European Penny Stocks Spotlight Siili Solutions Oyj And Two Others

As the European markets continue to hover near record highs, driven by positive sentiment about future earnings and economic prospects, investors are increasingly exploring diverse investment avenues. Penny stocks, a term that may seem outdated yet remains significant, often represent smaller or newer companies with the potential for surprising growth. In this article, we explore three European penny stocks that demonstrate robust financial health and offer intriguing opportunities for those willing to look beyond traditional investments.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.488 | €1.54B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.69 | €82.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.31 | €221.96M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.00 | €63.63M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.08 | SEK192.25M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.43 | €391.54M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0726 | €7.89M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.85 | €28.46M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 286 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Siili Solutions Oyj (HLSE:SIILI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Siili Solutions Oyj offers information system development services both in Finland and internationally, with a market cap of €37.54 million.

Operations: The company's revenue primarily comes from its Information Systems Development Services segment, generating €110.02 million.

Market Cap: €37.54M

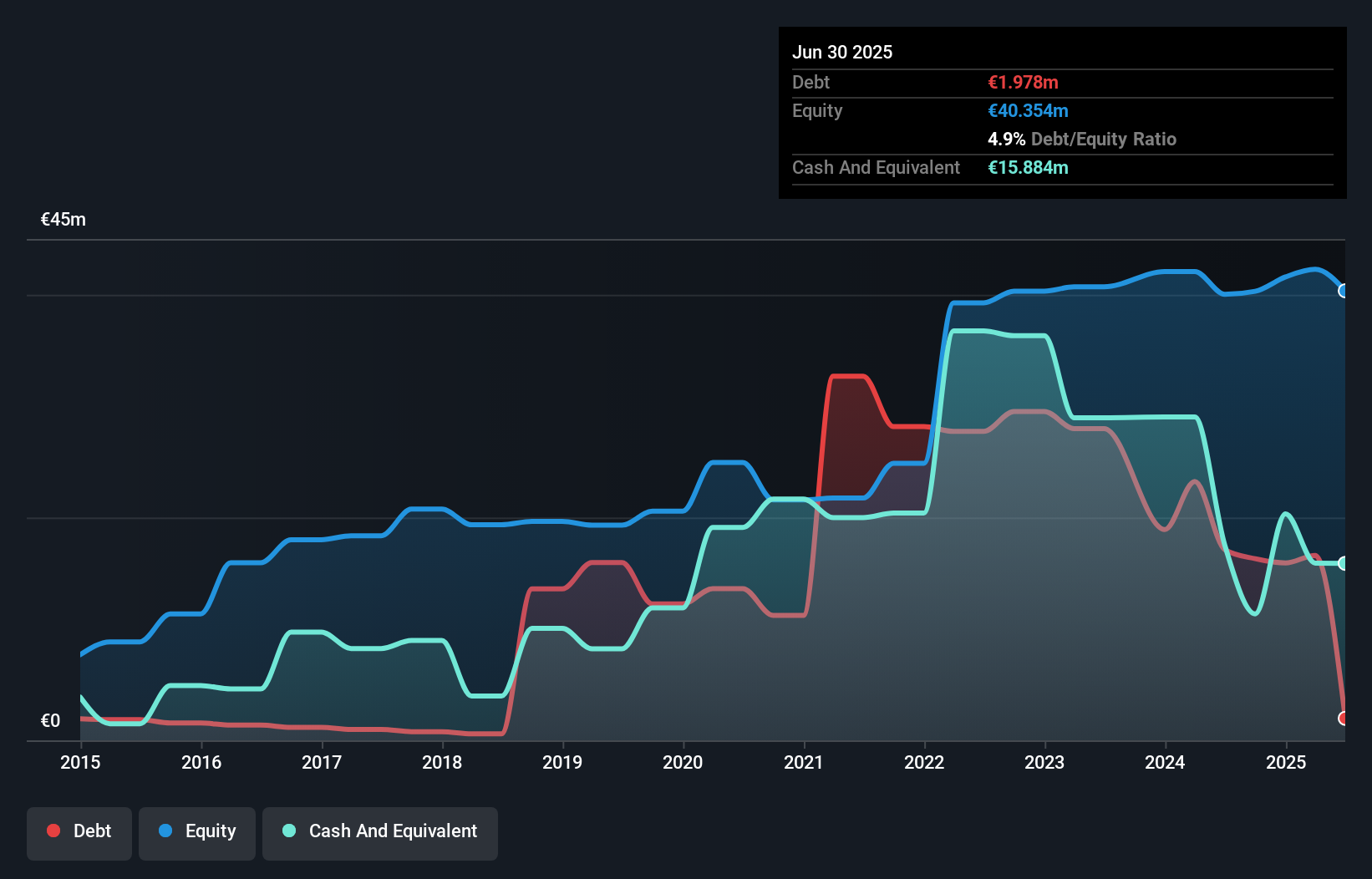

Siili Solutions Oyj, with a market cap of €37.54 million, operates in the information systems development sector. Despite a forecasted earnings growth of 58.88% annually, recent performance shows challenges with a net loss of €1.71 million in Q3 2025 and declining profit margins from last year’s 2.7% to the current 0.5%. The company's debt management is strong, having more cash than total debt and reducing its debt-to-equity ratio significantly over five years. However, interest coverage remains weak at 0.6x EBIT, and recent revenue guidance suggests stability rather than growth for the near term.

- Get an in-depth perspective on Siili Solutions Oyj's performance by reading our balance sheet health report here.

- Examine Siili Solutions Oyj's earnings growth report to understand how analysts expect it to perform.

BIMobject (OM:BIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BIMobject AB is a software company that develops cloud solutions and services for building information modelling (BIM) globally, with a market cap of SEK726.53 million.

Operations: The company generates revenue from its CAD / CAM Software segment, amounting to SEK181.87 million.

Market Cap: SEK726.53M

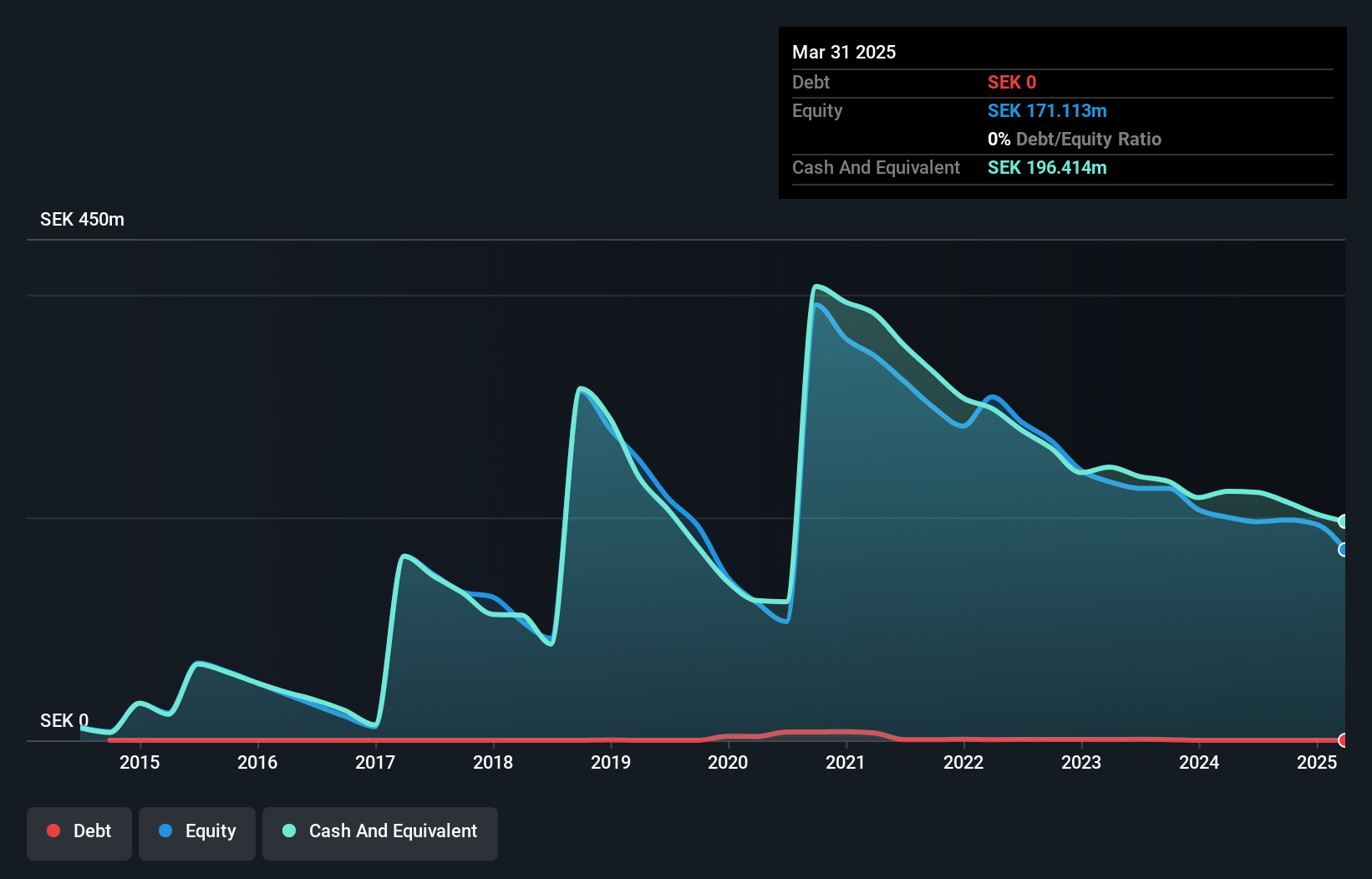

BIMobject AB, with a market cap of SEK726.53 million, operates in the CAD/CAM software sector and has reported recent revenues of SEK125.83 million for the first nine months of 2025. Despite being unprofitable with a net loss of SEK47.95 million over this period, the company benefits from having no debt and sufficient short-term assets to cover both its short- and long-term liabilities. Recent strategic agreements, such as with Sveriges Elgrossister (SEG), aim to enhance product data sharing and sustainability efforts in the electrical industry, potentially positioning BIMobject favorably for future growth despite current challenges in profitability.

- Jump into the full analysis health report here for a deeper understanding of BIMobject.

- Review our historical performance report to gain insights into BIMobject's track record.

aap Implantate (XTRA:AAQ1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: aap Implantate AG is a company that develops, manufactures, and markets traumatology products for orthopedics both in Germany and internationally, with a market cap of €19.75 million.

Operations: The company's revenue is derived from several regions, with North America contributing €2.74 million, Latin America generating €2.33 million, and the Asia Pacific region accounting for €0.67 million.

Market Cap: €19.75M

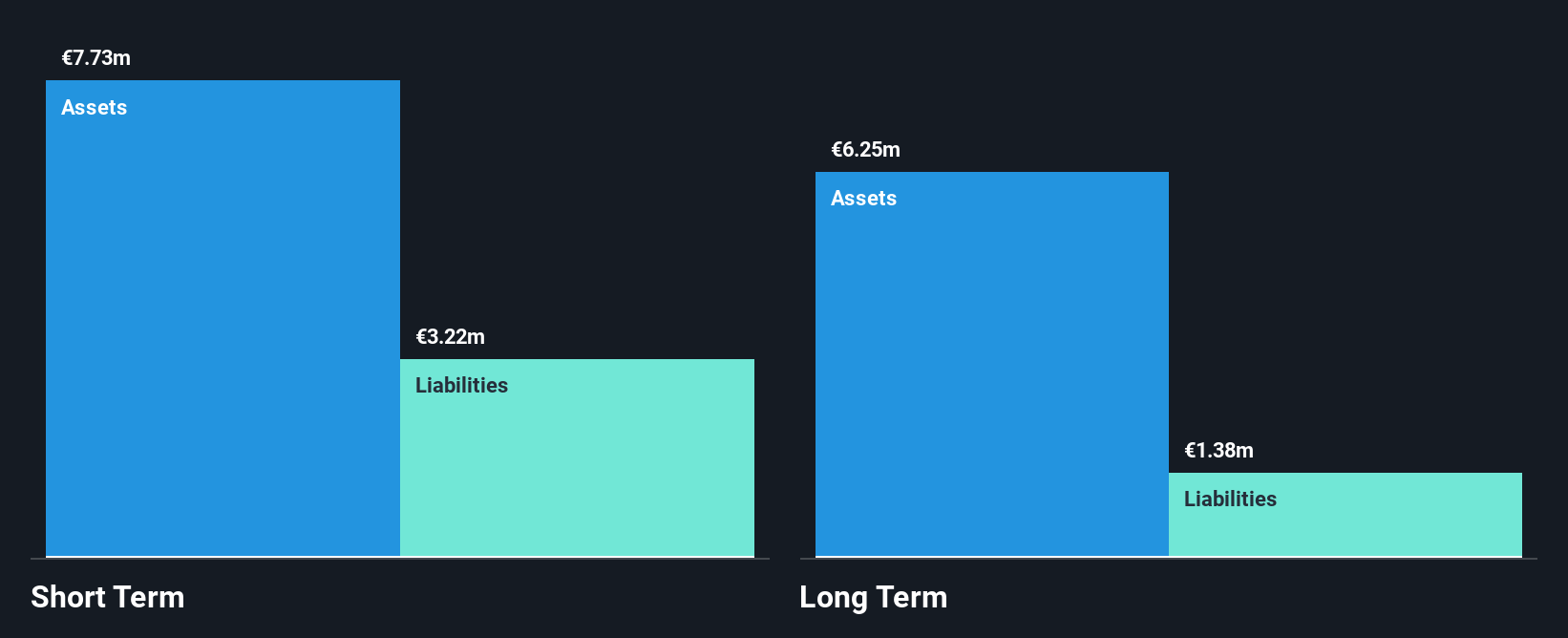

aap Implantate AG, with a market cap of €19.75 million, reported third-quarter 2025 sales of €3.26 million, up from €2.82 million in the same period in 2024. Despite being unprofitable, it has reduced losses by 23.7% annually over five years and maintains more cash than its total debt. The company's short-term assets (€7.7M) exceed both its short- and long-term liabilities (€3.2M and €1.4M respectively), indicating solid financial management despite less than one year of cash runway if current free cash flow trends persist without improvement in profitability or revenue growth acceleration.

- Click here and access our complete financial health analysis report to understand the dynamics of aap Implantate.

- Examine aap Implantate's past performance report to understand how it has performed in prior years.

Next Steps

- Embark on your investment journey to our 286 European Penny Stocks selection here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 29 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal