Undiscovered Gems in Middle East Stocks To Watch This January 2026

As the Middle East markets close out 2025, Egypt's stock exchange has notably outperformed its Gulf counterparts, driven by strong local economic fundamentals and corporate earnings, while the Saudi market faced challenges due to weak oil prices and a robust IPO pipeline. In this dynamic landscape, identifying promising stocks involves looking for companies that can leverage favorable economic conditions or navigate sector-specific challenges effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 31.20% | 44.24% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| C. Mer Industries | 76.92% | 13.56% | 68.93% | ★★★★★☆ |

| Amanat Holdings PJSC | 10.86% | 27.51% | -0.92% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

R.A.K. Ceramics P.J.S.C (ADX:RAKCEC)

Simply Wall St Value Rating: ★★★★★☆

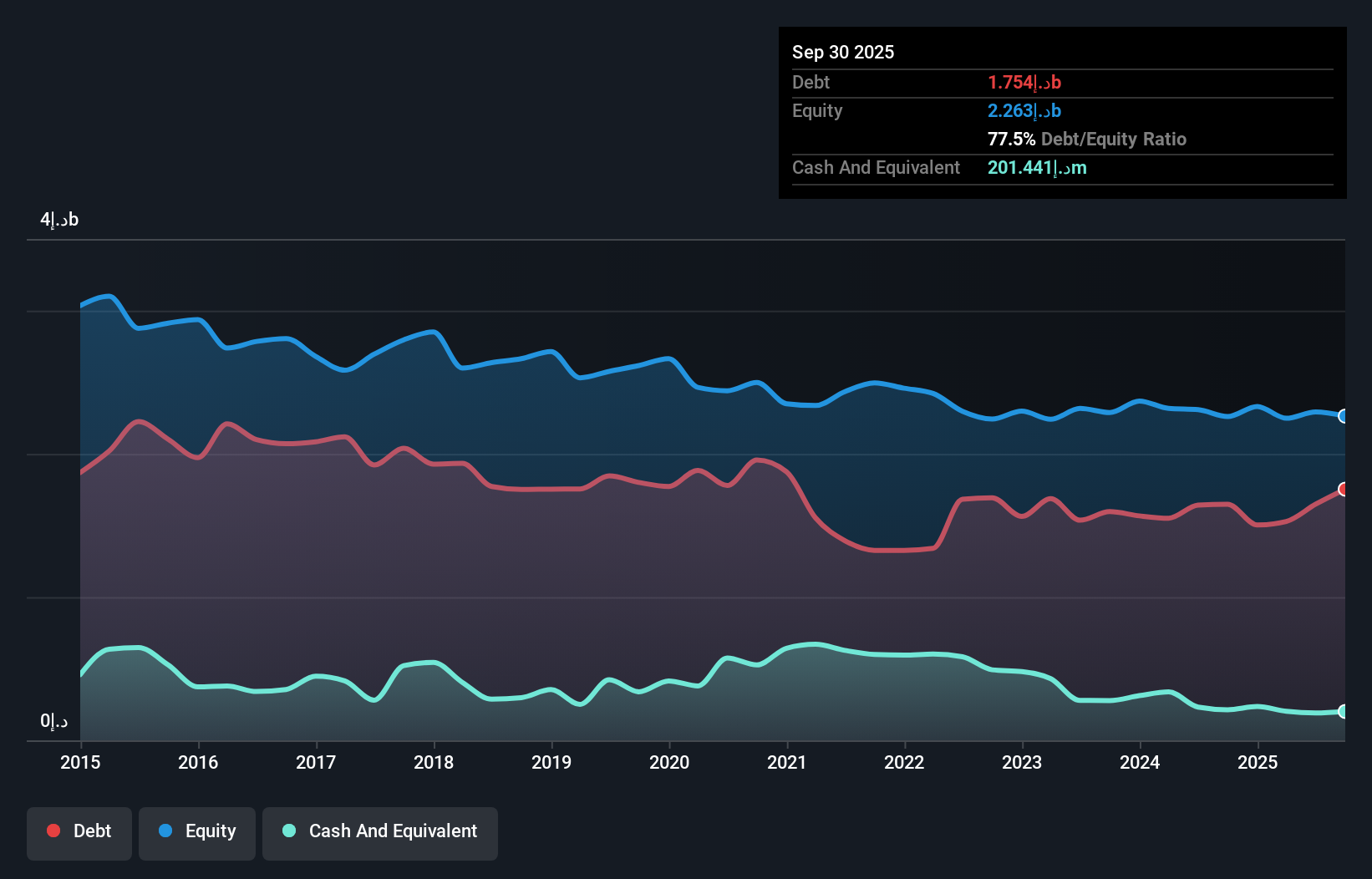

Overview: R.A.K. Ceramics P.J.S.C. is involved in the manufacture and sale of a range of ceramic products across the Middle East, Europe, Asia, and other international markets, with a market cap of approximately AED 2.49 billion.

Operations: RAKCEC generates significant revenue from its ceramic products segment, totaling AED 3.26 billion. The faucets segment contributes AED 565.93 million to the company's revenue stream.

R.A.K. Ceramics, a notable player in the Middle East's tile and ceramics industry, has demonstrated resilience with a net income of AED 66.88 million for Q3 2025, up from AED 54.49 million the previous year. The company's earnings per share rose to AED 0.07 from AED 0.05, reflecting solid operational performance despite its high net debt to equity ratio of 68.6%. With a price-to-earnings ratio of 10.5x below the AE market average and well-covered interest payments at an EBIT coverage of 4.2x, R.A.K.'s financial health appears robust amidst industry challenges.

- Click here to discover the nuances of R.A.K. Ceramics P.J.S.C with our detailed analytical health report.

Gain insights into R.A.K. Ceramics P.J.S.C's past trends and performance with our Past report.

Kamada (TASE:KMDA)

Simply Wall St Value Rating: ★★★★★★

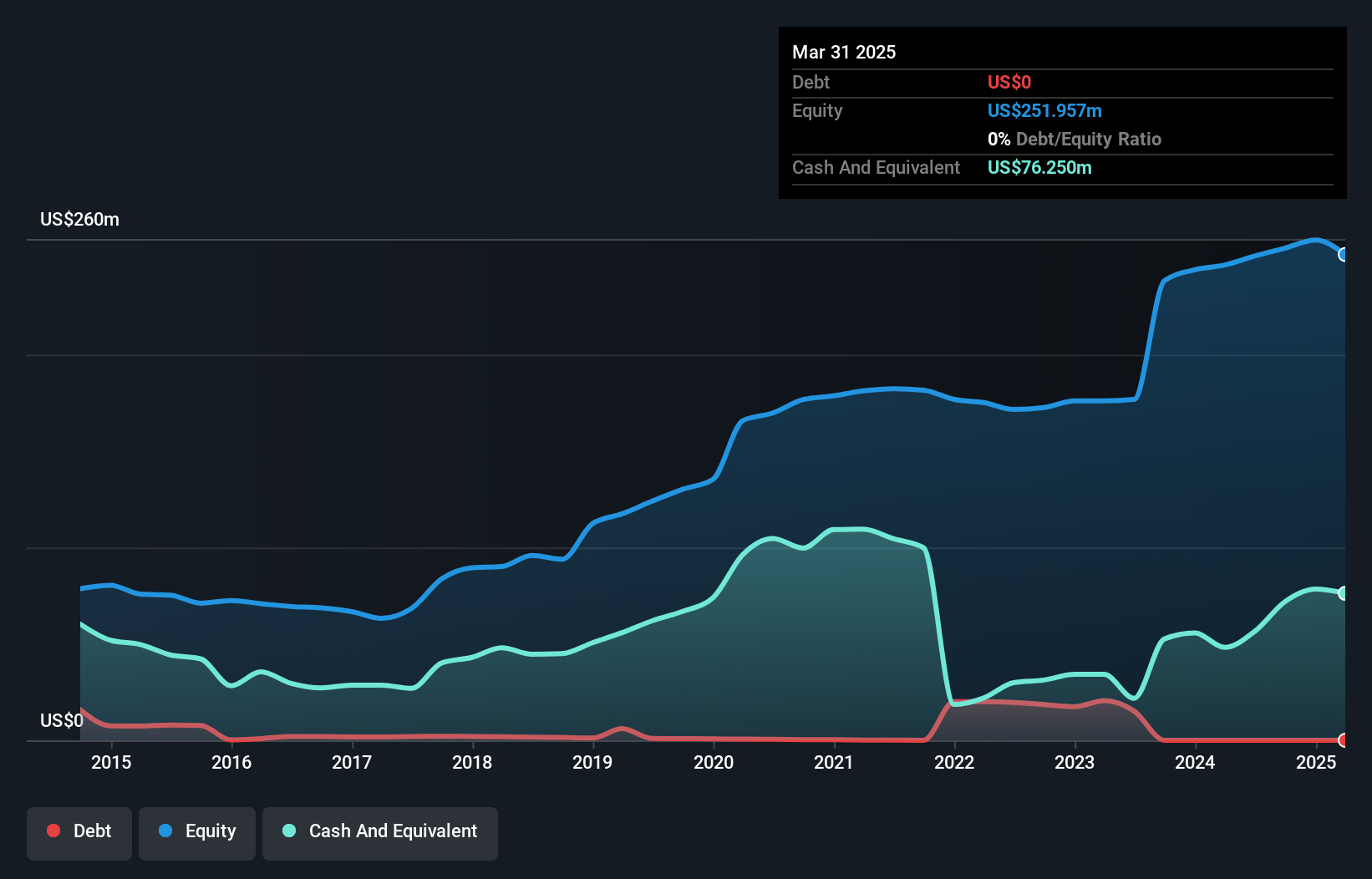

Overview: Kamada Ltd. focuses on the manufacturing and sale of plasma-derived protein therapeutics, with a market capitalization of ₪1.30 billion.

Operations: Kamada generates revenue primarily from its Proprietary Products segment, contributing $149.39 million, and a smaller portion from Distribution at $25.40 million.

Kamada, a nimble player in the biotech sector, recently made headlines by joining the NASDAQ Biotechnology Index. The company has shown impressive earnings growth of 30.1% over the past year, outpacing its industry peers. Despite a significant one-off loss of $6.8M affecting recent financials, Kamada remains debt-free and trades at 67.4% below its estimated fair value, indicating potential undervaluation. Recent developments include securing a two-year extension for supplying specialty plasma-derived products to Canadian Blood Services worth $10-$14 million and discontinuing an unpromising Phase 3 trial for Inhaled AAT due to efficacy concerns rather than safety issues.

- Take a closer look at Kamada's potential here in our health report.

Gain insights into Kamada's historical performance by reviewing our past performance report.

Malam - Team (TASE:MLTM)

Simply Wall St Value Rating: ★★★★☆☆

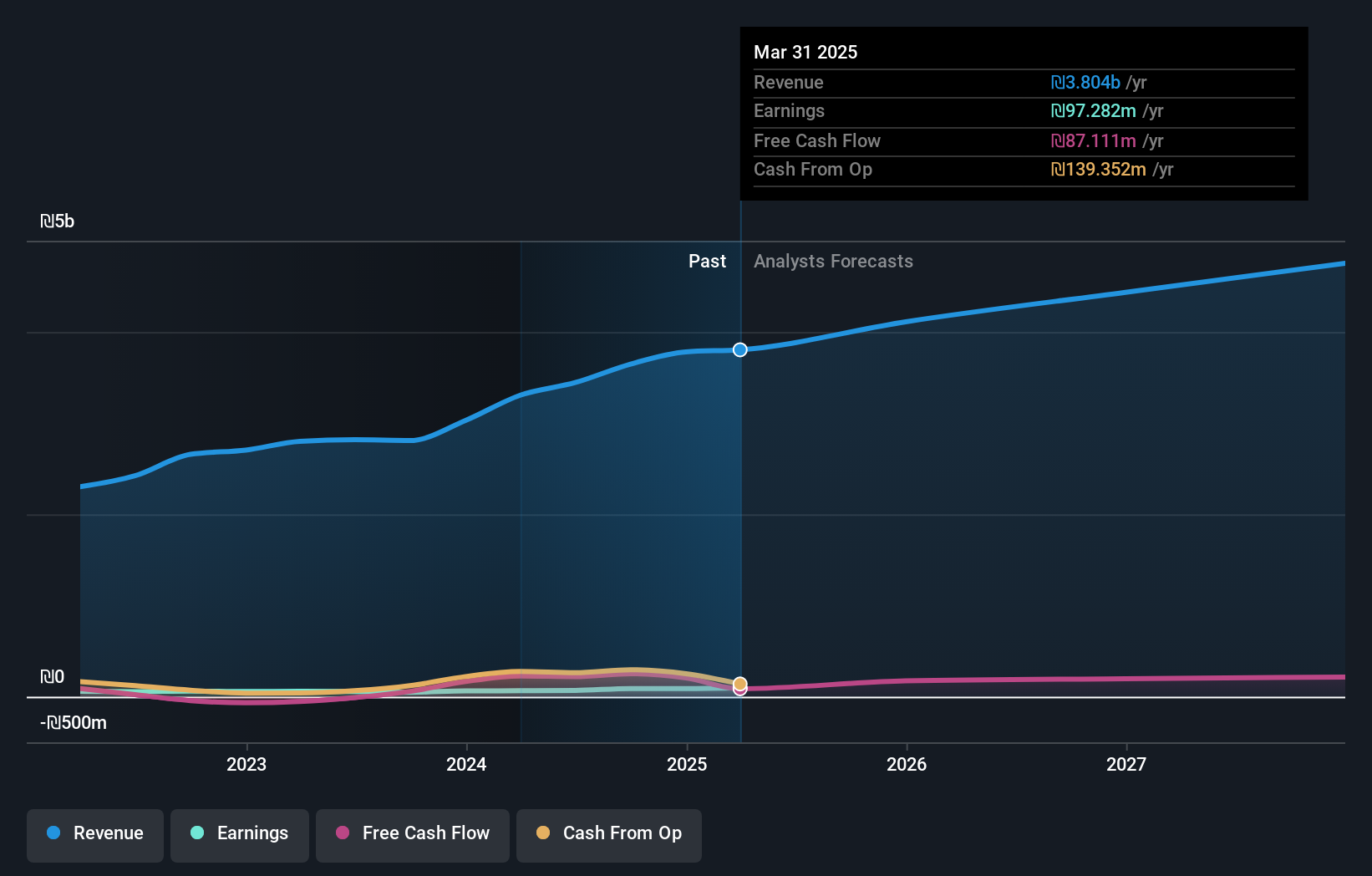

Overview: Malam - Team Ltd is an Israeli company that offers a range of information technology services, with a market capitalization of ₪2.91 billion.

Operations: Malam - Team Ltd generates revenue primarily from Infrastructure and Cloud services (₪2.31 billion) and Software, Projects, and Business Solutions (₪1.47 billion). Additional income is derived from Payroll Service, Human Resources, and Long-Term Savings (₪335.90 million), along with a minor contribution from the Establishment and Investment Sector in Start-Up Companies (₪4.86 million).

Malam - Team has shown steady progress with earnings increasing by 5% annually over the last five years, though its recent growth of 13.6% slightly lagged behind the IT industry's 14.4%. The company's debt to equity ratio doubled from 51.2% to 98.6%, indicating a significant rise in leverage, yet interest payments remain well covered at an EBIT coverage of 3.8 times. Despite a high net debt to equity ratio of 42.8%, Malam - Team stays profitable and free cash flow positive, reporting ILS sales of $1,116 million for Q3 and net income climbing to ILS $33 million compared to last year’s ILS $31 million.

- Click here and access our complete health analysis report to understand the dynamics of Malam - Team.

Evaluate Malam - Team's historical performance by accessing our past performance report.

Seize The Opportunity

- Click through to start exploring the rest of the 179 Middle Eastern Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal