3 UK Dividend Stocks To Consider With At Least 5.7% Yield

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China, which has impacted companies with strong ties to the Chinese economy. In such volatile market conditions, dividend stocks can offer investors a measure of stability and income through regular payouts, making them an attractive consideration for those seeking to navigate uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Seplat Energy (LSE:SEPL) | 6.75% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.59% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.35% | ★★★★☆☆ |

| MONY Group (LSE:MONY) | 6.82% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.09% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.89% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 3.59% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.66% | ★★★★★☆ |

| Begbies Traynor Group (AIM:BEG) | 3.88% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.58% | ★★★★★☆ |

Click here to see the full list of 50 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £493.82 million.

Operations: Foresight Group Holdings Limited generates revenue through its Real Assets segment (£105.67 million), Private Equity segment (£47.43 million), and Foresight Capital Management segment (£9.22 million).

Dividend Yield: 5.8%

Foresight Group Holdings recently announced an interim dividend increase to 8.1 pence per share, reflecting a commitment to its dividend policy of distributing 60% of adjusted profit after tax. The company reported strong earnings growth with net income rising to £18.39 million for H1 2026 from £12.65 million the previous year, supporting its sustainable payout ratio of 72.6%. Trading at a good value below fair estimates, Foresight's dividends are well-covered by both earnings and cash flows.

- Unlock comprehensive insights into our analysis of Foresight Group Holdings stock in this dividend report.

- Our expertly prepared valuation report Foresight Group Holdings implies its share price may be lower than expected.

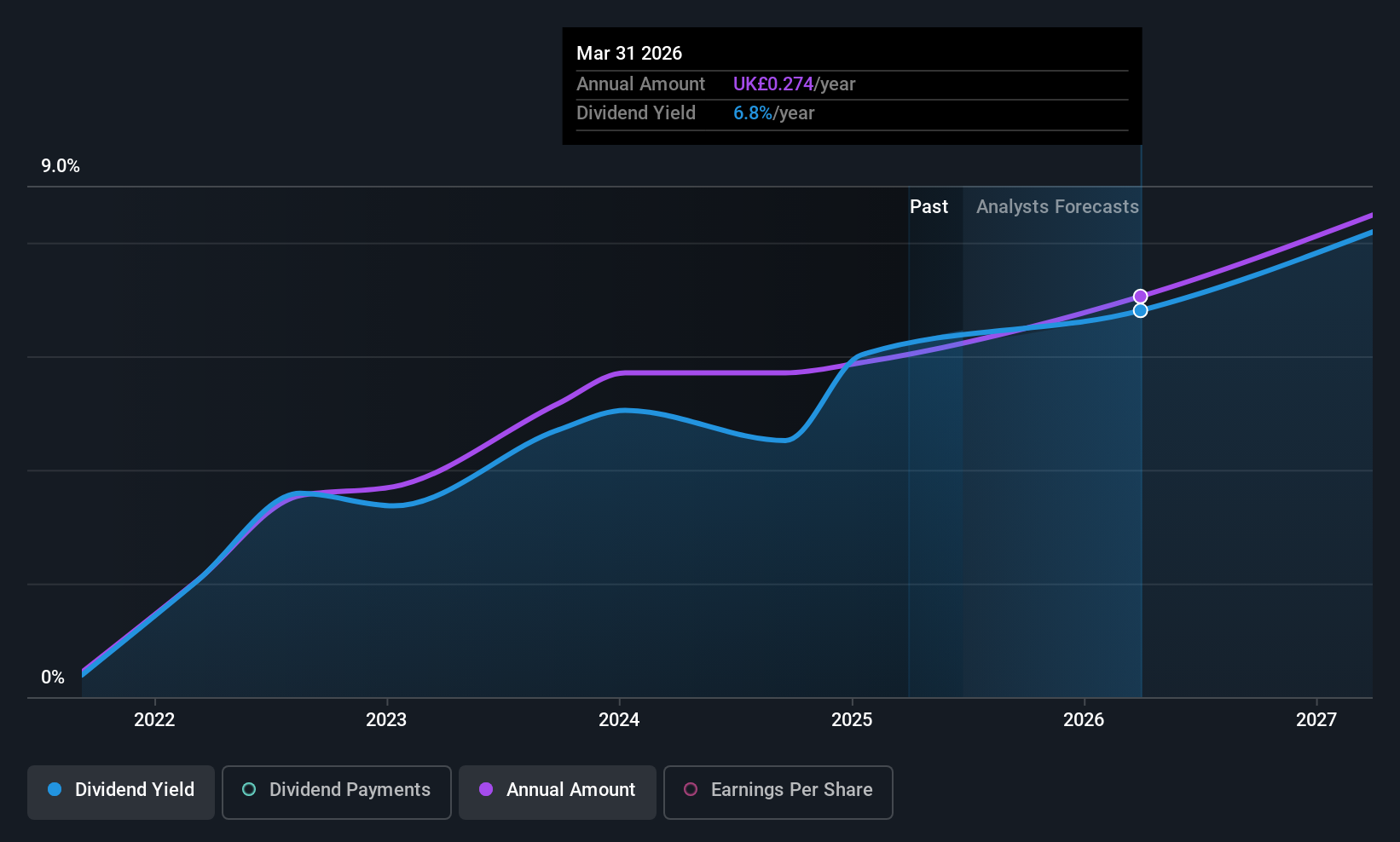

MONY Group (LSE:MONY)

Simply Wall St Dividend Rating: ★★★★★★

Overview: MONY Group plc operates in the United Kingdom, offering price comparison and lead generation services through its websites and applications, with a market cap of £962.58 million.

Operations: MONY Group plc generates revenue from its segments as follows: Money (£99.70 million), Travel (£19.30 million), Cashback (£58.20 million), Insurance (£233.40 million), and Home Services (£41 million).

Dividend Yield: 6.8%

MONY Group has maintained stable and growing dividends over the past decade, with a current payout ratio of 81.6% supported by earnings and cash flows. Its dividend yield of 6.82% ranks in the top 25% of UK payers, and recent buyback plan completion may further enhance shareholder value. Trading below its estimated fair value, MONY offers a compelling relative valuation in its sector while maintaining reliable dividend payments covered by both profits and free cash flows.

- Get an in-depth perspective on MONY Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that MONY Group's current price could be quite moderate.

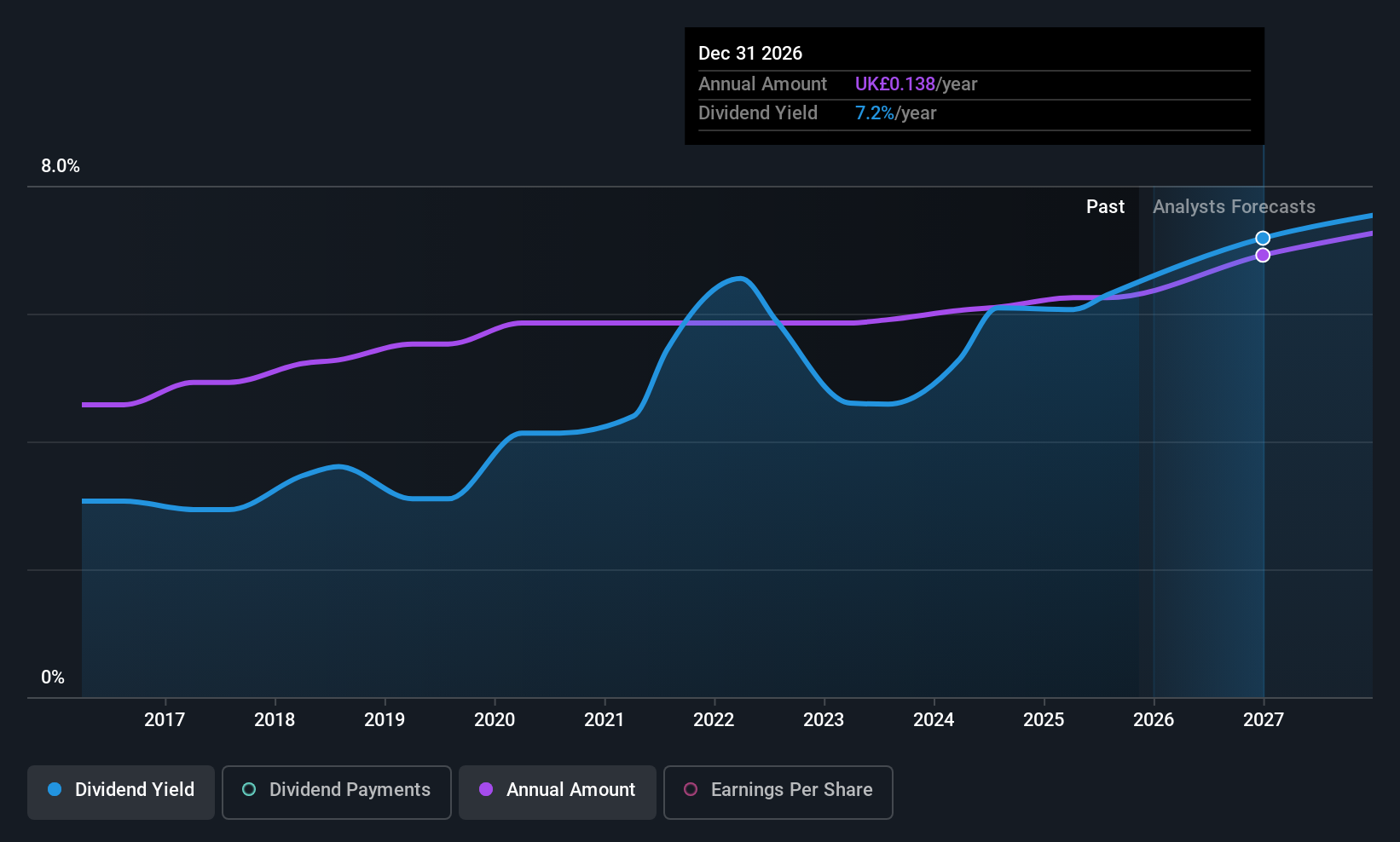

Seplat Energy (LSE:SEPL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Seplat Energy Plc is an independent energy company involved in oil and gas exploration, production, and gas processing across several countries including Nigeria, with a market capitalization of approximately £1.70 billion.

Operations: Seplat Energy Plc generates its revenue primarily from two segments: oil, which accounts for $2.37 billion, and gas, contributing $173.93 million.

Dividend Yield: 6.8%

Seplat Energy offers a compelling dividend yield of 6.75%, placing it among the top UK payers, though its dividend history is volatile. Recent earnings growth and a payout ratio of 50.8% suggest dividends are well-covered by earnings and cash flows, with a low cash payout ratio of 21.2%. The recent acquisition by Heirs Energies could influence future performance, while strategic board changes may impact governance.

- Take a closer look at Seplat Energy's potential here in our dividend report.

- According our valuation report, there's an indication that Seplat Energy's share price might be on the expensive side.

Taking Advantage

- Investigate our full lineup of 50 Top UK Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal