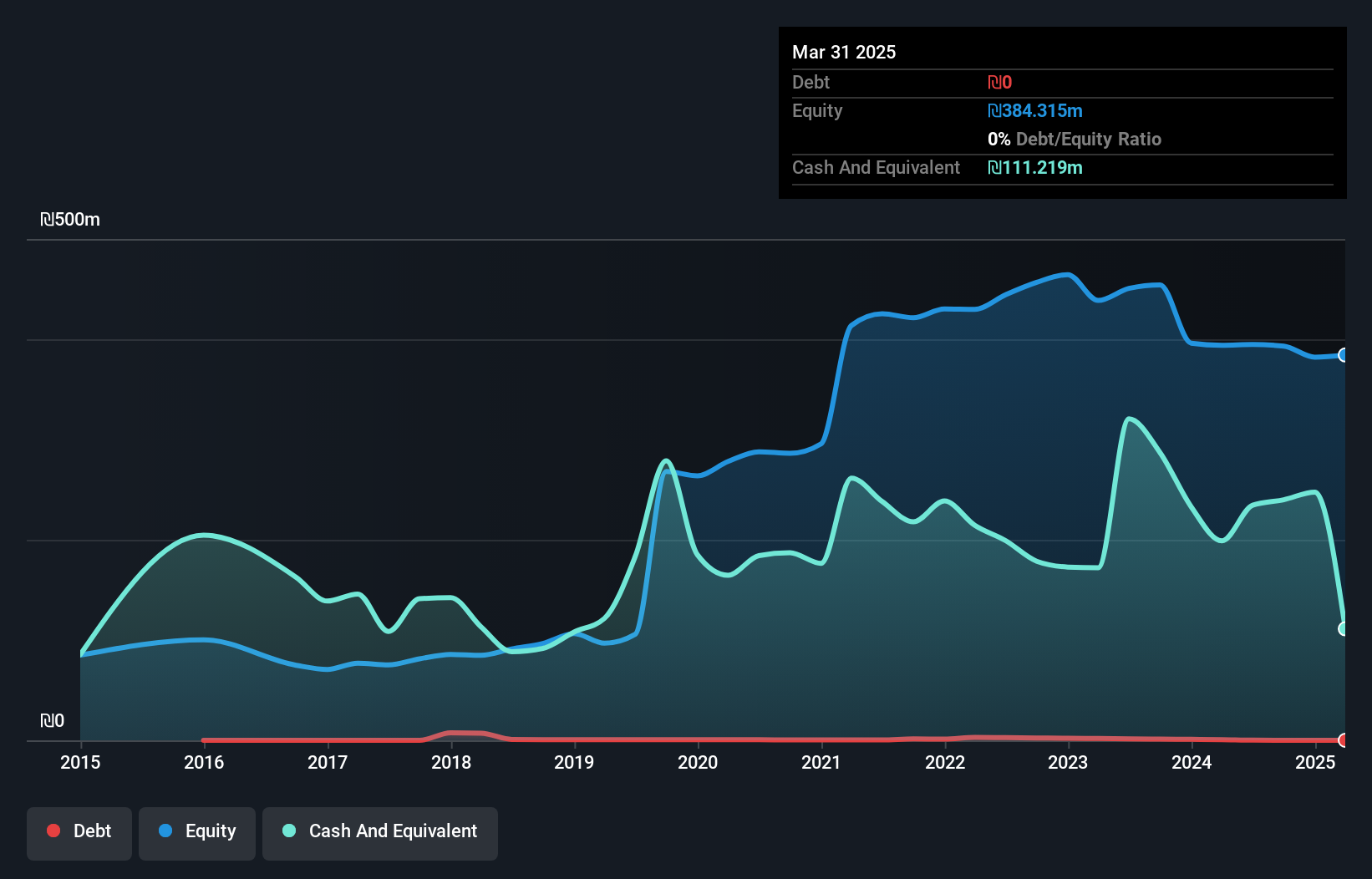

Novolog (Pharm-Up 1966) (TASE:NVLG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Novolog (Pharm-Up 1966) Ltd operates in the healthcare services sector in Israel with a market capitalization of ₪641.66 million.

Operations: The company generates revenue through its Logistics Division (₪1.74 billion), Health Services Division (₪205.13 million), and Digital Division (₪26.93 million).

Market Cap: ₪641.66M

Novolog (Pharm-Up 1966) Ltd, with a market cap of ₪641.66 million, has recently become profitable but faces challenges as earnings have declined over the past five years. The company reported lower sales and net income for Q3 2025 compared to the previous year, reflecting operational pressures. Despite this, Novolog's debt is well covered by operating cash flow at 337.1%, and it holds more cash than total debt, indicating strong liquidity management. However, its dividend yield of 3.12% is not well supported by earnings or free cash flows, suggesting potential sustainability issues in its dividend policy.

- Navigate through the intricacies of Novolog (Pharm-Up 1966) with our comprehensive balance sheet health report here.

- Examine Novolog (Pharm-Up 1966)'s past performance report to understand how it has performed in prior years.

Summing It All Up

- Reveal the 80 hidden gems among our Middle Eastern Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal